robo

TSP Legend

- Reaction score

- 471

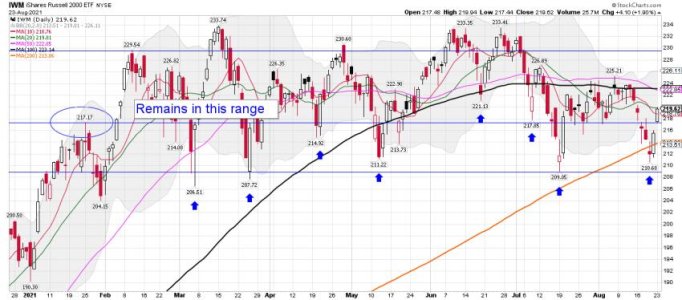

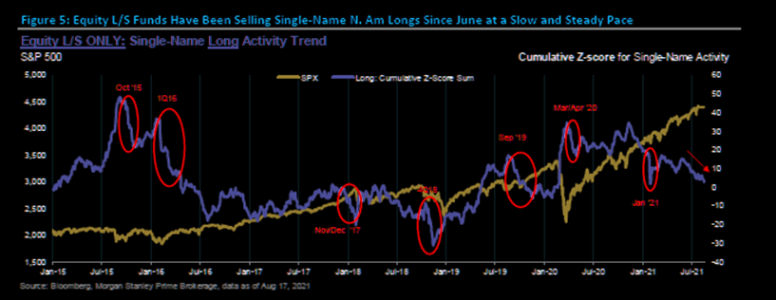

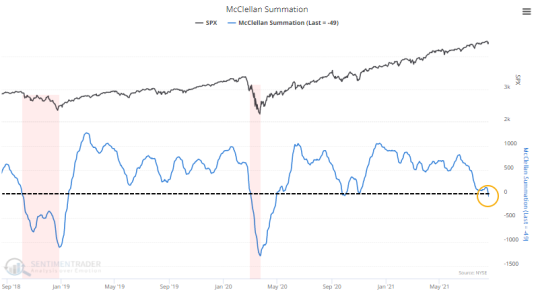

SPY daily: Tagging the upper BB..... adding a few more shares of SDS......

GDX daily: Moved above the 10 dma..... Breakout or Fakeout? Will those gaps fill?

EQX daily: On the move.....

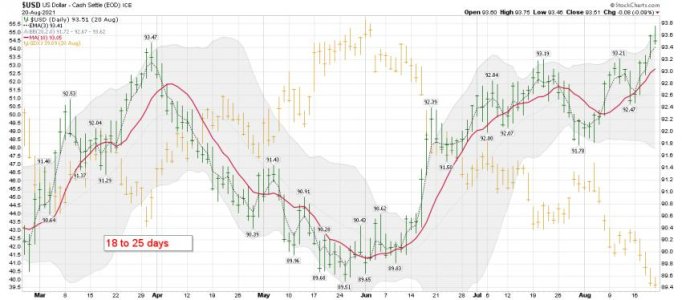

USD/GDXJ: Watching the dollar....

GDXJ: A nice gap up...

Long GDXJ, EQX, and adding SDS with stops. Small beer money trade for SDS.

Good trading!

Bottom Line: The trend remains up for SPY and a possible low for GDX. We shall see how it plays out. LOL.... There should be plenty of guessers sending out reports tonight.....

GDX daily: Moved above the 10 dma..... Breakout or Fakeout? Will those gaps fill?

EQX daily: On the move.....

USD/GDXJ: Watching the dollar....

GDXJ: A nice gap up...

Long GDXJ, EQX, and adding SDS with stops. Small beer money trade for SDS.

Good trading!

Bottom Line: The trend remains up for SPY and a possible low for GDX. We shall see how it plays out. LOL.... There should be plenty of guessers sending out reports tonight.....

Attachments

Last edited: