ebbnflow

Ebbchart

- Reaction score

- 30

Pattern 1/grn-grn-grn knows best.

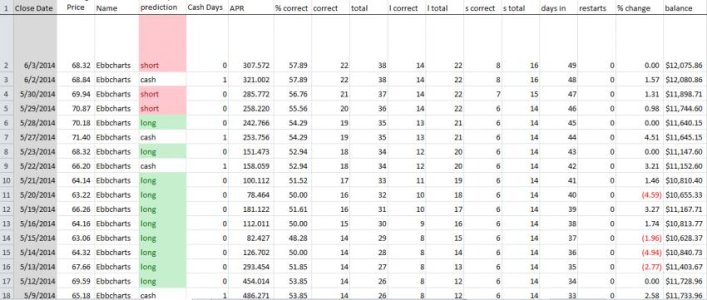

Thursday: Pattern 1/grn-grn-grn. Win Percentage (CSI 52.9%): C 53.4%, S 56.3%, I 49.0%.

Result: cash C-fund was safe; long S-fund was right; short I-fund was wrong.

Unofficial (May 29, 2014): C +0.54%; S +0.45%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.3%).

Cash Patterns (S-fund): 4/grn-red-grn (53.6%); 6/red-red-grn (53.6%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (56.5%); 3/grn-red-red (57.0%); 5/red-red-red (60.4%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 22/33 (67%). Long: 16/22 (73%). Short: 6/11 (55%). Cash: green (3 up, 3 down); red (3 up, 3 down).

Friday: Pattern 8/red-grn-red. Win Percentage (CSI 54.9%): C 55.6%, S 52.3%, I 56.8%.

Forecast: long C-fund; short S-fund; long I-fund.

Friday has pattern 8/red-grn-red. Win Percentage (S-fund): 52.3% (W 123, L 112). Strategy: Short <= 53%.

Today's market action has pattern 8/red-grn-red written all over it. It was a perfect snapshot (Kodak moment). :nuts:

Friday: Pattern 8/red-grn-red. Win Percentage (CSI 54.9%): C 55.6%, S 52.3%, I 56.8%.

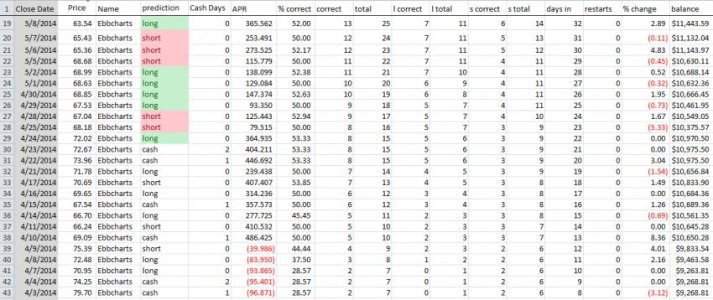

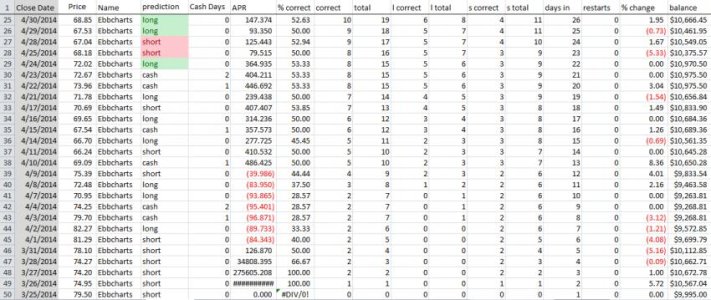

Result: long C-fund was right; short S-fund was right; long I-fund was right.

Unofficial (May 30, 2014): C +0.18%; S -0.30%; I +0.05%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.1%).

Cash Patterns (S-fund): 4/grn-red-grn (53.6%); 6/red-red-grn (53.6%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (56.5%); 3/grn-red-red (57.0%); 5/red-red-red (60.4%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 23/34 (68%). Long: 16/22 (73%). Short: 7/12 (58%). Cash: green (3 up, 3 down); red (3 up, 3 down).

Monday: Pattern 2/grn-grn-red. Win Percentage (CSI 53.3%): C 55.1%, S 51.9%, I 53.0%.

Forecast: long C-fund; short S-fund; short I-fund.

Monday has pattern 2/grn-grn-red. Win Percentage (S-fund): 51.9% (W 123, L 114). Strategy: Short <= 53%.