-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

redbrian

Investor

- Reaction score

- 3

Gold and stock DCL coming up. Double dump should break 30.5 GDX low and get a panic sell off (high volume). Jackson Hole is the key. If the Fed caves on tightening then it is game on. Otherwise September will be ugly for everything. Fed knows that so different speakers will say different things so the market will be confused and they can highlight whatever is needed to manage expectations.

robo

TSP Legend

- Reaction score

- 471

Red,

I'm still building a 10% position in the miners. I added some more shares this morning. A nice bounce from the early lows for the miners. That means someone continues to add shares for MT positions. I have NO IDEA when the miners will bottom, but I have lots of cash so I'm scaling in Brother. There is always a chance we could go much lower, and I would welcome lower prices to build my MT position that I will hold for months.

Long: GDXJ, EQX, and SDS.

GDXJ, EQX, and SDS daily charts:

I'm still building a 10% position in the miners. I added some more shares this morning. A nice bounce from the early lows for the miners. That means someone continues to add shares for MT positions. I have NO IDEA when the miners will bottom, but I have lots of cash so I'm scaling in Brother. There is always a chance we could go much lower, and I would welcome lower prices to build my MT position that I will hold for months.

Long: GDXJ, EQX, and SDS.

GDXJ, EQX, and SDS daily charts:

Attachments

robo

TSP Legend

- Reaction score

- 471

EQX, GDX, and GDXJ weekly charts. Some gaps left behind that some are worried about. We shall see how it plays out. Unlike others, I don't guess what will happen next. All I know is we are getting late in the cycle and buying now should get me a nice gain in the months ahead.

I continue to catch the falling knife, but my first buy was close to $6.00 for EQX. A slight undercut of that price today and so I added. Heck, it could go to $3.00 for all I know, but I'm betting it will get back to $10.00 in the months ahead. The upper BB is currently around $10.00ish.

Take Care!

I continue to catch the falling knife, but my first buy was close to $6.00 for EQX. A slight undercut of that price today and so I added. Heck, it could go to $3.00 for all I know, but I'm betting it will get back to $10.00 in the months ahead. The upper BB is currently around $10.00ish.

Take Care!

Attachments

redbrian

Investor

- Reaction score

- 3

Still a lot of uncertainty regarding gold/miners. GDX has a Head and Shoulder, Broken Wedge and sitting below downward sloping 50/200. I am not good enough to figure out the targets for those formations. I do want to see a test of 30.6. A panic break would be better since I am sitting in cash waiting for a good deal on something.

TSI and Money Flow are getting close.

P.S. Why is this forum called Bear Cave 2 (Bull Allowed). An awkward name. Chart Cave? Day Trading Den? Technical Tea?

TSI and Money Flow are getting close.

P.S. Why is this forum called Bear Cave 2 (Bull Allowed). An awkward name. Chart Cave? Day Trading Den? Technical Tea?

robo

TSP Legend

- Reaction score

- 471

IWM daily: The current price is below the Jan high marker..... Is that a tell?

Bottom Line: IWM remains in a trading range, and that is NOT what you want to see this late in the yearly cycle.

IWM monthly: Well, a bounce after tagging the 10 mma, but still moving sideways

Bottom Line: IWM remains in a trading range, and that is NOT what you want to see this late in the yearly cycle.

IWM monthly: Well, a bounce after tagging the 10 mma, but still moving sideways

Attachments

robo

TSP Legend

- Reaction score

- 471

"P.S. Why is this forum called Bear Cave 2 (Bull Allowed). An awkward name. Chart Cave? Day Trading Den? Technical Tea?"

LOL.... That was my choice of a name when I started this Cave back in 2005. We didn't get the big correction until 2007, but the indicators were there it was coming, and I was getting Bearish. So I opened up this thread and called it the Bear Cave..... LOL..... However, bull was allowed since I trade both ways.

Bottom Line: I picked the name in 2005 Brother.

As for the miners, I too would love to see "A panic break lower" but I will keep adding shares for now. I have a ways to go to complete my 10% position. Since I just started buying I would also welcome a mover lower.

Bottom Line: The miners remain in a downtrend and I have "NO BUY" signal yet.

GDX remains below the 10, 20, 50, and 100 dma, and is in a downtrend...... I be waiting for the turn too.....

LOL.... That was my choice of a name when I started this Cave back in 2005. We didn't get the big correction until 2007, but the indicators were there it was coming, and I was getting Bearish. So I opened up this thread and called it the Bear Cave..... LOL..... However, bull was allowed since I trade both ways.

