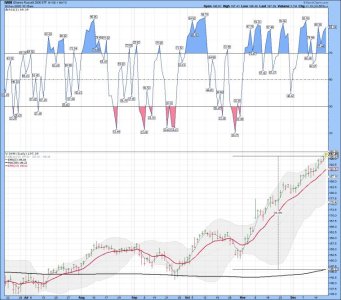

LOL..... Looking at the data one would think so, but my system remains on a buy signal for now.....

33 days since the confirmed buy signal and still going strong! As some are currently saying - We are in a meltup....

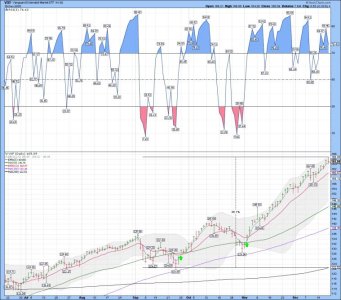

VXF daily below: Like the S fund

Bottom Line: Love it or hate it the Trend for stocks remains UP. Trend traders just follow the trend and it remains up! Some comments on Trend trading....

https://www.youtube.com/watch?v=3DeTQt9cjiU&feature=emb_logo

I'm not a sub at Fibtimer, but I do read his free weekly comments since I'm a trend trader.

"At Fibtimer we publish a weekly analysis for each strategy to prepare subscribers for what is "likely" to come. Better to be prepared than to be hit with surprises.

But we never presuppose that we are so smart we can tell, unerringly, what the markets will do next.

Trend timers do not try to anticipate reversals or breakouts. They respond to them.

Trend timers are not prognosticators. We just identify and follow trends.

Trend timers believe the markets are smarter than any of us. We make it our business not to try to figure out why the markets are going up or down, or even where they are going to stop.

Successful trend timers identify trends, trade those trends, and patiently allow them to play out while their profits grow.

Predicting the markets is a fool's game. It is fun to do over cups of morning coffee, but if you want to beat the financial markets, you must identify and trade trends.

You must also stay with your trend trading strategy through thick and thin. If no one can consistently predict where the markets are going, they also do NOT know when the next trend will begin. Taking all trades guarantees that you will never miss it when it start"

https://www.fibtimer.com/about/prior_commentaries.asp