robo

TSP Legend

- Reaction score

- 471

retread,

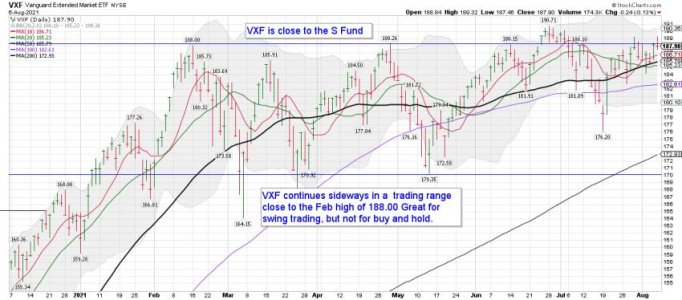

TSP is for MT trading only. I always try and point that out. In my opinion you should first do the matching in your TSP account, second is Roth IRA's for you and your wife at Vanguard in a trading account, third max out the rest of your TSP/401k for those that can, and last a straight up trading account at Vanguard. Well, that is how I played it and I moved my TSP funds to Vanguard once I could. For your TSP account you should be using a weekly chart Brother. I like TSP all except the two moves a month.

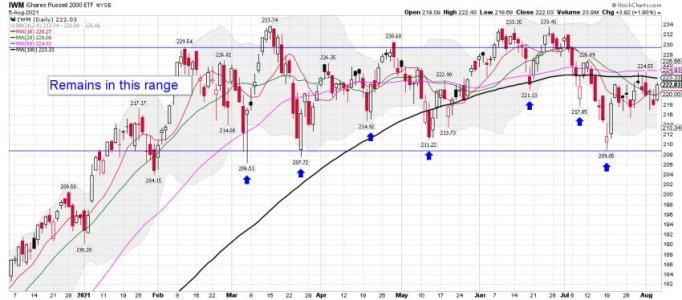

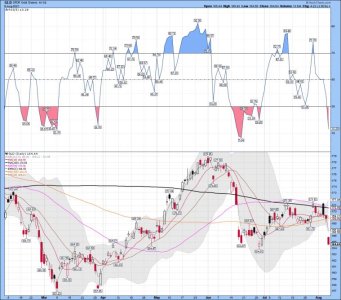

My posts about ST trading are NOT about a TSP account. However, my posts related to weekly and monthly charts are. The SPY weekly chart below. if you use the 20 wma for making moves you would have been long for most of this trend. Even after a short-term tag of the 20 wma you would have went right back to a buy signal. If you don't understand let me know and I will explain it better. I'm not including risk management data in the signals because that is used for how large a position size should be after a new buy signal. If you use the 40 wma for buy and sell signals, which I don't, you would still be long the C Fund. Back test it on my chart below. Tagging of the 200 wma is always a time of extremes and one should start scaling in small even if we move lower. Once we see the bottom forming adding tags of the 40 wma is also a good time to add. Again, we are talking about MT trading on the weekly chart. The daily is different.

Take Care!

Bottom Line: In my opinion you should also get a Roth IRA at Vanguard if you can. See the eggs and a basket picture below.

TSP is for MT trading only. I always try and point that out. In my opinion you should first do the matching in your TSP account, second is Roth IRA's for you and your wife at Vanguard in a trading account, third max out the rest of your TSP/401k for those that can, and last a straight up trading account at Vanguard. Well, that is how I played it and I moved my TSP funds to Vanguard once I could. For your TSP account you should be using a weekly chart Brother. I like TSP all except the two moves a month.

My posts about ST trading are NOT about a TSP account. However, my posts related to weekly and monthly charts are. The SPY weekly chart below. if you use the 20 wma for making moves you would have been long for most of this trend. Even after a short-term tag of the 20 wma you would have went right back to a buy signal. If you don't understand let me know and I will explain it better. I'm not including risk management data in the signals because that is used for how large a position size should be after a new buy signal. If you use the 40 wma for buy and sell signals, which I don't, you would still be long the C Fund. Back test it on my chart below. Tagging of the 200 wma is always a time of extremes and one should start scaling in small even if we move lower. Once we see the bottom forming adding tags of the 40 wma is also a good time to add. Again, we are talking about MT trading on the weekly chart. The daily is different.

Take Care!

Bottom Line: In my opinion you should also get a Roth IRA at Vanguard if you can. See the eggs and a basket picture below.

Attachments

Last edited: