-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

Looks like I may be seeing my 2750 on the SPY before this is all over.

2750 would be in the area of horizontal support from the June low, but 2825 has held twice (so far) and we have the 200 dma below that, which is just above the rising 200 dma (just under 2800). I'm not favoring 2750 at the moment, but it is in play.

I take it you are on the sidelines and looking for reentry?

Attachments

2750 would be in the area of horizontal support from the June low, but 2825 has held twice (so far) and we have the 200 dma below that, which is just above the rising 200 dma (just under 2800). I'm not favoring 2750 at the moment, but it is in play.

I take it you are on the sidelines and looking for reentry?

I went in yesterday 10% each C,S, & I. I knew I shouldn't have but was willing to risk a little (not that 30% is chump change

coolhand

TSP Legend

- Reaction score

- 530

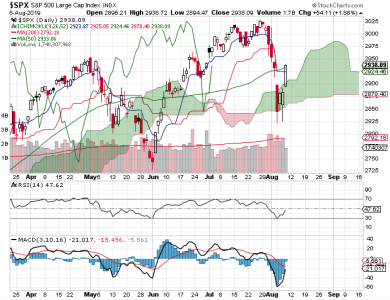

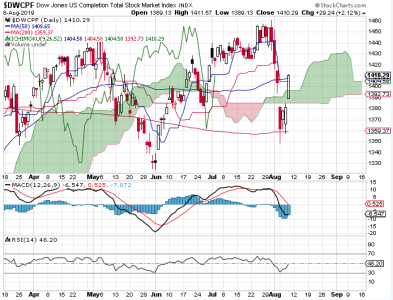

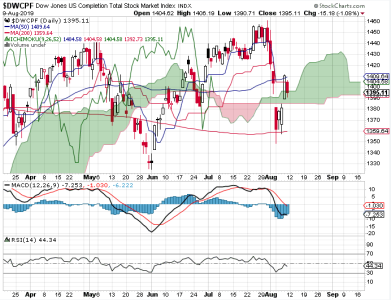

The market opened significantly lower today, but it wasn't long before the bulls began to claw back the losses over the balance of the trading session.

Both charts actually closed positive today. That's a bullish sign, but I wouldn't be complacent given the underlying global battle being waged over financial control of the markets. Gold and silver are soaring. Crypto (I follow Bitcoin primarily) is also holding up well as money is looking for safer havens. That doesn't' necessarily mean the bull is over (though it might). If this was a "V" bottom, I'd have expected a more solid upside push. Instead we are seeing significant volatility. But a bottom may be in. We just have to wait and see how it plays out.

Breadth remains negative, but it's steady. I note that TRINQ is low this evening, which could mean another bout of selling tomorrow. The OEX is modestly bearish too. But the CBOE remains on the bullish side.

I am leaning bearish for Thursday, though I am not particularly bearish overall. I am actually neutral until the market reveals more evidence of its intent to either resume a downside push or begin a climb to the upside. We do have some support below. Now we need to see if there is resistance above. Certainly, the 50 dma might be if price manages to test it.

NAAIM reports tomorrow. That should be interesting given how bullish they were last week before being ambushed.

Both charts actually closed positive today. That's a bullish sign, but I wouldn't be complacent given the underlying global battle being waged over financial control of the markets. Gold and silver are soaring. Crypto (I follow Bitcoin primarily) is also holding up well as money is looking for safer havens. That doesn't' necessarily mean the bull is over (though it might). If this was a "V" bottom, I'd have expected a more solid upside push. Instead we are seeing significant volatility. But a bottom may be in. We just have to wait and see how it plays out.

Breadth remains negative, but it's steady. I note that TRINQ is low this evening, which could mean another bout of selling tomorrow. The OEX is modestly bearish too. But the CBOE remains on the bullish side.

I am leaning bearish for Thursday, though I am not particularly bearish overall. I am actually neutral until the market reveals more evidence of its intent to either resume a downside push or begin a climb to the upside. We do have some support below. Now we need to see if there is resistance above. Certainly, the 50 dma might be if price manages to test it.

NAAIM reports tomorrow. That should be interesting given how bullish they were last week before being ambushed.

"I am leaning bearish for Thursday, though I am not particularly bearish overall. I am actually neutral until the market reveals more evidence of its intent to either resume a downside push or begin a climb to the upside. We do have some support below. Now we need to see if there is resistance above. Certainly, the 50 dma might be if price manages to test it."

This is push me pull me time. I was impressed the bulls almost closed the DJIA green yesterday and the SPY and NASDAQ actually pulled it off. We're certainly not out of the woods yet. Still have a few weeks of summertime volatility. Tie that with banks cutting basis points, the recent fed move and the looming trade meeting with China. And of course the tweets going one way and China being more willing to openly manipulate.

