RealMoneyIssues

TSP Legend

- Reaction score

- 101

Coolhand,

Thank you for a must read thread and good luck with your Premium Service !!!

-RMI

Thank you for a must read thread and good luck with your Premium Service !!!

-RMI

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Hi CH-

I was watching this disaster as it was dropping on Monday and bailed out completely as soon as it broke $6.00, then plowed everything into PDI which I had been watching for a while. This fund seems to be a bit more sound with a decent monthly dividend. Will take a while to recover what I lost on FAX, but I already feel better !! Do you have any perspective on PDI ??

Thanks again for your insight, all of your posts are truly enjoyable.

tc5

Hi CH-

I was watching this disaster as it was dropping on Monday and bailed out completely as soon as it broke $6.00, then plowed everything into PDI which I had been watching for a while. This fund seems to be a bit more sound with a decent monthly dividend. Will take a while to recover what I lost on FAX, but I already feel better !! Do you have any perspective on PDI ??

Thanks again for your insight, all of your posts are truly enjoyable.

tc5

IGR is VEEEEERRYYYY tempting...

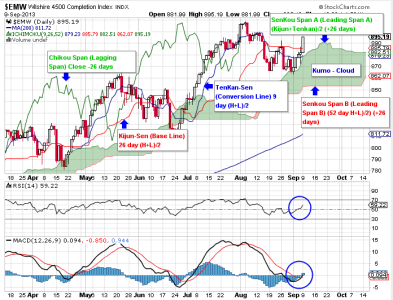

You are far better at explaining the meaning of the lines than I was, back when I tried. Good job, CH.

Thanks for the Ichimoku primer, CH. Looks very interesting. I'd love to do more research on this as well. Great job explaining the basics.

that Ichiro Suzuki method is very intriguing...looking back in hindsight over the chart it appears obvious when to buy and sell...how can you recognize this in the moment to pinpoint an entry and exit point...i would think the time to buy equities is now and then sell when the MACD is high again...can't be that simple though

Thank you for the charts and Ichimoku school, Coolhand. You do an excellent job of keeping our interests up and teaching us new things.