-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

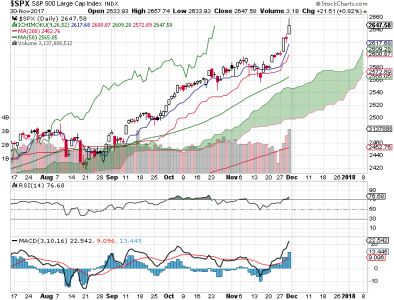

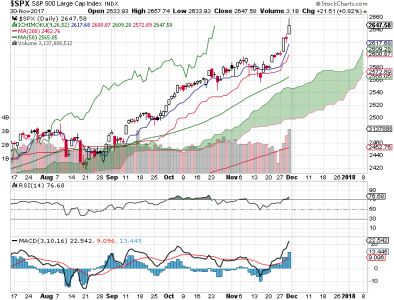

Today was a wild day as the indexes seemed to be moving in different directions. Probably because they were. The Naz got whacked for 1.27%, the S&P 500 was almost unchanged with a loss of 0.04%, the DOW was up 0.44%, and the DWCPF gained a modest 0.1%. The Russell 2000 was higher by 0.38%.

So the charts for the S&P 500 and DWCPF did not change much overall. The action was suspicious so it will be interesting to see if market character is changing over the days ahead. I think the market is gearing up for a serious rally, but not all boats may be lifted if the Naz is any indication.

The options are showing the smart and dumb money both leaning bullish. I would not bet against that, though some weakness is not out of the question. But as I said yesterday, the path of least resistance is currently up.

If you like precious metals, silver is hitting a 2 month low. I like to buy silver eagles on the dips, so I'm watching the chart closely for signs of a turn (SLV) before I snap up a roll or 5.

NAAIM reports tomorrow. I'm anticipating more bullishness from them.

So the charts for the S&P 500 and DWCPF did not change much overall. The action was suspicious so it will be interesting to see if market character is changing over the days ahead. I think the market is gearing up for a serious rally, but not all boats may be lifted if the Naz is any indication.

The options are showing the smart and dumb money both leaning bullish. I would not bet against that, though some weakness is not out of the question. But as I said yesterday, the path of least resistance is currently up.

If you like precious metals, silver is hitting a 2 month low. I like to buy silver eagles on the dips, so I'm watching the chart closely for signs of a turn (SLV) before I snap up a roll or 5.

NAAIM reports tomorrow. I'm anticipating more bullishness from them.

coolhand

TSP Legend

- Reaction score

- 530

As the market tries to grind higher, the sellers have been selling strength and that's tempering short term gains. I think it's a mistake to sell this market though. Breadth hit a new all-time high yesterday and that's key to what to expect moving forward. I'm talking mid to long term, not the next day or 3. We may be witnessing a parabolic move that will leave many looking like a deer in the headlights. Just my perspective based on the charts.

And there is nothing bearish about these charts from a longer term perspective. Yes, RSI is overbought, but in a market with strong breadth and no overhead resistance, I'd not worry about that too much.

The options are neutral. As expected, NAAIM got more bullish. They have been leaning bullish for a long time now and have not been wrong. Again, that's the longer term perspective.

It appears the market is going to open lower this morning. I'm taking it as a buying opportunity.

And there is nothing bearish about these charts from a longer term perspective. Yes, RSI is overbought, but in a market with strong breadth and no overhead resistance, I'd not worry about that too much.

The options are neutral. As expected, NAAIM got more bullish. They have been leaning bullish for a long time now and have not been wrong. Again, that's the longer term perspective.

It appears the market is going to open lower this morning. I'm taking it as a buying opportunity.

coolhand

TSP Legend

- Reaction score

- 530

Coolhand, what is your take on fund bias/allocation? I went 100% S, though C outperformed... Thanks!

I'm taking an educated guess that if the tax cuts get implemented (I think it's just a matter of time, BS political maneuvering notwithstanding) that the economy will begin to really get some traction. Small caps will likely do best in that scenario. I also think you may see a rotation out of some high flying silicon valley stocks as well. Not absolutely sure about that, but some are near the center of the political firestorm that has been playing out. I don't think it will bode well for them if the current administration continues to rack up wins (the majority population are in that camp (MSM polls mean nothing or are contrarian indicators)). I suspect that some very large companies are going to be broken apart in the months/years ahead. Too much power has been consolidated among them and that makes them a target. I'm talking about a wealth transfer to better level the playing field and neutralize the power grab among the loftiest at the top of the food chain. I'm just not sure of the timing or how it will actually play out.

Robo5555

TSP Analyst

- Reaction score

- 8

Robo5555

TSP Analyst

- Reaction score

- 8

Robo5555

TSP Analyst

- Reaction score

- 8

Plus I would not be surprised if they advance on the tax bill and finish positive today.

Sent from my Z981 using TSP Talk Forums mobile app

Sent from my Z981 using TSP Talk Forums mobile app

coolhand

TSP Legend

- Reaction score

- 530

Plus I would not be surprised if they advance on the tax bill and finish positive today.