As seen in the market commentary https://www.tsptalk.com/comments.php there were some major charts showing the lows held for support. Make no mistake, some were rattled imo, and it doesn't take that much to put fear into the markets these days imo. But that also brings opportunity. I'm neutral to slightly bullish going into September. Still have one move left for August though so if I'm wrong and support does break, I'm ready.

If we weren't limited in our moves I'm thinking many here would be making bank big time with this volatility.

This is push me pull me time. I was impressed the bulls almost closed the DJIA green yesterday and the SPY and NASDAQ actually pulled it off. We're certainly not out of the woods yet. Still have a few weeks of summertime volatility. Tie that with banks cutting basis points, the recent fed move and the looming trade meeting with China. And of course the tweets going one way and China being more willing to openly manipulate.

As seen in the market commentary https://www.tsptalk.com/comments.php there were some major charts showing the lows held for support. Make no mistake, some were rattled imo, and it doesn't take that much to put fear into the markets these days imo. But that also brings opportunity. I'm neutral to slightly bullish going into September. Still have one move left for August though so if I'm wrong and support does break, I'm ready.

If we weren't limited in our moves I'm thinking many here would be making bank big time with this volatility.

Cactus

TSP Pro

- Reaction score

- 38

You're right. That is why the limits were imposed on us in 2008. They can't have us making money now, can they?If we weren't limited in our moves I'm thinking many here would be making bank big time with this volatility.

coolhand

TSP Legend

- Reaction score

- 530

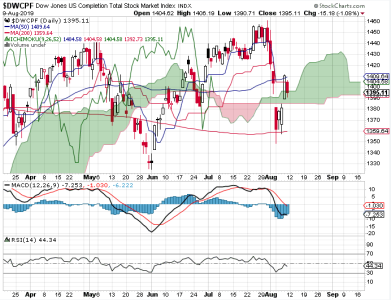

After today's launch, I guess we now know what direction the market wants to go.

Both charts show price closing above their respective 50 dma. Momentum has quickly turned up.

Cumulative breadth has flipped positive. My intermediate term system remains negative, but it's improving.

The OEX and CBOE are both neutral. NAAIM was an interesting ready. The bulls among them didn't flinch from their long positions, but the bears have placed some shorts. The reading is bullish at face value.

Futures are pointing much lower this evening, but it's difficult to trust them as momentum has shifted to the upside. Still, today's rally may very well spawn a pullback. Let's see if the 50 dma can hold.

Both charts show price closing above their respective 50 dma. Momentum has quickly turned up.

Cumulative breadth has flipped positive. My intermediate term system remains negative, but it's improving.

The OEX and CBOE are both neutral. NAAIM was an interesting ready. The bulls among them didn't flinch from their long positions, but the bears have placed some shorts. The reading is bullish at face value.

Futures are pointing much lower this evening, but it's difficult to trust them as momentum has shifted to the upside. Still, today's rally may very well spawn a pullback. Let's see if the 50 dma can hold.

coolhand

TSP Legend

- Reaction score

- 530

That 48% bear reading should make this a screaming buy, especially if it opens down Monday, shouldn't it? I have settled cash, IFTs, itching to get back in.

Sentiment is not what it used to be. That's why I focus on select surveys. I abandoned AAII more than a year ago because I no longer saw any correlation to the markets. Even TSP Talk's survey is not as useful as it used to be. I still post it, but I can't use it in isolation. The options don't work as well as they once did either. In fact, I find that the dumb money (CBOE) is more often aligned with market direction than not. In other words, it shouldn't be used as a contrarian indicator anymore. These I my observations of the past few years. The only survey I still place significant stock (pun intended) in is NAAIM, which I have spoken of many times in my daily postings. When I post my weekend thoughts I'll see where I stand overall as we head into the new week.

