With the OEX bearish for Friday, I was looking lower to close out the week, though I was not looking for a big move lower.

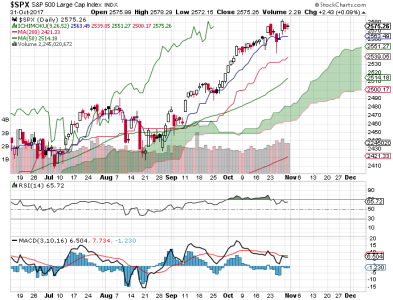

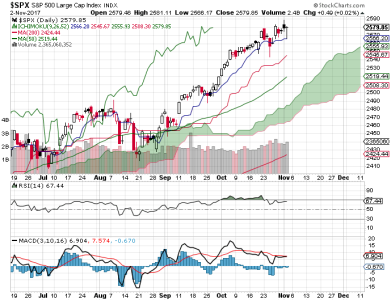

Not only did we not really get any weakness on Friday, the S&P 500 gapped higher and closed at yet another all-time high on increasing volume. I've said on several occasions recently that even as I may be leaning lower sentiment wise, I was not inclined to short this market. Friday probably surprised some bears (even a few money managers at NAAIM got short). In fact, the last time some of those money managers at NAAIM went short, the market rallied and they eventually took those shorts off. But as a whole, NAAIM has largely remained bullish despite occasional pockets of bearishness.

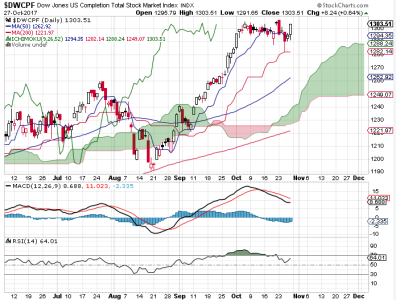

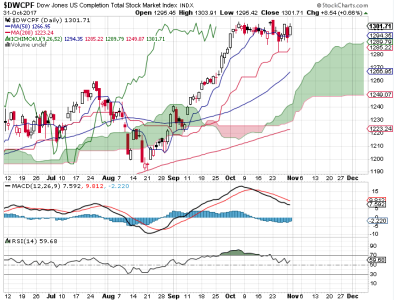

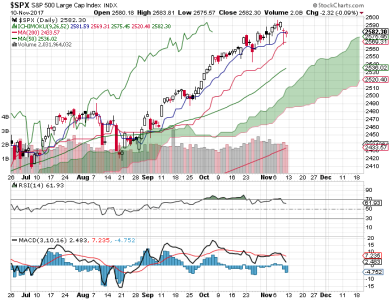

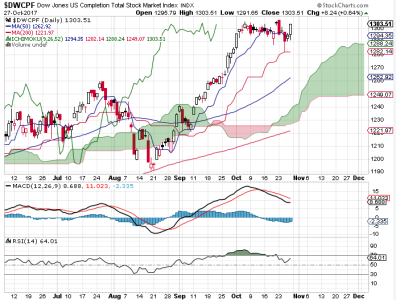

So we have a snap back rally to end the week last week. Momentum turned back up on the S&P 500, though RSI is back in an overbought condition.

I am not sure at this point, but I am a bit suspicious of Friday's rally. Then again, this is a bull market. The smart money (OEX) was bearish for Friday and the market rallied. Now they are bullish for Monday (as is the CBOE). I don't like to mention politics in my market analysis, but CNN was leaked information about an indictment coming on Monday surrounding the alleged Trump/Russia connection (no, I don't buy it). This is all smoke and mirrors, but it's the kind of news item that can be used to move the market if the powers that be desire such (I'm guessing down, but you never know). Maybe nothing comes of it, but it will be interesting to see if it appears to play a role. I just wanted to throw that out there because it has the potential to screw up my technical analysis.

So, the OEX is bullish as is the CBOE on Monday. That's rather neutral to my eye. NAAIM saw a few managers take short positions, but overall the group remains bullish. Breadth went positive again. To me, any downside is likely still limited. The breakout by the S&P 500 is bullish at face value and the indexes largely have no resistance above. I am looking higher for Monday, but still leave open the possibility for a small correction over the days ahead.