Some opinions on Sentiment and some rambling from me about other indicators: I DO NOT trade or take positions based on Sentiment. However, I use it sometimes to help me determine position size, but lean more toward cycles for that data. Are we deep into the weekly gold/miners cycle or just starting a new one? That is a very important indicator I like to use. Different tools for different folks. I have found sentiment hasn't worked well in a market like this one. LOL... In the stock market for sure.

Market Watch - Note that on BOTH or these articles from a so called Sentiment Expert they both start with opinion. He is good at what he does, but this market hasn't cared much about sentiment. As I always like to say after posting my data, links or charts - NO ONE EVER KNOWS for sure. Especially in the metals/miner sector.

Opinion: American consumers’ gray mood could put the S&P 500 in the green over the next 6 months

Last Updated: Aug. 21, 2021 at 9:33 a.m. ET

First Published: Aug. 17, 2021 at 7:10 a.m. ET

https://www.marketwatch.com/story/a...r-the-next-6-months-11629181914?mod=home-page

Mark Hulbert

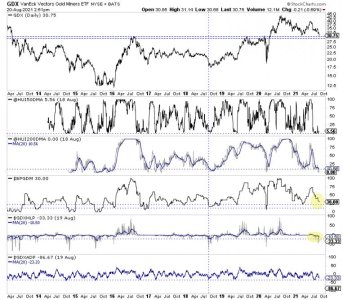

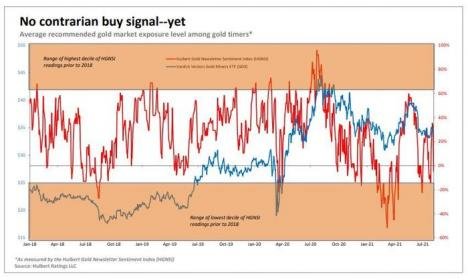

Opinion: As gold prices fall, there’s still not enough gloom to trigger a buy signal

Last Updated: Aug. 14, 2021 at 9:40 a.m. ET

First Published: Aug. 9, 2021 at 1:54 p.m. ET

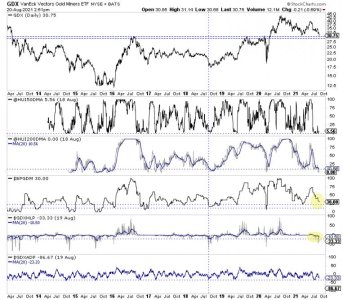

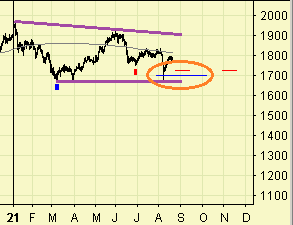

The chart I posted below is from Mark and is part of his sentiment tools he uses for buy and sell signals. Many like to use the COT, but I don't use them as much as I use to anymore.

https://www.marketwatch.com/story/a...ugh-gloom-to-trigger-a-buy-signal-11628531667

However, I do track this guy because he provides above average info about the COT.

Gold Mid-Tiers' Q2'21 Fundamentals

Aug. 21, 2021 1:57 AM ETVanEck Vectors Junior Gold Miners ETF (GDXJ)6 Comments11 Likes

321gold: Adam Hamilton archives

https://seekingalpha.com/article/44...k-0&utm_medium=email&utm_source=seeking_alpha

I'm still a sub with Kaplan and he provides me with some of that data I like to use. He has two weekly Zoom Meetings for his subs and answers most question in the chat room. I still track Fund flows, and insider data which he normally talks about weekly. Some indicators I don't have to look up.

https://twitter.com/TrueContrarian

https://truecontrarian-sjk.blogspot.com/

In a bear market, gold mining shares tend to be among the earliest sectors to complete their bottoming patterns.

Not many investors pay attention to precious metals and their producers, but funds including GDX and GDXJ had completed 7-1/2-year peaks on August 5, 2020, and entered downtrends which persisted for more than one year. During the 2000-2002 bear market, gold mining shares (see HUI) were among the earliest assets to complete their lows on November 15-16, 2000, almost two years ahead of the Nasdaq's October 10, 2002 nadir. Gold mining shares (GDX) later completed an important bottom near the opening bell on October 24, 2008, while the S&P 500 didn't complete its final 666.79 low until March 6, 2009. Last year, both GDX and GDXJ had bottomed on March 13-16, 2020, while most U.S. equities touched their lowest points on March 23, 2020. It is likely that the corrections for GDX and GDXJ, whether they are complete or not, will be followed over the next several months by key intermediate-term bottoms for nearly all equity sectors.

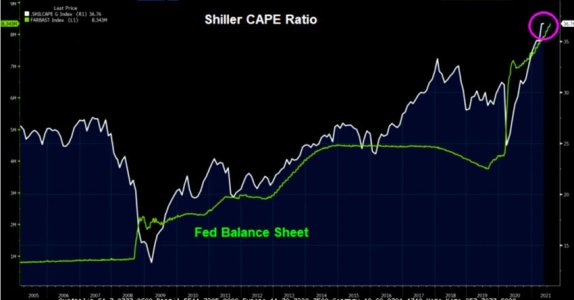

Kaplan

https://seekingalpha.com/article/4450037-bearish-rotation

The bottom line: we have a sector rotation for U.S. equities which closely resembles the early months of several past severe bear markets. Good bargains will tend to occur earliest for those sectors which tend to bottom first, including gold mining and silver mining shares. Caution is warranted since the initial decline is often roughly half of the total bear-market loss and because U.S. stock-market valuations overall have never been higher. Near all 2021 peaks we have experienced both aggressive insider selling relative to insider buying along with all-time record equity fund net inflows, thereby confirming that the risk of being heavily invested today is highest when it is widely perceived to be lowest.

Kaplan

https://truecontrarian-sjk.blogspot.com/