coolhand

TSP Legend

- Reaction score

- 530

Price on the S&P 500 tagged declining trend line resistance on Monday and fell back. It could be another lower high. Support is not far below should the index reverse once more.

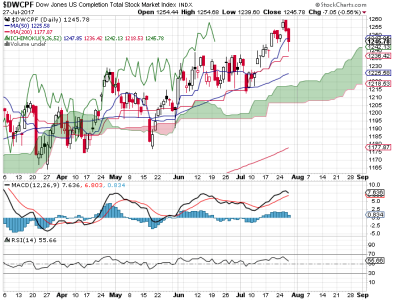

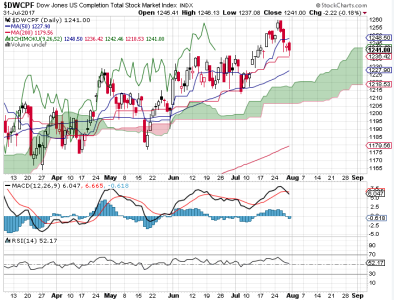

The DWCPF gave back some of Friday's gains on momentum that continues to get more negative.

It's tough to get excited about this market right now. Monday's weak close does suggest we may see more selling pressure over the next day or two. A test of recent lows is very possible. Breadth does remain positive as does liquidity and they have been trumping most other indicators (as usual). Unfortunately, many other indicators are acting as a drag on price in spite of breadth and liquidity.

I am looking for more weakness over the next couple of days, but since the market is not all that far from its previous low, any additional weakness is not likely to be long lived. If market character is any indication, anyway.