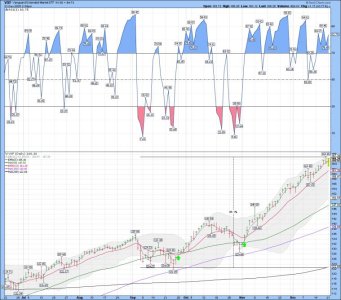

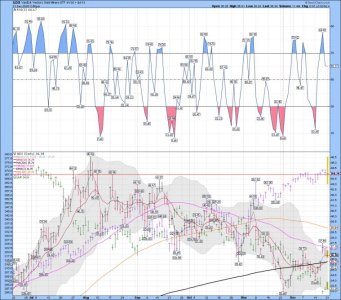

Something to think about from Jessie as we continue to hit additional extremes..... A chart for the 2007 and 2000 tops.... Apples to apples.....

It's time to go fishing in my opinion.

Failure to take advantage of a serendipitous act of good luck in the stock market is often a mistake.

Jesse Livermore

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth – or the first. These two are the most expensive eighths in the world. They have cost stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent.

Jesse Livermore

If you can’t sleep at night because of your stock market position, then you have gone too far. If this is the case, then sell your position down to the sleeping level.

Jesse Livermore

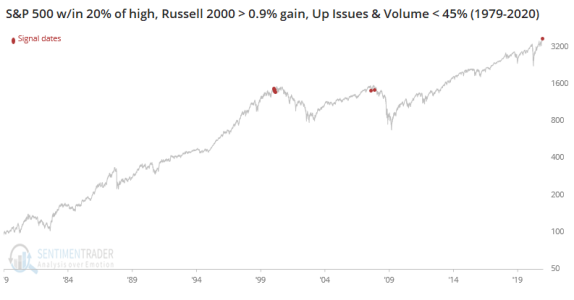

Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks. Then get out of all your stocks; get out for keeps! You have to use your brains and your vision to do this; otherwise my advice would be as idiotic as to tell you to buy cheap and sell dear.

"One of the most helpful things that anybody can learn is to give up trying to catch the last eighth-or the first. These two are the most expensive eighths in the world."

Jesse Livermore

Play the market only when all factors are in your favor. No person can play the market all the time and win. There are times when you should be completely out of the market, for emotional as well as economic reasons.

Jesse Livermore

Do not use the words “Bullish” or “Bearish.” These words fix a firm market-direction in the mind for an extended period of time. Instead, use “Upward Trend” and “Downward Trend” when asked the direction you think the market is headed. Simply say: “The line of least resistance is either upward or downward at this time.” Remember, don’t fight the tape!

Jesse Livermore

There is a time to go long. There is a time to go short. There is a time to go fishing.

Jesse Livermore

https://www.english-culture.com/50-famous-quotes-by-jesse-livermore/