-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

So...as usual, buy in for the holidays, see some weakness, sell losing money..never get back in. Gotcha...maybe this time I'll just let it ride...that would have made me a millionaire by now if I had done that in 2008.

I've been holding TNA for the last 3 weeks or so and I'm down, but I'm not selling. My commentary is general in nature. Many folks have their own perspective about how they want to use information that others provide. I use several professional sources myself and they don't always agree. But some are short term and other longer term. As investors/traders we have to decide what kind of investing/trading we are comfortable with. Lately, the bulls have not been getting much going, but the S&P 500 chart does not look the same as the DWCPF. I will also say that many pros that I follow are getting frustrated on both side of the trade the past few weeks. It's been a difficult market for many, but it is not falling apart to this point.

coolhand

TSP Legend

- Reaction score

- 530

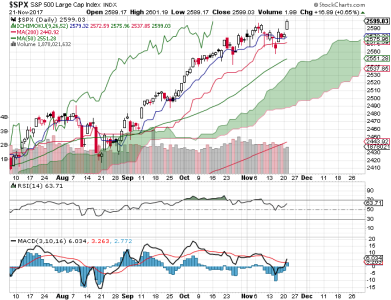

After a somewhat tepid upside move on Monday, Tuesday saw the sellers return, though once again the downside remained limited.

Both charts are showing short term weakness right now, with momentum sliding in negative territory. Breadth remains negative. I note that TRIN closed at a somewhat high level today, so that may indicate another reversal on Wednesday. The options are neutral. Seasonality is on the bearish side heading into Thanksgiving too.

So what is causing this uninspiring trading of late? My guess is that it is rooted in geopolitics (think Saudi purge, NK, etc.), but also in the tax reform debate going on in Congress. This is all creating an uncertain environment, which is something that stock markets do not like. I remain longer term bullish beyond the current malaise.

Both charts are showing short term weakness right now, with momentum sliding in negative territory. Breadth remains negative. I note that TRIN closed at a somewhat high level today, so that may indicate another reversal on Wednesday. The options are neutral. Seasonality is on the bearish side heading into Thanksgiving too.

So what is causing this uninspiring trading of late? My guess is that it is rooted in geopolitics (think Saudi purge, NK, etc.), but also in the tax reform debate going on in Congress. This is all creating an uncertain environment, which is something that stock markets do not like. I remain longer term bullish beyond the current malaise.

coolhand

TSP Legend

- Reaction score

- 530

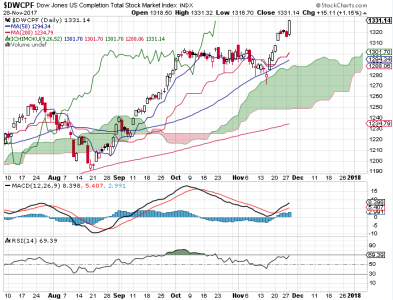

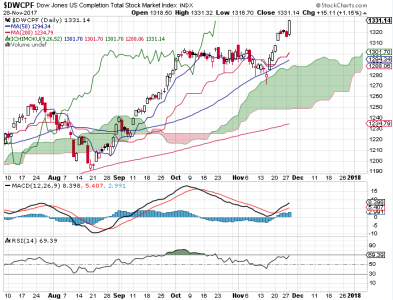

Wednesday's action did some technical damage; especially on the DWCPF chart as price closed under the rising 50 dma. Momentum remains to the downside. It appears that pre-Thanksgiving weakness started early this year. The holiday is now only a few trading days away, which means seasonality is going to become more of an issue for the bears (it's bullish). That doesn't guarantee a rally, but I'd not be shorting the market after next week without good reason.

The options are leaning bullish for Thursday. Many other indicators are negative. NAAIM reports in the morning. They have been leaning bullish all along, but not as much as past months. Futures are bullish this evening, so maybe a bounce before a retest of the lows by Friday?

The options are leaning bullish for Thursday. Many other indicators are negative. NAAIM reports in the morning. They have been leaning bullish all along, but not as much as past months. Futures are bullish this evening, so maybe a bounce before a retest of the lows by Friday?

The other shoe drops!! I just need to turn off the news for a while, come back in a year and enjoy the gains I guess!!

So...as usual, buy in for the holidays, see some weakness, sell losing money..never get back in. Gotcha...maybe this time I'll just let it ride...that would have made me a millionaire by now if I had done that in 2008.

