coolhand

TSP Legend

- Reaction score

- 530

A few days ago I showed you a chart of the Bank Index, BKX. It was in rally mode and I noted that this was highly suggestive of rising rates. It was and we got one on Wednesday. Yesterday, I said that I was looking for some weakness on Wednesday, but that it was likely a buying opportunity. We got some weakness. Was it a buying opportunity? I think it might have been. The action has to be maddeningly frustrating for the bears. Downside traction is hard to come by. Money flows are shifting, so while one sector or index may be getting hammered, others are rising. The fact is, money has to find a home and it usually seeks those places where it's treated best. The exception to that is a central bank manipulated correction. That's why I watch liquidity, which remains steadfastly bullish.

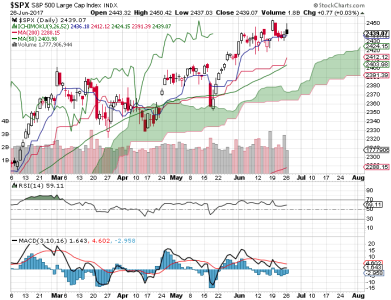

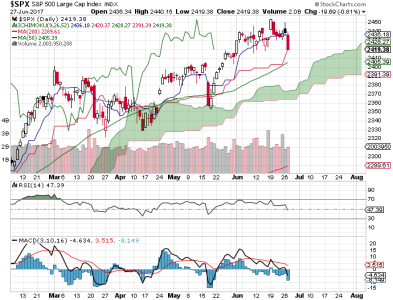

We got a modest pullback in the S&P 500 on Wednesday. The trend remains up.

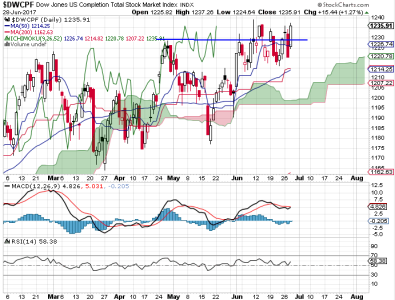

The DWCPF pulled back a bit deeper, but not enough for price to drop back below that line of resistance. That area is still resistance all the way to 1239 or so. We can see that the last rally off the bottom in mid-May has come a good ways.

My indicators are largely neutral to bullish. The market is due a more meaningful pullback, but so far it's been elusive. It could come at any time, but fresh highs could too. I'm still not excited about downside prospects.

We got a modest pullback in the S&P 500 on Wednesday. The trend remains up.

The DWCPF pulled back a bit deeper, but not enough for price to drop back below that line of resistance. That area is still resistance all the way to 1239 or so. We can see that the last rally off the bottom in mid-May has come a good ways.

My indicators are largely neutral to bullish. The market is due a more meaningful pullback, but so far it's been elusive. It could come at any time, but fresh highs could too. I'm still not excited about downside prospects.