robo

TSP Legend

- Reaction score

- 471

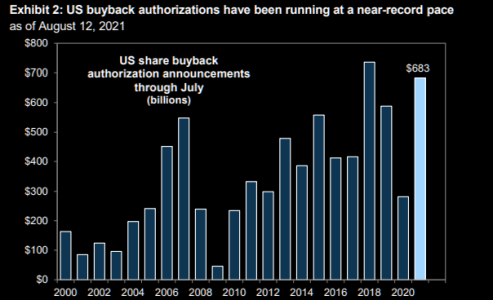

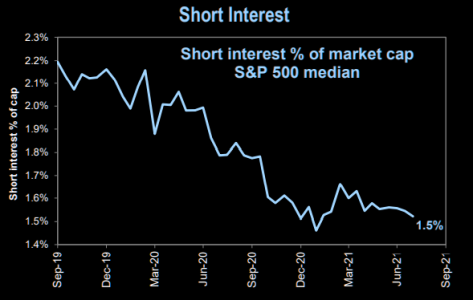

Buy Backs! The insiders are selling their shares at historical records and using share holders money to do Buy Backs.

Kostin: "Repurchases totaled more than $200 bn in 2Q and buyback announcements through July equaled $683 bn. Previously-announced deals should drive nearly $250 bn of cash M&A spending in 2H 2021, joining a potential $460 bn of buybacks if the recent pace continues. This demand should easily outweigh equity supply from IPOs, follow ons, SPACs, and convertibles as well as potential selling from upcoming IPO lock-up expiries. The 4-quarter S&P 500 shareholder yield of 2.5% (1.2% net buyback, 1.3% dividend) registers 357 bp above the real 10-year UST yield of -1.1%, a wider gap than average during the last 30 years"

https://themarketear.com/

Kostin: "Repurchases totaled more than $200 bn in 2Q and buyback announcements through July equaled $683 bn. Previously-announced deals should drive nearly $250 bn of cash M&A spending in 2H 2021, joining a potential $460 bn of buybacks if the recent pace continues. This demand should easily outweigh equity supply from IPOs, follow ons, SPACs, and convertibles as well as potential selling from upcoming IPO lock-up expiries. The 4-quarter S&P 500 shareholder yield of 2.5% (1.2% net buyback, 1.3% dividend) registers 357 bp above the real 10-year UST yield of -1.1%, a wider gap than average during the last 30 years"

https://themarketear.com/