Sent from my Z981 using TSP Talk Forums mobile app

Most of the losses have already been wiped out. :smile:

coolhand

TSP Legend

- Reaction score

- 530

Friday was a wild ride as the market plunged on political news, but it recovered most of its losses by the close.

You can see the long tails on Friday's candlesticks.

We could be in for more volatile action in the days/weeks ahead, so be prepared for a possible emotional roller coaster. I don't have any real idea of how things play out other than to watch technical indicators and sentiment.

NAAIM got more bullish last week and are not shorting this market. The options look a bit bearish for Monday. The TSP Talk sentiment survey is overdone at 64% bulls. That's troubling and could trigger more selling pressure in the short term; especially with the options leaning bearish.

Breadth still looks very good and that's a big deal for the bulls. Overall, the indicators say to remain invested.

You can see the long tails on Friday's candlesticks.

We could be in for more volatile action in the days/weeks ahead, so be prepared for a possible emotional roller coaster. I don't have any real idea of how things play out other than to watch technical indicators and sentiment.

NAAIM got more bullish last week and are not shorting this market. The options look a bit bearish for Monday. The TSP Talk sentiment survey is overdone at 64% bulls. That's troubling and could trigger more selling pressure in the short term; especially with the options leaning bearish.

Breadth still looks very good and that's a big deal for the bulls. Overall, the indicators say to remain invested.

I would call last Friday a screaming buy...and I personally put my nonTSP cash into the market, after the news broke. Flynn has nothing on Donald, or anyone else. The last person Russia would ever tell about meddling in elections, if there was any, would be Donald. The second last would be Kushner. Flynn said he would cooperate, is all. No extremes in the aaii to affect trading. I'm expecting next week to be good, even if others are less certain.

Sent from my SM-J320P using Tapatalk

Sent from my SM-J320P using Tapatalk

coolhand

TSP Legend

- Reaction score

- 530

Judging from the futures this evening, the market may be about to punish the bears once again. If we gap higher in the morning, I'm hoping it sticks and climbs higher as the day wears on. At some point there may be a point of recognition that this thing is for real and many more may start piling in. We can go parabolic on that kind of emotion.

JamesE

TSP Strategist

- Reaction score

- 4

Being retired, I may meet my five year investment goal in one!

As always man, thanks for sharing your work, it is greatly appreciated!

coolhand

TSP Legend

- Reaction score

- 530

In my last post, I said I was hoping we'd gap higher Monday and climb higher as the day wore on. We got the gap, but not the go. In fact, the reversal wiped out everything and then some. I was sporting about a 4.5% gain in TNA in the early going and ended up with a 1% loss by the close. I don't like to see that kind of action. It tends to be bearish, but this is not an ordinary market and the reversal just puts me in a neutral stance in the short term.

Volume has been high in recent days. We are still overbought on the S&P 500. Momentum has been turned back down, but price is still not far off its all-time high.

Breadth remains very bullish, but has mostly flat-lined. The options data is not ready as I write this, so I don't know how they are positioned for Tuesday yet.

I'll try to post an update early Tuesday morning with the options data.

Volume has been high in recent days. We are still overbought on the S&P 500. Momentum has been turned back down, but price is still not far off its all-time high.

Breadth remains very bullish, but has mostly flat-lined. The options data is not ready as I write this, so I don't know how they are positioned for Tuesday yet.

I'll try to post an update early Tuesday morning with the options data.

coolhand

TSP Legend

- Reaction score

- 530

The options are mildly bearish for Tuesday. Futures are up in the wee morning hours. I am certain that another run to the upside is coming despite the selling interest. The selling is indicative of bears who are fighting a bull market. How has that gone for them over the past several years?

Thanks..love having you here and hearing your insights!!The options are mildly bearish for Tuesday. Futures are up in the wee morning hours. I am certain that another run to the upside is coming despite the selling interest. The selling is indicative of bears who are fighting a bull market. How has that gone for them over the past several years?

Sent from my SAMSUNG-SM-N910A using Tapatalk

coolhand

TSP Legend

- Reaction score

- 530

The selling continued on Tuesday and it looks like Wednesday could see a continuation of downside pressure as the options smart money is leaning heavily bearish. I note that TRINQ closed at a very high level, which often presages a reversal. But Wednesday is Weird Wolly Wednesday, so things could get interesting.

Breath has turned down, but is not bearish. The S&P 500 exited its overbought condition yesterday. Momentum is falling. Overall, it looks like another buying opportunity is shaping up. I have no intent to bet against this market even as I endure a draw-down on my positions.

Breath has turned down, but is not bearish. The S&P 500 exited its overbought condition yesterday. Momentum is falling. Overall, it looks like another buying opportunity is shaping up. I have no intent to bet against this market even as I endure a draw-down on my positions.

Similar threads

- Replies

- 0

- Views

- 151

- Replies

- 0

- Views

- 167

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 129

- Replies

- 0

- Views

- 80