Cactus

TSP Pro

- Reaction score

- 38

Sure, if you bought in at the end of 2008 or better yet March of 2009, but we didn't know it at the time. On the other hand if you bought & held like I did in the Spring of 2000 you would not have made your money back before losing it again in 2008. I grant you that Buy & Hold has done better than most of us here during the years since 2008, but those were good years and another crash could change that quickly.So...as usual, buy in for the holidays, see some weakness, sell losing money..never get back in. Gotcha...maybe this time I'll just let it ride...that would have made me a millionaire by now if I had done that in 2008.

coolhand

TSP Legend

- Reaction score

- 530

The bullish options at the close on Wednesday did indeed work out for Thursday as the broader market rallied hard for a change.

The rally helped turn some indicators back up on Thursday. Breadth improved significantly, though it's still negative. Momentum is trying to turn back up. NAAIM came in with some bears putting on shorts, but they are not bearish taken as a whole. The modestly bearish slide over the past few weeks in this survey could set up a significant rally. It would certainly coincide with seasonality in a few more days.

So, despite the rally we could still see a retest of the lows and perhaps as soon as Friday, though I'd give that a bit more room and stretch it to Monday. That's my guess as the powers that be may be in the process of setting table for the next big move to the upside as we head toward the holiday period. As much as I'd like to see the market take off from here, I doubt I'll be accommodated.

The rally helped turn some indicators back up on Thursday. Breadth improved significantly, though it's still negative. Momentum is trying to turn back up. NAAIM came in with some bears putting on shorts, but they are not bearish taken as a whole. The modestly bearish slide over the past few weeks in this survey could set up a significant rally. It would certainly coincide with seasonality in a few more days.

So, despite the rally we could still see a retest of the lows and perhaps as soon as Friday, though I'd give that a bit more room and stretch it to Monday. That's my guess as the powers that be may be in the process of setting table for the next big move to the upside as we head toward the holiday period. As much as I'd like to see the market take off from here, I doubt I'll be accommodated.

coolhand

TSP Legend

- Reaction score

- 530

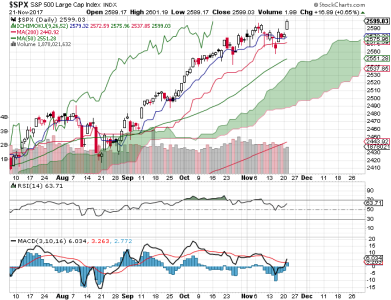

I was anticipating a possible reversal on Friday after Thursday's big upside move. The S&P 500 did pullback, but not a whole lot. The DWCPF tacked on moderate gains. That's bullish as small caps may be ready or not far from ready to lead the way to the upside again.

The S&P 500 chart still looks bullish by almost any measure. The DWCPF rallied after closing under its rising 50 dma for 1 day. It is now not far from its all-time closing high.

TSP Talk sentiment didn't get any more bearish at the end of last week, but it did get a bit more bullish. It's at a level that's troublesome, but I'm not overly concerned about it. NAAIM is neutral. The options are neutral for Monday. Breadth flipped positive again on Friday. Is liquidity ready to ramp up again? It's on the rise. There remains a chance for a retest of the lows, but with positive seasonality almost on top of us we might not get it. Small caps have woken up and that's bullish. Some of the signals in my intermediate term system may have bottomed (bullish if true). Overall, I'm neutral for next week, but can see this market go either way. Monday may tell us a lot.

The S&P 500 chart still looks bullish by almost any measure. The DWCPF rallied after closing under its rising 50 dma for 1 day. It is now not far from its all-time closing high.

TSP Talk sentiment didn't get any more bearish at the end of last week, but it did get a bit more bullish. It's at a level that's troublesome, but I'm not overly concerned about it. NAAIM is neutral. The options are neutral for Monday. Breadth flipped positive again on Friday. Is liquidity ready to ramp up again? It's on the rise. There remains a chance for a retest of the lows, but with positive seasonality almost on top of us we might not get it. Small caps have woken up and that's bullish. Some of the signals in my intermediate term system may have bottomed (bullish if true). Overall, I'm neutral for next week, but can see this market go either way. Monday may tell us a lot.

coolhand

TSP Legend

- Reaction score

- 530

Monday turned out to be a good day for the bulls and that paints a more bullish picture heading into the holiday. Any retest of the lows would have been more likely to happen by now.

The S&P 500 may not be doing much at the moment, but the DWCPF hit a fresh all-time closing high just 3 days after closing below its 50 dma. And it looks poised to add to those gains too as the index closed near its high of the day to boot. Momentum is turning up from a lengthy, but controlled downward trend and has room to run to the upside before getting overbought.

