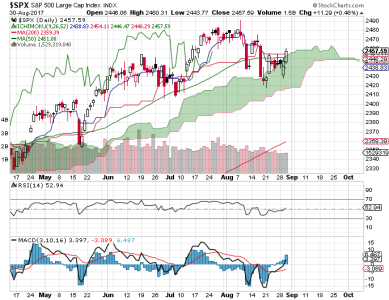

One week ago, I said that we may have seen the bottom even as the signals remained mixed. Last week's rally confirmed the bottom as the broader market marched smartly higher for most of the week.

Price on the S&P 500 is now flirting with resistance near the 2480 area. Momentum is rising, but is now getting a bit extended.

The DWCPF has rallied significantly over the past 2 weeks, but remains well off its all-time high.

NAAIM is showing caution, but remains bullish. The TSP Talk weekly sentiment is showing rising bullishness and is getting close to getting overly bullish, though I think it's still neutral. The options are leaning somewhat bearish for Tuesday.

Cumulative breadth is very bullish and rising, but may be getting extended. My intermediate term system is still negative, but has been very close to a positive condition for the last several days. Friday's close saw TRIN close at a very low level, which is bearish for Tuesday.

For next week, I am leaning bearish, but I am not looking for a deep decline. The market is due some weakness after several up days and we have some indicators that support that possible outcome. NAAIM remains bullish, but appears to be reining in their long positions; going to cash rather than flipping short.