Robo5555

TSP Analyst

- Reaction score

- 8

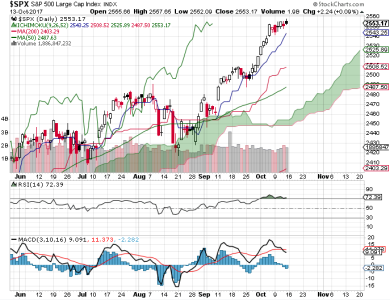

While some of the main sentiment surveys I follow are largely on the bullish side, many others show significant bearishness. NAAIM has been bullish for a long time now and they've not been wrong when taken in the long-term context. Breadth and liquidity will continue to trample the bears as long as they remain in their current configurations. We can't know the future with certainty, but it sure looks bullish to my eye. If anything changes, I'll certainly pass that along.

Thanks CH. Your posts are an important part of my strategy. 22% last 12 months, currently split between CSI.