It took the Seven Sentinels quite a bit of time to flip back to a buy, but that's how much the market was on the ropes when it tagged SPX 1040 for the third time a mere 8 trading days ago. Since the 1st of September there's only been one red close and the S&P has advanced about 7.8% in that time.

But significant resistance looms around 1130 for the S&P. I suspect we'll surpass and close above that level to convince as many as possible that the rally is for real and to get as many bears to capitulate as possible before the market turns again.

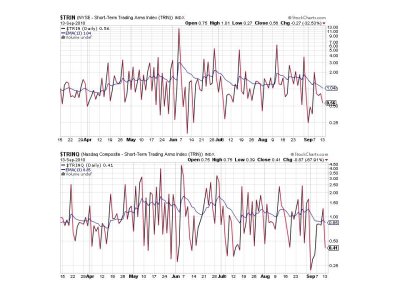

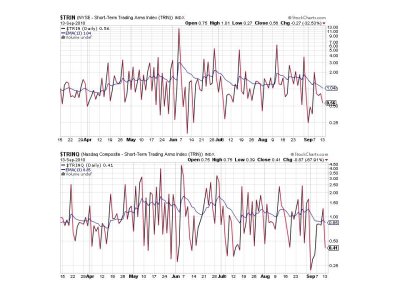

Here's the charts:

NYMO has posted a new 28 day trading high today, which along with buys from the other seven signals, means the system is back on a buy.

Healthy advances are seen in the A/D line in these charts.

TRIN and TRINQ are on buys, but we have low readings after a big run-up.

BPCOMPQ continues to ebb higher and remains on a buy.

The second chart here is showing NYMO hitting the 28 day trading high.

So as I said previously, the system now has all seven signals on buys with NYMO posting a new 28 day trading high, which flips the system to buy status.

I am fairly confident we'll run higher yet, but we've covered a lot of ground in a short period of time and momentum is getting lofty looking at the NAMO and NYMO charts. We can consolidate and grind higher yet though. The only thing I'd caution here is that when the market turns again I doubt I can get a sell signal fast enough to hold gains. That's been a problem in this market environment and something to consider if you're in stocks. As more mechanical systems flip to buys and the bears capitulate, downside risk will rise.

But significant resistance looms around 1130 for the S&P. I suspect we'll surpass and close above that level to convince as many as possible that the rally is for real and to get as many bears to capitulate as possible before the market turns again.

Here's the charts:

NYMO has posted a new 28 day trading high today, which along with buys from the other seven signals, means the system is back on a buy.

Healthy advances are seen in the A/D line in these charts.

TRIN and TRINQ are on buys, but we have low readings after a big run-up.

BPCOMPQ continues to ebb higher and remains on a buy.

The second chart here is showing NYMO hitting the 28 day trading high.

So as I said previously, the system now has all seven signals on buys with NYMO posting a new 28 day trading high, which flips the system to buy status.

I am fairly confident we'll run higher yet, but we've covered a lot of ground in a short period of time and momentum is getting lofty looking at the NAMO and NYMO charts. We can consolidate and grind higher yet though. The only thing I'd caution here is that when the market turns again I doubt I can get a sell signal fast enough to hold gains. That's been a problem in this market environment and something to consider if you're in stocks. As more mechanical systems flip to buys and the bears capitulate, downside risk will rise.