Bottom Line: I picked the name in 2005 Brother.

As for the miners, I too would love to see "A panic break lower" but I will keep adding shares for now. I have a ways to go to complete my 10% position. Since I just started buying I would also welcome a mover lower.

Bottom Line: The miners remain in a downtrend and I have "NO BUY" signal yet.

GDX remains below the 10, 20, 50, and 100 dma, and is in a downtrend...... I be waiting for the turn too.....

Attachments

robo

TSP Legend

- Reaction score

- 471

Is it time to start buying the miners? Kaplan thinks it is..... GDXJ went lower then $41.17 today

Monday, August 16, 2021

“It’s not always easy to do what’s not popular, but that’s where you make your money.” --John Neff

GDXJ slid to 41.17, its lowest dividend-adjusted point since May 14, 2020.

This was the lowest level for GDXJ in over 15 months. Additional downside is possible and perhaps even likely but by early 2023 or sooner a rebound could result in GDXJ being substantially higher than it is now. Doubling is possible and even tripling can't be ruled out. I am therefore sticking stubbornly with my ladder of good-until-canceled purchase orders and thereby buying more into weakness. The total decline since its 7-1/2-year peak of August 5, 2020 through today's intraday low for GDXJ, including all reinvested dividends, surpassed 36.5%.

GDX has dropped just under 30% over a nearly identical time period dating back to its August 5, 2020 high.

Kaplan

https://truecontrarian-sjk.blogspot.com/

GDXJ daily chart:

Monday, August 16, 2021

“It’s not always easy to do what’s not popular, but that’s where you make your money.” --John Neff

GDXJ slid to 41.17, its lowest dividend-adjusted point since May 14, 2020.

This was the lowest level for GDXJ in over 15 months. Additional downside is possible and perhaps even likely but by early 2023 or sooner a rebound could result in GDXJ being substantially higher than it is now. Doubling is possible and even tripling can't be ruled out. I am therefore sticking stubbornly with my ladder of good-until-canceled purchase orders and thereby buying more into weakness. The total decline since its 7-1/2-year peak of August 5, 2020 through today's intraday low for GDXJ, including all reinvested dividends, surpassed 36.5%.

GDX has dropped just under 30% over a nearly identical time period dating back to its August 5, 2020 high.

Kaplan

https://truecontrarian-sjk.blogspot.com/

GDXJ daily chart:

Attachments

redbrian

Investor

- Reaction score

- 3

Video on the oil sector from an Ultra-Bear. He was calling for a break of the support line and commodity bust last winter but changed his Elliott wave count and moved the bust to this winter.

[video]https://www.thezebergreport.com/11_Oil_Companies_Video[/video]

Looks like a couple posters here. How many lurkers?

[video]https://www.thezebergreport.com/11_Oil_Companies_Video[/video]

Looks like a couple posters here. How many lurkers?

Last edited:

robo

TSP Legend

- Reaction score

- 471

Many folks here have their own account talks, and just post their thoughts for other members to look over. My thread doesn’t get many looks, but I don’t have to put up with all the political crap like I had to from other sites I used to post at. It is NOT allowed here at TSPtalk. I just post my market thoughts, and sometimes someone stops by and leaves a comment. This is a place I can go back over my charts and market thoughts without being attacked because someone didn’t agree with me. After all, most are just opinions. I'm a firm believer in a journal for my thoughts, and this is the place I’m currently using when it comes to the stock market. I do post things I don’t agree, they too are just opinions most of the time. I try and post data that is facts when I can.

Anyway, I can look back over my comments, charts and

say... What the heck was I thinking! Tom also does a nice daily report, and other members also post some excellent market thoughts and links.

Take care.

Also, I hate posting using this IPad!

Anyway, I can look back over my comments, charts and

say... What the heck was I thinking! Tom also does a nice daily report, and other members also post some excellent market thoughts and links.

Take care.

Also, I hate posting using this IPad!

Last edited:

rangerray

TSP Pro

- Reaction score

- 209

You are doing great. Even though I may not hit the “like” button, I am looking. I can sift through the information that first interest me well, but I usually pick up a nugget here and there, so it’s all good.

Sent from my iPhone using TSP Talk Forums

Sent from my iPhone using TSP Talk Forums

redbrian

Investor

- Reaction score

- 3

Perhaps two different styles can pick better entries. Daily/Weekly. Gold holding up. GDX following the stocks down. Spy turned at the 50 last time. Will start paying attention when SPY nears the 50. Oddly, enough everyone had a week to get into GDX after SPY turned last month. Nice to see more trading info and less fluff.

