Yesterday, I said that a bottom was likely in given the big reversal in the major averages. I also said that if the DWCPF could clear its last peak at a key resistance area, the market might mount a decent rally.

Well, the 1st of the month has a tendency to be positive, but expectation and then news of a Paris Accord exit seems to have been the catalyst for the nice gains we got on Thursday. And it really was good news for us here in the US. The rally makes me wonder who really has control of the market right now. It may not be the CB. And that would be a really good thing if true.

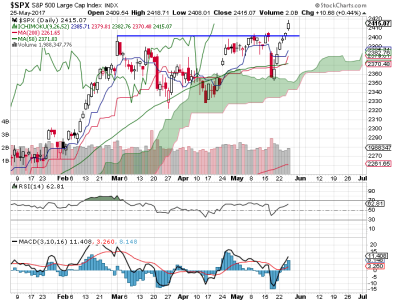

The S&P 500 had a nice pop to the upside today and volume was decent. Momentum has turned back up too.

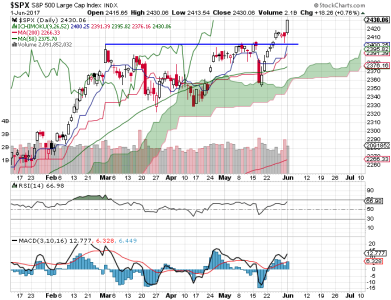

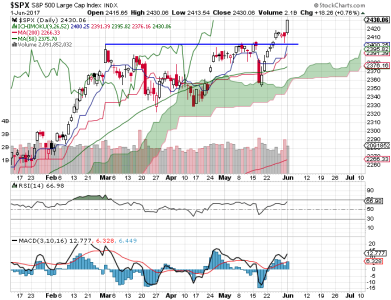

I have to say, it's about time the DWCPF gave us S funders a break. Price did a lot of catching up on Thursday, but it hasn't quite tested its all-time high yet. It's likely that it does, but I don't know if it will be the very short-term. But I do like what I see right now as it powered through that area of resistance with ease. There may be resistance just up ahead as well, but not for the S&P 500, so resistance on this chart does not mean as much to me. If anything, this index may continue to outperform a bit longer.

Breadth, which was already positive along with liquidity, took a decided jump to the upside today. That could indicate some upside follow through is likely. NAAIM came in a bit less bullish on Thursday, but not nearly enough to be of any concern. It's bullish. And so am I for now.