The options are neutral for Tuesday. Breadth remains bullish. At this point, any pullback we get should be bought as we approach the beginning of the most seasonally positive time of year.

The S&P 500 may not be doing much at the moment, but the DWCPF hit a fresh all-time closing high just 3 days after closing below its 50 dma. And it looks poised to add to those gains too as the index closed near its high of the day to boot. Momentum is turning up from a lengthy, but controlled downward trend and has room to run to the upside before getting overbought.

The options are neutral for Tuesday. Breadth remains bullish. At this point, any pullback we get should be bought as we approach the beginning of the most seasonally positive time of year.

coolhand

TSP Legend

- Reaction score

- 530

It sure hasn't taken long for the market to hit high fresh all-time highs after biasing sideways to down for more than a month. Tuesday's action was not unexpected given how the small cap space acted on Monday. The DWCPF did not look like it was ready for a reversal and now we can see that in fact it wasn't.

Today's action shows price closing not far off its high of the day and remember, there is no resistance above.

Breadth is also hitting fresh highs. The options are neutral. Momentum is rising again. It appears that the bull is back in charge once more (or maybe he was the whole time). At this point, even if we get some weakness, it's best to stay long as the upside could be much higher over the weeks ahead. We'll let the market be our guide on that point.

Today's action shows price closing not far off its high of the day and remember, there is no resistance above.

Breadth is also hitting fresh highs. The options are neutral. Momentum is rising again. It appears that the bull is back in charge once more (or maybe he was the whole time). At this point, even if we get some weakness, it's best to stay long as the upside could be much higher over the weeks ahead. We'll let the market be our guide on that point.

coolhand

TSP Legend

- Reaction score

- 530

This market actually had some signals calling for some selling last week, but there was very little of that. I note that breadth is hitting all-time highs again, and we know we should not bet against that as it indicates this market has some sponsorship.

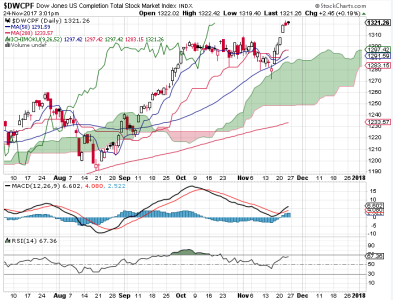

We can see that both charts are sitting at or near their all-time high.

Sentiment shows that TSP Talk got slightly less bullish, but bullish nonetheless. NAAIM got more bullish and those that were short aren't anymore. That's bullish. The options are neutral.

Breadth is hitting all-time highs. Bears beware.

We are now entering the more bullish time of the year as the indexes plumb new highs. I don't think we can look at that from a contrarian point of view. There are those who very much want this market higher. I remain bullish longer term.

We can see that both charts are sitting at or near their all-time high.

Sentiment shows that TSP Talk got slightly less bullish, but bullish nonetheless. NAAIM got more bullish and those that were short aren't anymore. That's bullish. The options are neutral.

Breadth is hitting all-time highs. Bears beware.

We are now entering the more bullish time of the year as the indexes plumb new highs. I don't think we can look at that from a contrarian point of view. There are those who very much want this market higher. I remain bullish longer term.

coolhand

TSP Legend

- Reaction score

- 530

Aside from technicals, I see major political matters as the cause of recent bullish momentum and, the potential for retreat on the order of 5% if there is a stall or major revision of the tax proposal. A toss up.

Sent from my SM-J320P using Tapatalk

I've seen major political matters for as long as I can remember...:laugh:. But I'm not oblivious to them either :worried:. I don't think the Fed has the control it once had over the markets. I really don't. The battle lines are not just across political lines, but also along central bank lines. I don't know how it all plays out so I try to focus on technical indicators.

Aside from the tax proposal situation, how much rally can we expect from a few top level swamp creatures being removed from office (there are plenty of them about now). :smile:

One can only hope.

ravensfan

Market Veteran

- Reaction score

- 284

Aside from the tax proposal situation, how much rally can we expect from a few top level swamp creatures being removed from office (there are plenty of them about now). :smile:

One can only hope.

Usually I just like your posts, but today I just couldn't resist responding and hopefully I don't get myself in to much hot water with Tom for making a political statement. Regarding those swamp creatures, it is just embarrassing the reasons they are being asked to resign. You would think they would learn their lesson but ala Bill Clinton they have brought shame to the office they hold. Perhaps it is time for the American people to demand term limits for those in Congress.

