Boghie

Market Veteran

- Reaction score

- 372

Yesterday's bump and level action matched with todays fairly level behavior is a very good sign.

Everything has a price. Market behavior like this presents a baseline. I might move more to risk soon.

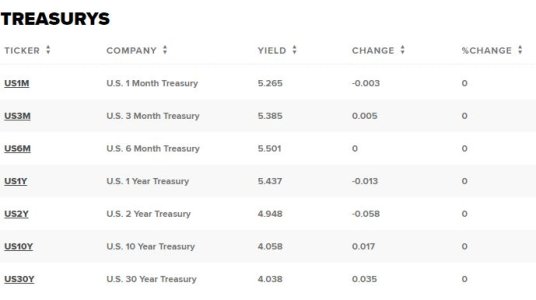

Even bonds might be a decent purchase now that they are earning something. All in all, maybe wait till after the next FED rate increase and stick more of my nose under the tent.

Everything has a price. Market behavior like this presents a baseline. I might move more to risk soon.

Even bonds might be a decent purchase now that they are earning something. All in all, maybe wait till after the next FED rate increase and stick more of my nose under the tent.