Science!!!

All funds should be looked at...

I am not a swinger, I normally hold one of three allocations with a little fudging here and there based on my 'feelz':

- An allocation over weighted for aggression

- A normal market allocation

- And, an allocation with a conservative weighting

Right now, I am holding an allocation that is more conservative than my normal conservative one. To be absolutely honest, I am trying to rework my allocations based on my holdings, age, and emotions. I really don't need to be as aggressive as I once was.

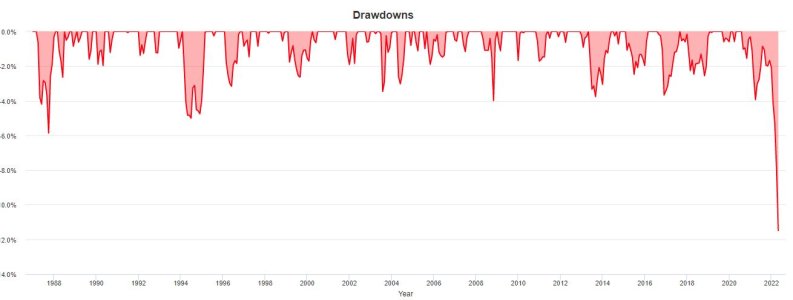

On the F-Fund... Let us look at the 'recent' (meaning since the start of the recent drawdown which ALL of the funds excepting G have participated in) performance of all of the 'at risk' funds we can invest in:

[table="width: 500"]

[tr]

[td]Fund[/td]

[td]Drawdown[/td]

[td]Dates[/td]

[/tr]

[tr]

[td]F[/td]

[td]-11.50%[/td]

[td]January 2022+[/td]

[/tr]

[tr]

[td]C[/td]

[td]-12.96%[/td]

[td]January 2022+[/td]

[/tr]

[tr]

[td]S[/td]

[td]-15.42%[/td]

[td]November 2021+[/td]

[/tr]

[tr]

[td]I[/td]

[td]-12.68%[/td]

[td]September 2021+[/td]

[/tr]

[/table]

For quite some time I have underweighted both G and F. The G offers NOTHING, and the F was in a bubble and needed a correction. The REAL question is: Which of the four funds is nearing it's max drawdown and which of them still have some travel time? Right now it looks like there is plenty of downside left for C/S/I. If I am doing the math right our F-Fund should have had a drawdown of 6.8% from July 2021 to April 2022 - not the 11.50% we have actually seen. If we carry the drawdown to where the 'Average Yield to Maturity' becomes:

- 3% the drawdown should be 9.3%

- 3.5% should be 12.1%

- 4% than the drawdown should be 14.8%.

The bond market has priced in an Average Yield to Maturity of 3.40%.

An article using July numbers for AGG:

https://seekingalpha.com/article/4437734-agg-interest-rate-sensitivity-conservative-model-portfolio

This article documented the 'avg yield to maturity' (the coupon rate) of AGG as 1.47% on June 30, 2021.

An article presenting how bonds are priced:

https://www.wallstreetmojo.com/bond-pricing-formula/

I think the Average Yield to Maturity is now 2.57%

A nice snapshot of AGG right now:

https://screener.fidelity.com/ftgw/etf/goto/snapshot/keyStatistics.jhtml?symbols=AGG

Personally, I think I am likely going to take an October 2007 approach and go something like 40/30/10/10/10. Had I held that allocation my drawdown would be 8% right now, and the max drawdown in the last 35 years was 13.73%. This can become a very ugly market very quickly and the FED has to raise interest rates in the face of it. However, I want enough in the risk funds to appreciably share in the early recovery gains - which are often quick and dramatic. Nobody can claim an IFT is quick and I don't want to miss 3%+ jumps early in the recovery cycle.

Yowser. It was difficult to create policies that both damage the economy AND instigate inflation - but we did it!!!