coolhand

TSP Legend

- Reaction score

- 530

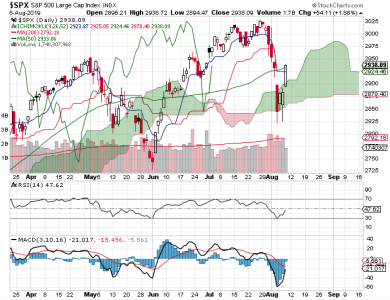

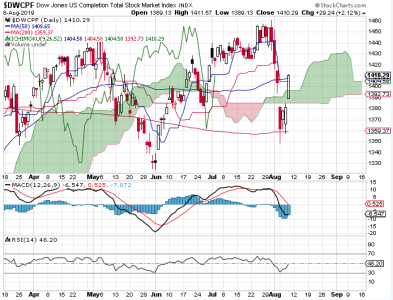

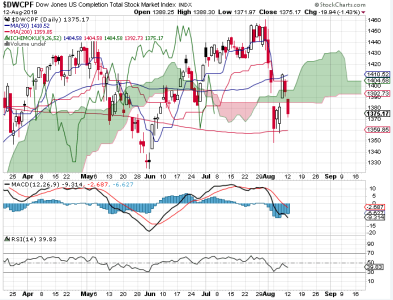

Friday's market action saw the bears drive price back below the 50 dma on both the S&P 500 and DWCPF. Has the 50 dma now become resistance? Maybe in the short term, but I don't think the bulls are done. This is still a bull market, after all.

For the week, all 3 TSP stock funds closed lower, but the difference in closing price from Monday to Friday was significant. In other words, the bulls retraced the bulk of losses over the course of the week and are now poised to retake the 50 dma if they can keep the pressure on.

For some reason, the charts on the stockcharts website are not loading. I downloaded the above charts on Friday when I wasn't having that problem. But I did look at all the charts Friday, so I'll have to go by memory here.

The options were neutral (CBOE, OEX). TSP Talk was relatively unchanged and is neutral (we're leaning bullish). NAAIM remains largely bullish, though the bears among them put on some shorts, so expect continued volatility. Cumulative breadth flipped negative again after Friday's reversal. The selling wasn't benign, there was volume behind it. That is another indication to expect more volatility.

Overall, I suspect the bulls are going to make it very difficult for the bears to have their way with the market. And I think the bears will ultimately get worn down as the bull comes back to life. NAAIM's overall positioning supports this perspective. I am not sure how the new week will end, but I am siding with the bulls.

For the week, all 3 TSP stock funds closed lower, but the difference in closing price from Monday to Friday was significant. In other words, the bulls retraced the bulk of losses over the course of the week and are now poised to retake the 50 dma if they can keep the pressure on.

For some reason, the charts on the stockcharts website are not loading. I downloaded the above charts on Friday when I wasn't having that problem. But I did look at all the charts Friday, so I'll have to go by memory here.

The options were neutral (CBOE, OEX). TSP Talk was relatively unchanged and is neutral (we're leaning bullish). NAAIM remains largely bullish, though the bears among them put on some shorts, so expect continued volatility. Cumulative breadth flipped negative again after Friday's reversal. The selling wasn't benign, there was volume behind it. That is another indication to expect more volatility.

Overall, I suspect the bulls are going to make it very difficult for the bears to have their way with the market. And I think the bears will ultimately get worn down as the bull comes back to life. NAAIM's overall positioning supports this perspective. I am not sure how the new week will end, but I am siding with the bulls.

coolhand

TSP Legend

- Reaction score

- 530

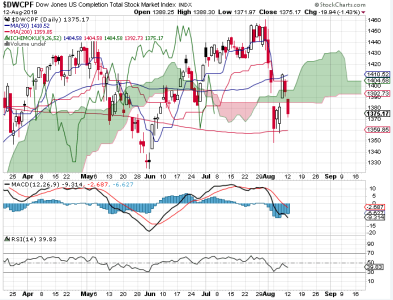

The bears pinned another hurt on the bulls to start the new week. We now have to entertain the possibility that a retest of the lows may occur.

The S&P is holding up better than the DWCPF, but both sold down. Once again, we need to watch the 200 dma for support should the bears have the ability to press their short term advantage.

I note that while my intermediate term system remains negative, TRIN and TRINQ both point to a bounce for Tuesday, but how much of one we can expect I don't know. Breadth remains negative.

The OEX is neutral and the CBOE is bearish. If I don't use the CBOE as a contrarian indicator than it's bearish at face value. They have tended to be right often enough to not bet against them too often.

So I have mixed indicators heading into Tuesday. I see a bounce as a real possibility, but it may not hold. Or, we sell down early and bounce later in the session.

The S&P is holding up better than the DWCPF, but both sold down. Once again, we need to watch the 200 dma for support should the bears have the ability to press their short term advantage.

I note that while my intermediate term system remains negative, TRIN and TRINQ both point to a bounce for Tuesday, but how much of one we can expect I don't know. Breadth remains negative.

The OEX is neutral and the CBOE is bearish. If I don't use the CBOE as a contrarian indicator than it's bearish at face value. They have tended to be right often enough to not bet against them too often.

So I have mixed indicators heading into Tuesday. I see a bounce as a real possibility, but it may not hold. Or, we sell down early and bounce later in the session.

coolhand

TSP Legend

- Reaction score

- 530

We got the bounce and it was a good one.

