robo

TSP Legend

- Reaction score

- 471

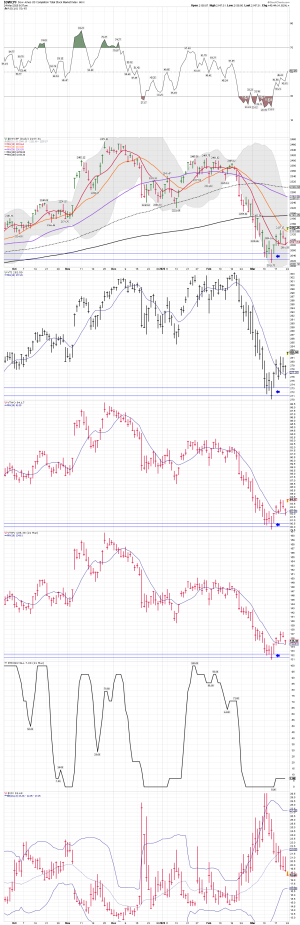

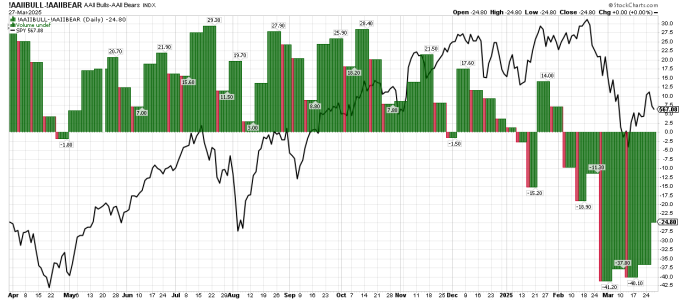

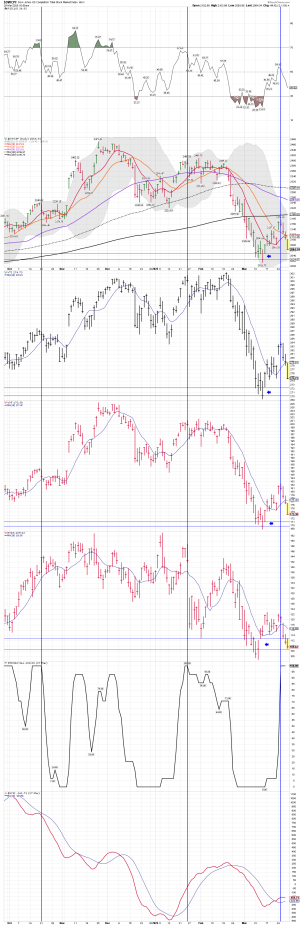

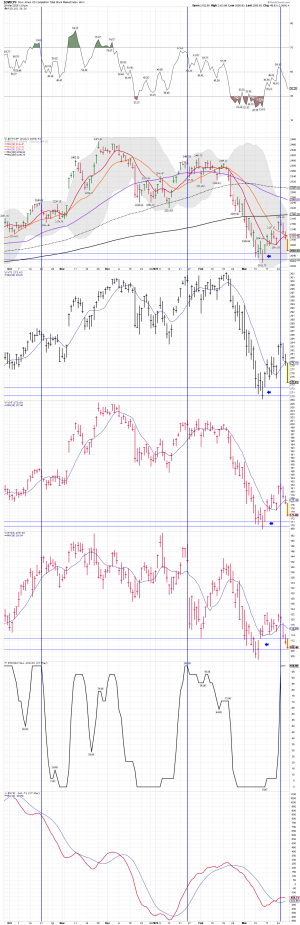

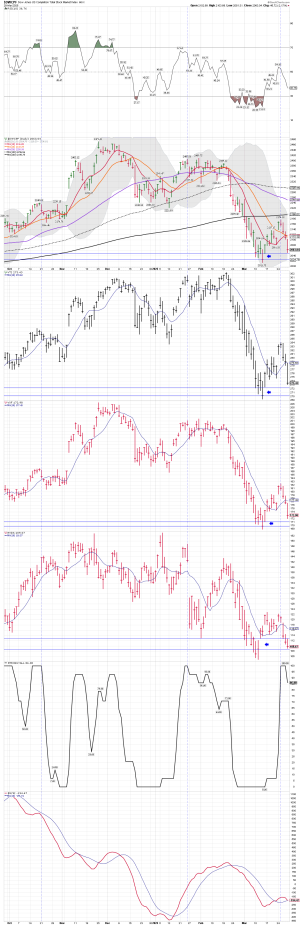

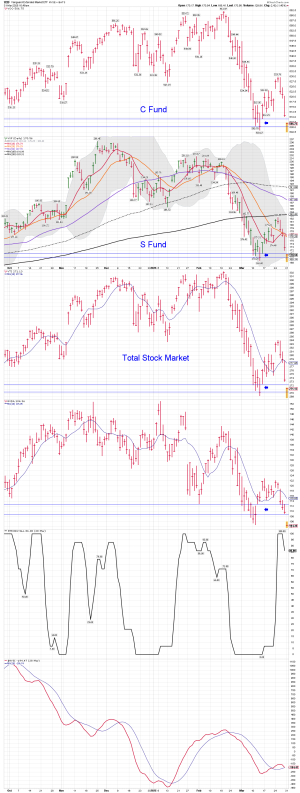

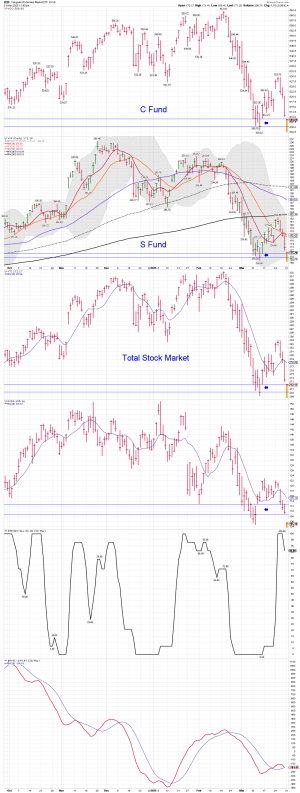

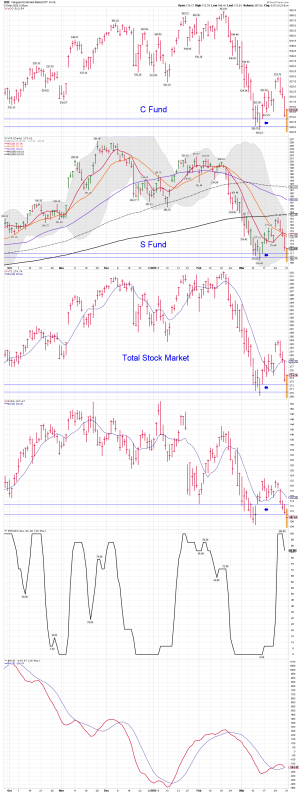

S Fund and Tariff talk: A nice gap up above the 20 day MA in early trading, as the talk of reduced tariffs is in the news.