Last edited:

robo

TSP Legend

- Reaction score

- 471

I added shares of the miners today Brother. If the miners move lower I will just add.... I got smacked hard doing this with MTDR, but in the end I made money. I think this will be a better then average MT trade. I added another 500 shares of EQX today. Close to my fill of this gold stock, and will look at other stocks. Overall position getting close to 2% position and most of it is EQX... The max will be 10% and I reduce and take gains once we get deeper into the weekly cycle and the upper BB. That is once the new weekly cyele low is confirmed, and we are trending up on the weekly chart. It remains in a downtrend right now. A (-56%) move down since the $13.66 marker high. A move back to $10.00ish would make me happy, but do we move down to $4.00ish first is the big question. I will be adding GDXJ going forward, and ST trading JNUG and NUGT when I like the setups after the cycle low is confirmed. We shall see what happens next....

The following order executed on 08/18/2021 at 10:30 AM, Eastern time:

Account:

Transaction type: Buy

Order type: Market

Security: EQUINOX GOLD CORP NO PAR (EQX)

Quantity: 500 share(s)

Price:* $6.01

The following order executed on 08/18/2021 at 10:30 AM, Eastern time:

Account:

Transaction type: Buy

Order type: Market

Security: EQUINOX GOLD CORP NO PAR (EQX)

Quantity: 500 share(s)

Price:* $6.01

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Red,

Here is the MTDR data I was talking about. I got caught in that huge gap down from about $8.00ish and it went down to $1.11. I added shares and did ok in the end, but one just never knows how any stock will play out in the end. Avoid all those that think they know for sure. Of course I sold way to early on the way back up..... That sucked too!

The Big gap down was on a Sunday night when I couldn't do a darn thing but watch.

Here is the MTDR data I was talking about. I got caught in that huge gap down from about $8.00ish and it went down to $1.11. I added shares and did ok in the end, but one just never knows how any stock will play out in the end. Avoid all those that think they know for sure. Of course I sold way to early on the way back up..... That sucked too!

The Big gap down was on a Sunday night when I couldn't do a darn thing but watch.

Attachments

robo

TSP Legend

- Reaction score

- 471

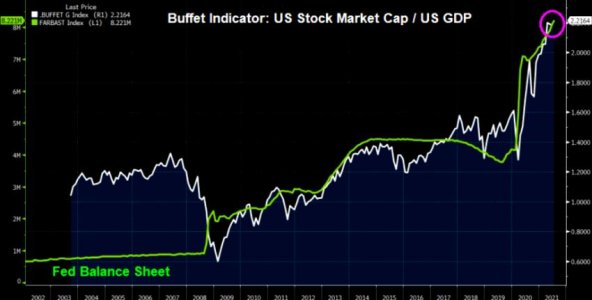

Trade the trend, but is this getting a bit bubbly?

You definitely don't use the Buffett indicator (US stock market cap/US GDP) for the short term book, but the indicator continues to trade at elevated levels.

On the other hand, Fed is still pumping...

https://themarketear.com/

You definitely don't use the Buffett indicator (US stock market cap/US GDP) for the short term book, but the indicator continues to trade at elevated levels.

On the other hand, Fed is still pumping...

https://themarketear.com/

Attachments

robo

TSP Legend

- Reaction score

- 471

Are you ready to buy the miners? The guy below based on his charts thinks so. I say we shall see if the $30.00ish area holds for GDX. I have stopped reading some of these guys on 321 gold because they are to political, and talk about their rights not to wear masks etc. It doesn't belong in the comments about what gold will do next. But some have to bring it into everything. Please keep it out of this thread, but it's in this guys comments so I'm bringing it up. I would never pay this guy money for his guesses on what gold will do next.

I stop in at 321 gold on occasion to read over some of these guys comments..... I would NEVER take a trade based on anything they post. To many Conspiracy dudes are posting here and I hate to hear or read that crap. The same goes for political crap. It's nice that Tom doesn't allow it. Again, we shall see if his support level holds. The reason I mentioned the political crap is he makes a comment about wearing masks and the end of his report. Based on other free stuff I have read from him he's about average on his calls. So flip a coin and call it heads or tails or just get a magic 8 ball. However, I read many of these guys for entertainment! LOL....

It's true that Strong Support is Strong Support until it's NOT. As I have been posting I have been buying shares of EQX around $6.00ish. It tagged that area again this morning.

https://www.clivemaund.com/gmu.php?art_id=68&date=2021-08-14

3 2 1 g o l d ... Welcome!