As for the tax reform question, there is no doubt a bill will be passed. If for no other reason than self preservation of their cushy jobs. I went to the G fund on Friday with the thought that we will see a lot of fighting amongst our elected officials and the markets reacting to every negative word. So in my own self preserving way I am gambling that the market goes down this week, but eventually the politicians will pass a bill and we will end up with a nice Santa rally.

Thanks again for your great commentary!:smile:

coolhand

TSP Legend

- Reaction score

- 530

Usually I just like your posts, but today I just couldn't resist responding and hopefully I don't get myself in to much hot water with Tom for making a political statement. Regarding those swamp creatures, it is just embarrassing the reasons they are being asked to resign. You would think they would learn their lesson but ala Bill Clinton they have brought shame to the office they hold. Perhaps it is time for the American people to demand term limits for those in Congress.

As for the tax reform question, there is no doubt a bill will be passed. If for no other reason than self preservation of their cushy jobs. I went to the G fund on Friday with the thought that we will see a lot of fighting amongst our elected officials and the markets reacting to every negative word. So in my own self preserving way I am gambling that the market goes down this week, but eventually the politicians will pass a bill and we will end up with a nice Santa rally.

Thanks again for your great commentary!:smile:

There is much that is wrong with our system, but hopefully it will be fixed in the years to come. My main point was not so much political, but that the market can react to just about anything in some manner that could blindside many. There is a lot going on under the surface that has yet to become common public knowledge. How the market deals with these revelations as they break free is unknown, but again, it will likely catch many by surprise.

It would appear the question is not tax plan passage, but the extent of watering down to achieve such or, perhaps, some other special favors to preserve GOP majority votes and the proposal as is. And, once known - will this news be bought or sold?

Sent from my SM-J320P using Tapatalk

Sent from my SM-J320P using Tapatalk

coolhand

TSP Legend

- Reaction score

- 530

It would appear the question is not tax plan passage, but the extent of watering down to achieve such or, perhaps, some other special favors to preserve GOP majority votes and the proposal as is. And, once known - will this news be bought or sold?

Sent from my SM-J320P using Tapatalk

This is why I follow NAAIM. These insiders may know things that we mere mortals do not. And right now they are bullish.

coolhand

TSP Legend

- Reaction score

- 530

No charts this evening. Not much has changed. The options remain neutral.

In my previous post, I mentioned that I follow NAAIM because some of them may have information that we are not generally privy to, but I have other measures of risk that I do not share. They too are showing no risk to this market.

In my previous post, I mentioned that I follow NAAIM because some of them may have information that we are not generally privy to, but I have other measures of risk that I do not share. They too are showing no risk to this market.

coolhand

TSP Legend

- Reaction score

- 530

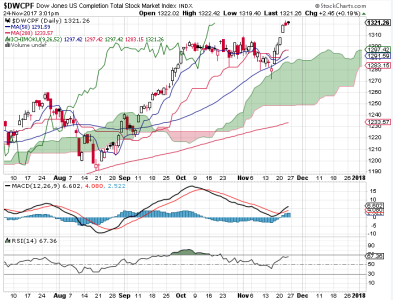

Hopefully, no one got caught on the wrong side of today's rally. The path of least resistance is up as there is no resistance above. Liquidity continues to drive this market and I see no reason (technically) for that to change.

And it ain't even the holidays yet.

The S&P 500 is now overbought (so what) after today's launch. The DWCPF is right behind.

The options show the smart money neutral, but the dumb money is leaning heavily bullish. Now, that's bearish, but in a market making new highs on record breadth I'd not get too bearish on that alone, though a pullback is certainly reasonable. Just don't look for anything deep.

I'm long TNA (still) in my brokerage account and mostly S fund in TSP (no, I have not been using the tracker). There is too much chance of much bigger gains this month to get wobbly knees. The indicators say to remain invested.

And it ain't even the holidays yet.

The S&P 500 is now overbought (so what) after today's launch. The DWCPF is right behind.

The options show the smart money neutral, but the dumb money is leaning heavily bullish. Now, that's bearish, but in a market making new highs on record breadth I'd not get too bearish on that alone, though a pullback is certainly reasonable. Just don't look for anything deep.

I'm long TNA (still) in my brokerage account and mostly S fund in TSP (no, I have not been using the tracker). There is too much chance of much bigger gains this month to get wobbly knees. The indicators say to remain invested.

Similar threads

- Replies

- 0

- Views

- 149

- Replies

- 0

- Views

- 165

- Replies

- 0

- Views

- 115

- Replies

- 0

- Views

- 126

- Replies

- 0

- Views

- 78