I thought we might see some attempt to counter any rally and price did peak around 1030, fell modestly lower and then went largely sideways into the close. Notice that price was reject at the 50 dma on the S&P 500. We'll have to see if the bulls have anything left in the short term for another retest.

Looking at the indicators, breadth is now neutral, which is an improvement over yesterday when it was negative.

The OEX is neutral again and the CBOE is bearish again. My indicators are not leaning in either direction right now, so things could get choppy for a bit. I am neutral for Wednesday and sill think the bulls might close the week in the green.

I thought we might see some attempt to counter any rally and price did peak around 1030, fell modestly lower and then went largely sideways into the close. Notice that price was reject at the 50 dma on the S&P 500. We'll have to see if the bulls have anything left in the short term for another retest.

Looking at the indicators, breadth is now neutral, which is an improvement over yesterday when it was negative.

The OEX is neutral again and the CBOE is bearish again. My indicators are not leaning in either direction right now, so things could get choppy for a bit. I am neutral for Wednesday and sill think the bulls might close the week in the green.

coolhand

TSP Legend

- Reaction score

- 530

This video is an excellent presentation of the financial markets. Pay particular attention to what Jim Sinclair says in the latter half of the video when he points out his family crest. Research him. He's someone you want to pay attention to. He has a website https://www.jsmineset.com/about/.

https://www.youtube.com/watch?v=VMCu9GWpgzg&feature=youtu.be

These 13 Families Rule the World: The Shadow Forces Behind the NWO | Humans Are Free

https://www.youtube.com/watch?v=VMCu9GWpgzg&feature=youtu.be

These 13 Families Rule the World: The Shadow Forces Behind the NWO | Humans Are Free

This video is an excellent presentation of the financial markets. Pay particular attention to what Jim Sinclair says in the latter half of the video when he points out his family crest. Research him. He's someone you want to pay attention to. He has a website https://www.jsmineset.com/about/.

https://www.youtube.com/watch?v=VMCu9GWpgzg&feature=youtu.be

These 13 Families Rule the World: The Shadow Forces Behind the NWO | Humans Are Free

Excellent. Passing this on coolhand.

coolhand

TSP Legend

- Reaction score

- 530

I sure didn't see today's dump coming. We got the test of the previous lows

Both charts show price closing at a lower low. The S&P remains above its 200 dma, but not the DWCPF. Are they going to save it? Volume was elevated and momentum is heading lower.

TRIN closed at a very high level, which suggests another bounce. Breadth remains negative. The OEX remains neutral and the CBOE remains bearish.

I still think the market turns back up, but the news headlines sure don't make me comfortable. Something may happen with China, which may be used as a narrative to turn the market back up. I'm guessing on that, but POTUS is suggesting a private meeting with Xi. On the other hand, there is a lot of finger pointing at the Fed right now, which dovetails with the sell-offs. Trying to guess what actually happens and when is not very discernable. NAAIM wasn't overly bearish last week, though they did back off their bullishness.

Let's see where NAAIM sits tomorrow. Right now, the bears appear to have the upper hand, but this is still a bull market until it's not.

Both charts show price closing at a lower low. The S&P remains above its 200 dma, but not the DWCPF. Are they going to save it? Volume was elevated and momentum is heading lower.

TRIN closed at a very high level, which suggests another bounce. Breadth remains negative. The OEX remains neutral and the CBOE remains bearish.

I still think the market turns back up, but the news headlines sure don't make me comfortable. Something may happen with China, which may be used as a narrative to turn the market back up. I'm guessing on that, but POTUS is suggesting a private meeting with Xi. On the other hand, there is a lot of finger pointing at the Fed right now, which dovetails with the sell-offs. Trying to guess what actually happens and when is not very discernable. NAAIM wasn't overly bearish last week, though they did back off their bullishness.

Let's see where NAAIM sits tomorrow. Right now, the bears appear to have the upper hand, but this is still a bull market until it's not.

PessOptimist

Market Veteran

- Reaction score

- 67

Thank you coolhand. I appreciate your posts.

PO

PO

coolhand

TSP Legend

- Reaction score

- 530

Futures were up fairly well overnight, but over the past hour or 2 they've plunged. It is looking like were heading lower at the open and maybe in a big way if futures keeping building to the downside. NAAIM comes out late in the morning. This next drop will likely shake some bulls loose. Maybe that's at least part of the reason for the pressure, but I am certain that it's geopolitical/financial more than anything else. If NAAIM comes in bearish it may be a signal, but I need to see the survey before I can read the tea leaves.

Similar threads

- Replies

- 0

- Views

- 150

- Replies

- 0

- Views

- 166

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 128

- Replies

- 0

- Views

- 79