Gold Market Update - READY FOR NEXT MAJOR UPLEG & GREAT ENTRY POINT...

originally published Saturday, August 14, 2021

I stop in at 321 gold on occasion to read over some of these guys comments..... I would NEVER take a trade based on anything they post. To many Conspiracy dudes are posting here and I hate to hear or read that crap. The same goes for political crap. It's nice that Tom doesn't allow it. Again, we shall see if his support level holds. The reason I mentioned the political crap is he makes a comment about wearing masks and the end of his report. Based on other free stuff I have read from him he's about average on his calls. So flip a coin and call it heads or tails or just get a magic 8 ball. However, I read many of these guys for entertainment! LOL....

It's true that Strong Support is Strong Support until it's NOT. As I have been posting I have been buying shares of EQX around $6.00ish. It tagged that area again this morning.

https://www.clivemaund.com/gmu.php?art_id=68&date=2021-08-14

3 2 1 g o l d ... Welcome!

Gold Market Update - READY FOR NEXT MAJOR UPLEG & GREAT ENTRY POINT...

originally published Saturday, August 14, 2021

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

GDX daily: Another move down this morning, and we are getting close to BTing the March low marker of $30.64..... We shall see if it holds up today..... LOL.... That doesn't mean it will tomorrow... Charts can give you clues and help you see patterns, but NO ONE knows for sure what will happen. Good calls and good guesses are based on your tools and odds that your trade COULD be a winner.

EQX daily: Tagging the $6.00ish are again.

Bottom Line: GDX, GDXJ and EQX all remain in a downtrend. I have NO BUY signal yet based on the tools I use.

EQX daily: Tagging the $6.00ish are again.

Bottom Line: GDX, GDXJ and EQX all remain in a downtrend. I have NO BUY signal yet based on the tools I use.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

SPY daily closeup: A tag of the lower BB after moving below the 10 and 20 dma. A 1/2 cycle low or something bigger? You can guess as many time as you want. We shall see if we are heading to the 50 dma. The pattern has been to get a nice bounce after the tag. We shall see if I need to sell SDS soon.

The SPY is now in a ST downtrend..... That's a cash or SDS position for me. You CAN NOT short at Vanguard, but I have other accounts for that trading.

I remain long SDS for a trade only.

LONG - EQX, GDXJ, and SDS.....

Good Trading!

The SPY is now in a ST downtrend..... That's a cash or SDS position for me. You CAN NOT short at Vanguard, but I have other accounts for that trading.

I remain long SDS for a trade only.

LONG - EQX, GDXJ, and SDS.....

Good Trading!

Attachments

robo

TSP Legend

- Reaction score

- 471

SPY weekly: Whats not to like. The SPY hasn't even touched the 10 wma yet.

SPY daily: Having some trouble getting back above the 20 dma...... We shall see how it closes....

GDXJ daily: The 2020 smash down chart: Did you BTD early? LOL.... I did and it wasn't fun!

Bottom Line: The trend remains up for SPY on the weekly, but remains on a sell on the daily. I trade using the daily in case you don't understand how I can have to signals. There is ST trading and there is MT trading. The weekly is for MT trading and the daily is for ST trading using my trading system.

Positions: SDS, GDXJ, and EQX. GDXJ and EQX are both counter-trend positions as I'm scaling in for a MT position. I'm trying to catch the falling knife. You should NOT be buying shares for an index that is trending down. Well, your NOT suppose to because it could just keep going much lower. Did you BTD during the 2020 sell-off? If you bought early it got ugly. A chart of that time frame below for GDXJ. You got your money back if you BTD early, but most get scared and just sell and then they are afraid to get back in. Maybe that is not you, but many are in that group.

SPY daily: Having some trouble getting back above the 20 dma...... We shall see how it closes....

GDXJ daily: The 2020 smash down chart: Did you BTD early? LOL.... I did and it wasn't fun!

Bottom Line: The trend remains up for SPY on the weekly, but remains on a sell on the daily. I trade using the daily in case you don't understand how I can have to signals. There is ST trading and there is MT trading. The weekly is for MT trading and the daily is for ST trading using my trading system.

Positions: SDS, GDXJ, and EQX. GDXJ and EQX are both counter-trend positions as I'm scaling in for a MT position. I'm trying to catch the falling knife. You should NOT be buying shares for an index that is trending down. Well, your NOT suppose to because it could just keep going much lower. Did you BTD during the 2020 sell-off? If you bought early it got ugly. A chart of that time frame below for GDXJ. You got your money back if you BTD early, but most get scared and just sell and then they are afraid to get back in. Maybe that is not you, but many are in that group.

Attachments

Last edited: