SPY daily: Options Expiration week data on my SPY chart below - 5 of the last 6 months during Options Expiration week they were down. (See my chart below) The week that was up, the following week was down. We shall see how the pattern does next week. This was a tool/pattern Sy Harding used in his use in his reports. I was a sub with him. So it's just something I still track. Options Expiration weeks are inside the blue vertical lines.

https://www.marketwatch.com/optionscenter/calendar

For those that didn't know him:

Sy Harding's Seasonal Timing Strategy (STS)

Sy Harding, applied the Moving Average Convergence Divergence indicator, or MACD, to the Dow after the average best time to leave the market, April 20, following the "sell in May and Go away" strategy. Likewise, around the best days on average to enter the market, October 16, Harding's STS looks for positive MACD to enter the market again.

Apr 30, 2015 - Sy L. Harding, 80, died on Tuesday, April 21, 2015 at the Florida Hospital in DeLand, FL, after a sudden illness.

For example. Sy waits for the MACD to turn positive after October 16, the average best day to enter the stock market based on the "Seasons in the Sun Strategy." Harding writes:

The idea is that if a rally is underway when the October 16 calendar date for seasonal entry arrives, as indicated by the MACD indicator, we will enter at that time. However, if the MACD indicator is on a sell signal when the October 16 calendar date arrives, indicating a market decline is underway, it would not make sense to enter before that decline ends, even though the best average calendar entry date has arrived. Instead, our Seasonal Timing Strategy simply waits to enter until MACD gives its next buy signal, indicating that the decline has ended.

In the Spring, Harding uses the same MACD indicator to look for the favorable exit point from the market any time after April 20, the average best day to exit the market based on the "Seasons in the Sun Strategy." We use the same method to better pinpoint the end of the market's favorable period in the spring. If MACD is on a sell signal when the calendar exit day of April 20 arrives, we exit at that point. However, if the technical indicator is on a buy signal, indicating the market is in a rally when April 20 arrives, it makes no sense to exit the market just because the calendar date has arrived. So our Seasonal Timing Strategy's exit rule is to simply remain in the market until MACD triggers its next sell signal indicating the rally has ended.

In a nutshell. STS looks for daily MACD to give signals on or after the average best days to enter and leave the market using the seasonal strategy.

The average best day to exit the market is April 20

The average best day to enter the market is October 16

IF MACD is negative on April 20, then you exit the market that day. If MACD is positive, then you wait for it to turn negative to exit the market.

Likewise, if MACD is positive on October 16, then you enter the market on that day. If MACD is negative, then you wait for it to turn positive to enter the market..

https://www.forbes.com/sites/sharding/?sh=524242c93285

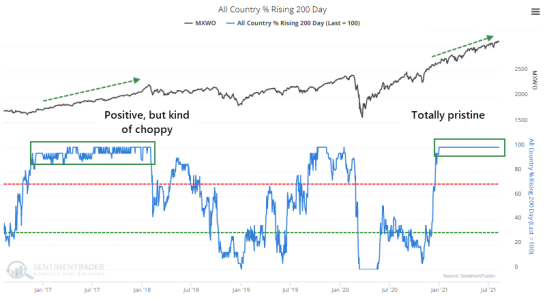

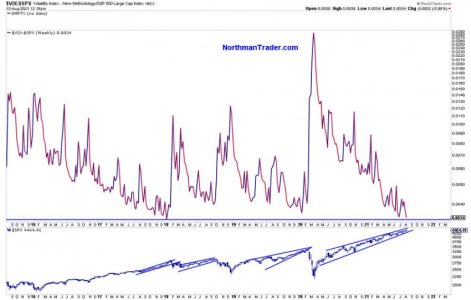

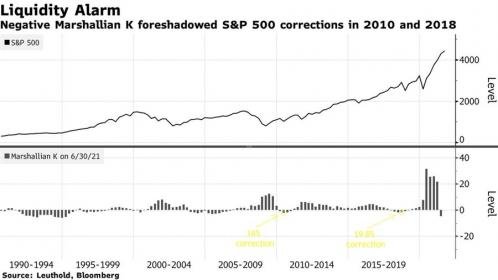

For the record: I just trend trade these days. The price action has continued to drift higher since the 2020 March low, after short-term tags down to the 50 dma.

So will next week be up or down? LOL....

Bottom Line: The SPY trend remains up!

May 23, 2014,03:31pm EDT

What? Some Proven Investment Strategies Are Too Simple To Accept?

Sy HardingContributor

Investing

I cover being street smart about the stock, bond and gold markets

https://www.forbes.com/sites/shardi...ies-are-too-simple-to-accept/?sh=86c5ed17c727