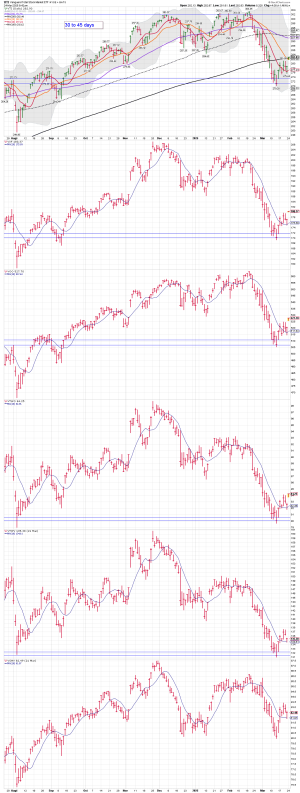

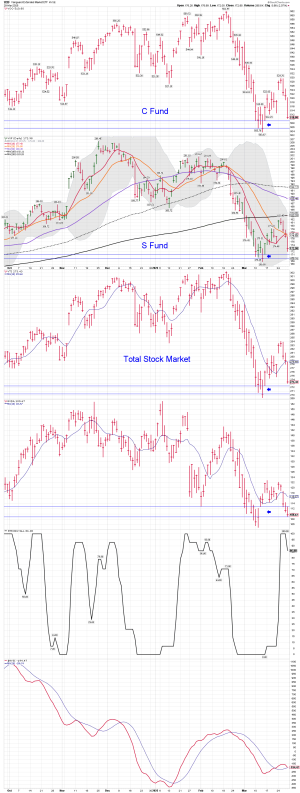

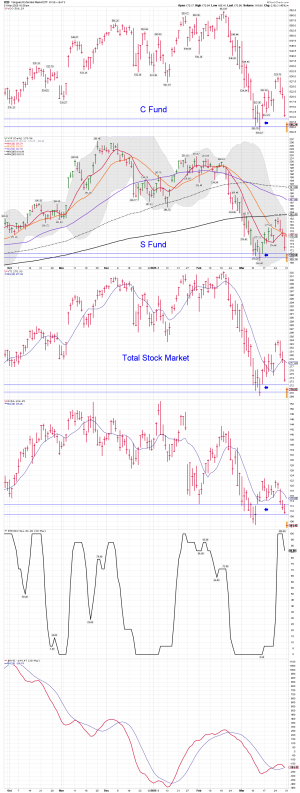

Vanguard Indexes: Looking good too. VTI moving back above the 20 day and the 200 day MA. That could bring in some additional buyers...

Vanguard Indexes: Looking good too. VTI moving back above the 20 day and the 200 day MA. That could bring in some additional buyers...

Attachments

Last edited: