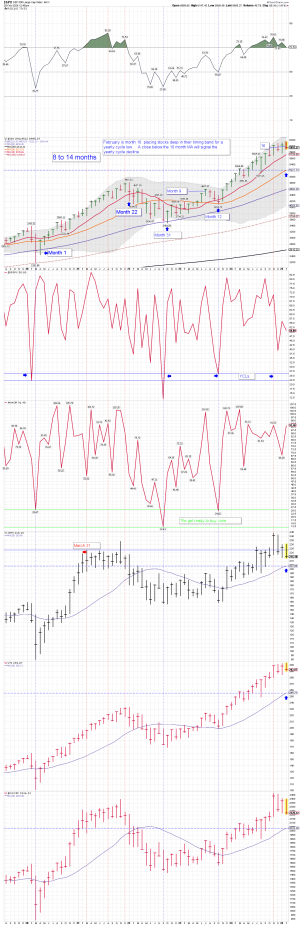

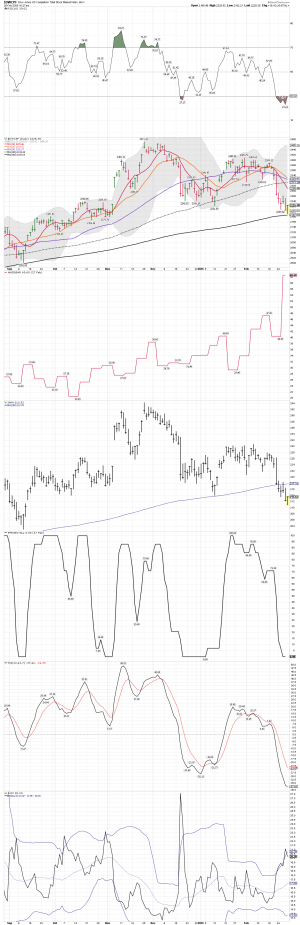

The indicators and the odds are lining up for an oversold bounce. We shall see how it plays out. I'm waiting to see it the tariffs are put into place.

It’s time for a bear-busting rally.

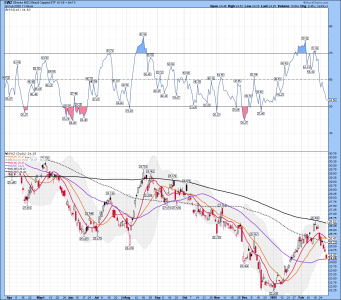

The American Association of Individual Investors (AAII) reported yesterday that over 60% of its survey respondents were bearish on their outlook for the stock market for the next six months. Only 19% were bullish.

That’s the most lopsided report we’ve seen in several years. And from a contrarian perspective, it’s bullish.

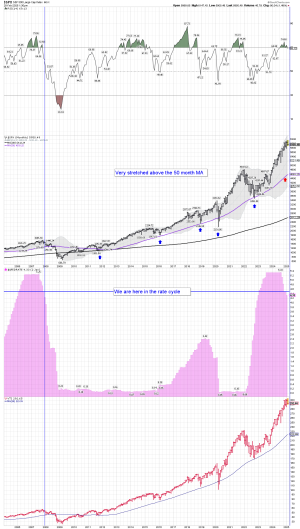

Back on November 13, 2024 – following the large, post-election rally that pushed the S&P 500 above 6000 for the first time ever – bulls outnumbered bears 50% to 28%. From a contrarian perspective, that was bearish. And stocks have struggled to make any headway since then.

Now, with the S&P 500 still stuck near 6000 and trading down just 2% from its all-time high, the vast majority of investors have turned bearish. It’s remarkable that two months of choppy, back-and-forth action can create that drastic a shift in sentiment. This is the sort of bearish reading we’d typically get following a 10% to 15% decline in the market.

So, there’s plenty of fuel to power the stock market higher from here.

Now, though, with the AAII survey showing such a large bearish sentiment (a contrary indicator), if stocks start to move higher, then we could see a dramatic rally over the next few weeks as bearish investors flip to bullish and chase stock prices higher.

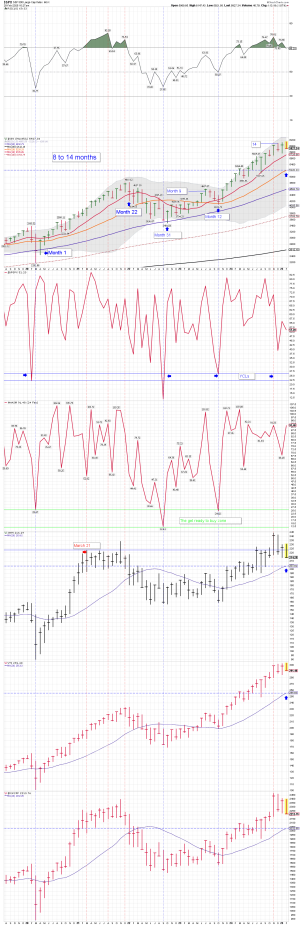

Traders should use any weakness over the next few days as a chance to add long exposure to the stock market.

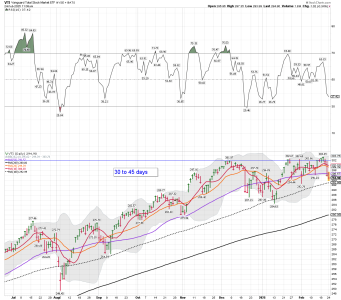

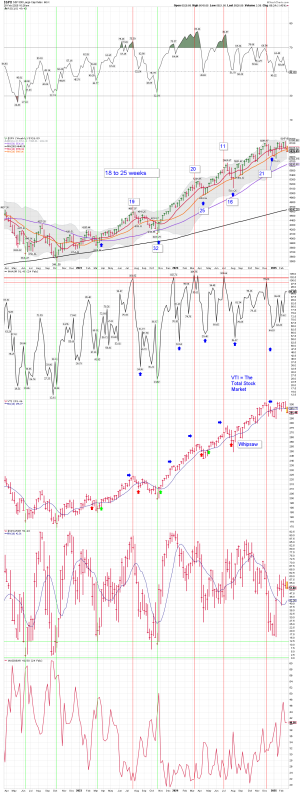

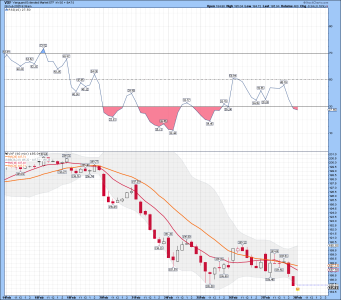

I remain flat, but watching VXF for a ST trade.

VXF 60 minute chart: It might be trying to bottom around 185ish....