Boghie

Market Veteran

- Reaction score

- 374

Re: TSP Allocation

The market seems frothy. Don't worry about the -7% to -10% drawdowns, those happen frequently and happen fairly quickly. If you cannot accept a -10% year than you should not be in equities. That statement DOES NOT mean that if such a decline trends slowly and consistently that one has to camp in some allocation, it just means that you have to accept normal fluctuation. Personally, if I get a drawdown of about 7% from the high point I will allocate more conservatively. If I get a nice consistent up market I move to more risk. I am not going to try to guess.

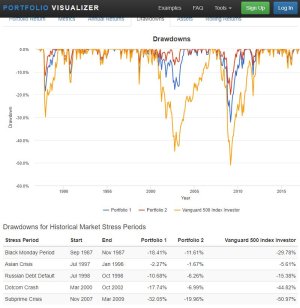

Anyway, these are what we are trying to avoid:

Portfolio #1: G/F/C/S/I 10/30/27/23/10

Portfolio #2: G/F/C/S/I 30/30/17/13/10

Portfolio Vanguard 500: G/F/C/S/I 0/0/100/0/0

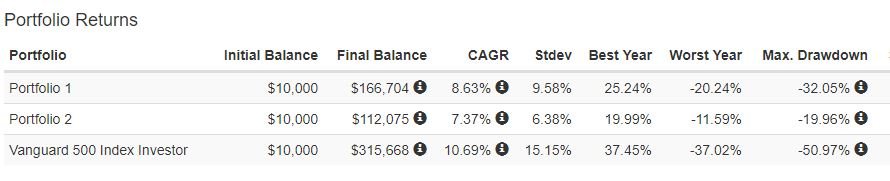

Right now I am in Portfolio #1 which seems to be a comfortable allocation for me right now. All I kinda need to retire at age 65 with a comfortable standard of living is a return of 5.5%. While I usually use Quicken to provide average return and risk, I will use Portfolio Visualizer - which has data from 1987 on. Obviously, that ignores some market data, but it does catch a lot of big and recent market moves as well as the normal blah. Here are the basic metrics:

What works for me is avoiding the worst and the worst of the worst. For example, I chunked 2008 with a -11% dump. That is actually a +26% advantage over market returns. Same, same for 2000 - 2003. Also, I am wary of all in/all out strategies. The market can move rapidly. Missing early returns (see April of this year) by being 100% in the G Fund means you lost out on a LOT of gains. True, if you predicted 'The Black Plague of 2020' you saved yourself losses in March, but the sleepers recovered in April anyway. All in/All out trading would have required being right twice during a period of turmoil. I rode it by moving to a conservative allocation (50% out of the market) during the downturn - thus alleviating some of the worst of the temporary dump, and then migrating back to a normal to aggressive allocation and the fear subsided. Never all in/all out. Works for me.

The market seems frothy. Don't worry about the -7% to -10% drawdowns, those happen frequently and happen fairly quickly. If you cannot accept a -10% year than you should not be in equities. That statement DOES NOT mean that if such a decline trends slowly and consistently that one has to camp in some allocation, it just means that you have to accept normal fluctuation. Personally, if I get a drawdown of about 7% from the high point I will allocate more conservatively. If I get a nice consistent up market I move to more risk. I am not going to try to guess.

Anyway, these are what we are trying to avoid:

Portfolio #1: G/F/C/S/I 10/30/27/23/10

Portfolio #2: G/F/C/S/I 30/30/17/13/10

Portfolio Vanguard 500: G/F/C/S/I 0/0/100/0/0

Right now I am in Portfolio #1 which seems to be a comfortable allocation for me right now. All I kinda need to retire at age 65 with a comfortable standard of living is a return of 5.5%. While I usually use Quicken to provide average return and risk, I will use Portfolio Visualizer - which has data from 1987 on. Obviously, that ignores some market data, but it does catch a lot of big and recent market moves as well as the normal blah. Here are the basic metrics:

What works for me is avoiding the worst and the worst of the worst. For example, I chunked 2008 with a -11% dump. That is actually a +26% advantage over market returns. Same, same for 2000 - 2003. Also, I am wary of all in/all out strategies. The market can move rapidly. Missing early returns (see April of this year) by being 100% in the G Fund means you lost out on a LOT of gains. True, if you predicted 'The Black Plague of 2020' you saved yourself losses in March, but the sleepers recovered in April anyway. All in/All out trading would have required being right twice during a period of turmoil. I rode it by moving to a conservative allocation (50% out of the market) during the downturn - thus alleviating some of the worst of the temporary dump, and then migrating back to a normal to aggressive allocation and the fear subsided. Never all in/all out. Works for me.