redbrian

Investor

- Reaction score

- 3

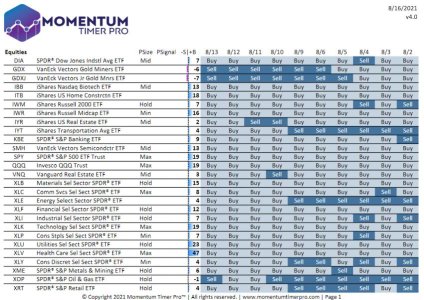

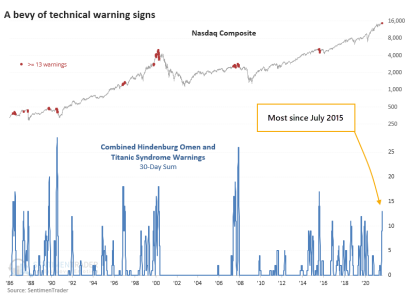

Made four grand trading the miners last week. Hoping for a drop to 30 before taking another bite of the apple. GDX weakness compared to gold makes me think the pain isn't over yet (plus the Fed is talking about thinking about maybe tightening someday which will be a drag on gold until they change their mind).

P.S. I got inline images to work which is less tedious than managing attachments.

P.S. I got inline images to work which is less tedious than managing attachments.