coolhand

TSP Legend

- Reaction score

- 530

Looks like a non event or even a sell the news now. CH, any prognostications on the S fund through the end of May? I'm starting to think about checking out...

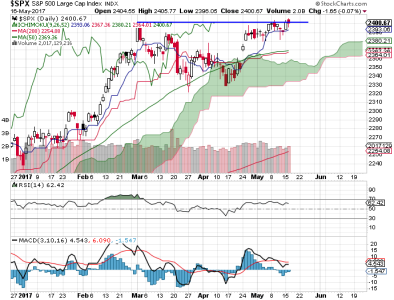

I have no solid reason to exit the S fund yet, though I am a bit frustrated with it myself. It has its weeks. I am looking for a reason to sell in order to reload, but they have made it impossible so far with the quick decline off the top. The fact that the S&P 500 has been relatively steady makes me think it's too early to bail. If we get another rally this month, I'll likely be a seller. But I need to see where my indicators are before I make any decisions.

. That was the big news item of the day, though it happened after the close on Tuesday.

. That was the big news item of the day, though it happened after the close on Tuesday.