coolhand

TSP Legend

- Reaction score

- 530

In my last post, I said that Monday may see some upside given the bullish OEX P/C. We got the upside, but it was anything but inspiring if you're a bull. I still think the lows may get retested too.

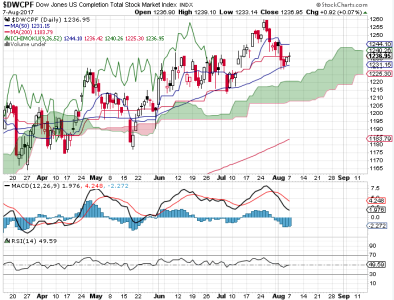

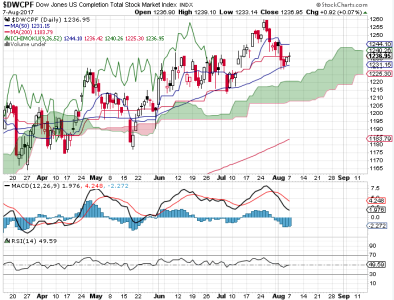

The S&P 500 traded in a tight range on Monday, just barely eking past the upper triangle line. That puts the index at an all-time high, but only by a bit. Any move lower to retest lows may not see much downside on this index, but the DWCPF is another story.

The DWCPF is made up of small and mid-cap stocks, which tend to get hit harder in a sell-off. So far, price has been able to close above its rising 50 dma, but that could be a bear flag that will break to the downside. Momentum is trying to turn up, but I'm not so sure it will get there without move lower again first.

The OEX P/C is now neutral. My intermediate term system remains positive, but only by a bit. Breadth is still positive, but tracking sideways. I am not particularly bearish, but I suspect we will turn down one more time before bottoming or retesting and making another run to the upside. It could take a few days.

The S&P 500 traded in a tight range on Monday, just barely eking past the upper triangle line. That puts the index at an all-time high, but only by a bit. Any move lower to retest lows may not see much downside on this index, but the DWCPF is another story.

The DWCPF is made up of small and mid-cap stocks, which tend to get hit harder in a sell-off. So far, price has been able to close above its rising 50 dma, but that could be a bear flag that will break to the downside. Momentum is trying to turn up, but I'm not so sure it will get there without move lower again first.

The OEX P/C is now neutral. My intermediate term system remains positive, but only by a bit. Breadth is still positive, but tracking sideways. I am not particularly bearish, but I suspect we will turn down one more time before bottoming or retesting and making another run to the upside. It could take a few days.