robo

TSP Legend

- Reaction score

- 471

"I know nothing of your history and am better for it. Have a good day"

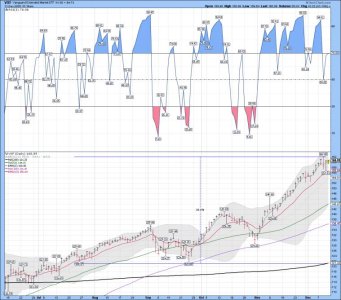

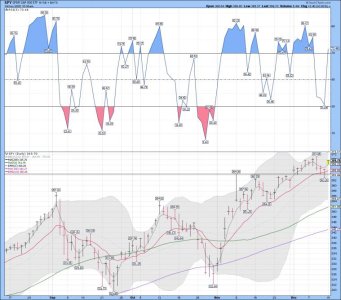

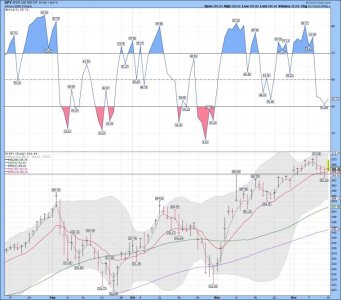

I post data about my trading system (which is currently long) and other data about risk/management ( the risk of being long).

Bottom Line: My trading system remains long, but the medium term data is warning one should have taken some profits after a very nice run. My system is based on a mechanical trading system ( numbers) and has NO OPINIONS or GUESS WORK on how I'm positioned. I also use over 10 indicators for risk management and position size. Some are now hitting historical extremes again.

The trend remains up, but with lots of RISK now!

My last buy signal was 28 days ago when the SPY moved above the 3 ema, and it was confirmed once it moved above the 13 ema. It remains in place for now. No guess work or opinions in my trading system. My work will probably just confuse you if you don't understand how trend trading works or how to trade using moving averages. In the short term anything can happen, but the medium term is sending out BIG warnings signals about having to much money in stocks. I currently only have a 10% position after reducing on the way up. Keep in mind I'm 70 so when I'm 100% long my stock position is only 30% of my total account. The rule of 100 is a good average for those of us that are NOT greedy....

I have posted before how my trading system works, and why I trend trade. It is system based on data only.

The "Trading Edge"

"Without a crystal ball, you can't know the future direction of stock prices with any amount of certainty, regardless of whether you use fundamental or technical analysis.

However, once you recognize the market prices are the result of millions of investors who "believe" they know the direction prices are going to take, you have the "key" to beating the markets.

Knowing that prices are based on the beliefs of the masses is your "trading edge."

If you look at any long term chart of the financial markets, you will see that "most" of the time, the markets are moving up or down in trends that last many months, and sometimes years.

These "trends" reflect the "beliefs" of all those investors. And those "beliefs" are controlled by the "emotions" of fear and greed.

While prices are rising, the majority of investors "believe" they will "continue" to rise.

While prices are "falling" the majority of investors "believe" they will "continue" to fall.

Because emotions are involved, you will see more investors buying near tops and pushing prices higher than anyone expected they would go.

And of course, because emotions are involved, you will also see more investors selling near bottoms, pushing prices lower than anyone expected they would go.

This has been going on since the beginning of free market trading."

https://www.fibtimer.com/about/prior_commentaries.asp

https://www.youtube.com/watch?v=3DeTQt9cjiU&feature=emb_logo

I post data about my trading system (which is currently long) and other data about risk/management ( the risk of being long).

Bottom Line: My trading system remains long, but the medium term data is warning one should have taken some profits after a very nice run. My system is based on a mechanical trading system ( numbers) and has NO OPINIONS or GUESS WORK on how I'm positioned. I also use over 10 indicators for risk management and position size. Some are now hitting historical extremes again.

The trend remains up, but with lots of RISK now!

My last buy signal was 28 days ago when the SPY moved above the 3 ema, and it was confirmed once it moved above the 13 ema. It remains in place for now. No guess work or opinions in my trading system. My work will probably just confuse you if you don't understand how trend trading works or how to trade using moving averages. In the short term anything can happen, but the medium term is sending out BIG warnings signals about having to much money in stocks. I currently only have a 10% position after reducing on the way up. Keep in mind I'm 70 so when I'm 100% long my stock position is only 30% of my total account. The rule of 100 is a good average for those of us that are NOT greedy....

I have posted before how my trading system works, and why I trend trade. It is system based on data only.

The "Trading Edge"

"Without a crystal ball, you can't know the future direction of stock prices with any amount of certainty, regardless of whether you use fundamental or technical analysis.

However, once you recognize the market prices are the result of millions of investors who "believe" they know the direction prices are going to take, you have the "key" to beating the markets.

Knowing that prices are based on the beliefs of the masses is your "trading edge."

If you look at any long term chart of the financial markets, you will see that "most" of the time, the markets are moving up or down in trends that last many months, and sometimes years.

These "trends" reflect the "beliefs" of all those investors. And those "beliefs" are controlled by the "emotions" of fear and greed.

While prices are rising, the majority of investors "believe" they will "continue" to rise.

While prices are "falling" the majority of investors "believe" they will "continue" to fall.

Because emotions are involved, you will see more investors buying near tops and pushing prices higher than anyone expected they would go.

And of course, because emotions are involved, you will also see more investors selling near bottoms, pushing prices lower than anyone expected they would go.

This has been going on since the beginning of free market trading."

https://www.fibtimer.com/about/prior_commentaries.asp

https://www.youtube.com/watch?v=3DeTQt9cjiU&feature=emb_logo

Attachments

Last edited: