robo

TSP Legend

- Reaction score

- 471

I talked with my son and he remains long stocks in the S and C Fund. He too thought he still had unlimited moves into the G Fund after his two moves into stocks.Hey Robo, have you been able to make the moves that you've made in the Autotracker in the TSP? Some have been saying they are not able to make those partial moves into the G-fund after #2, which is troublesome. Thanks.

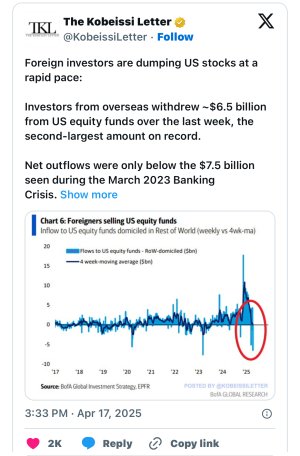

That really changes my recommendations to him using my daily charts if they have changed the rules. I always like to scale out after making large positions into stocks during oversold extremes. He rides it out a tad more. I make the same kind of moves at Vanguard as I recommend to him, but I scale in and out. I am up around 10k so far this year at Vanguard, but I have unlimited moves, and I can buy anytime during the trading day. What a big difference. My son also has a Vanguard account. As we all know this really sucks - The S Fund is up 2%, you place a request to move 25% back to the G Fund and the S Fund closes down close to 3%..... LOL... That happened to me recently on the TSP account. However, my son DID NOT take the recommendation, and remained in stocks. He told me a friend of his at work bailed after his account was down over 100k.... Ouch! Let me know what the new rules are if they have changed. My son offered to move some funds to try it, but I told him just wait until he is ready to go back to the G Fund. For now stocks continue to grind higher.

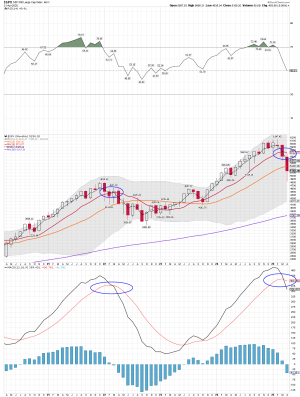

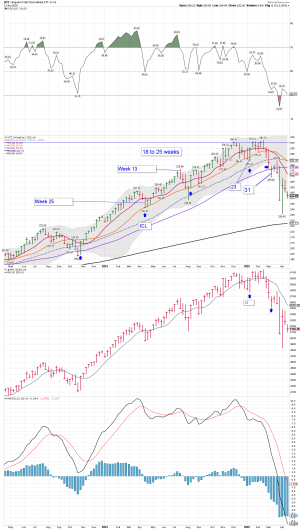

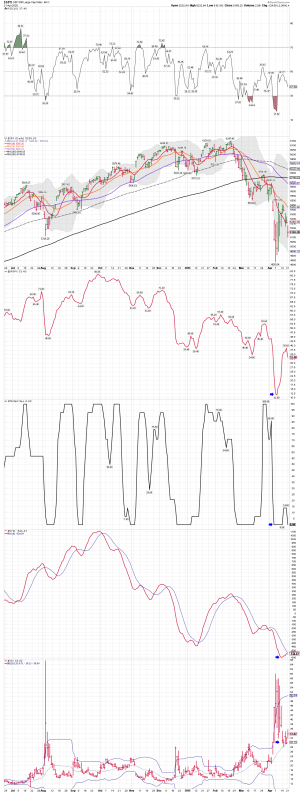

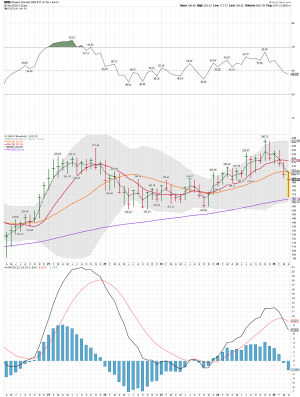

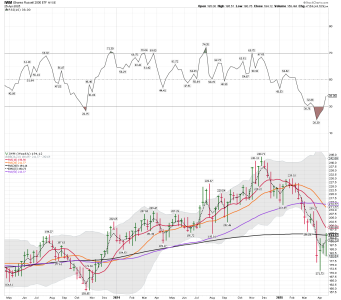

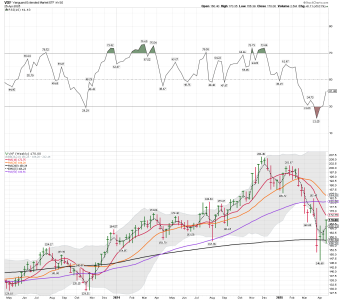

The SPX and VXF are both back above the 10 day SMA, the NYSI indicator has turned up, the VIX has moved back into the BBs, the PMOBUUALL has turned higher, HYG is leading stocks again, All are Bullish signs for now.

Attachments

Last edited: