Gold bulls say that gold's corrective phase is over and it will rise to new all-time highs.

https://www.clivemaund.com/gmu.php?art_id=68&date=2021-08-14

Gold bears say that gold is setting up for a drop similar to 2013.

https://www.sunshineprofits.com/gold-silver/gold-trading/ignorance-always-backfires-pay-attention-to-gold-miners/

I was leaning towards the bear case given the Fed's taper talk until Kaplan turned dovish today. I expected them to talk tough at least until Jackson Hole. I think a gold crash is off the table.

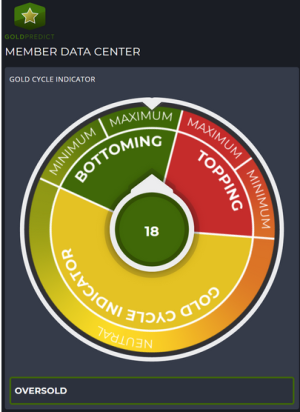

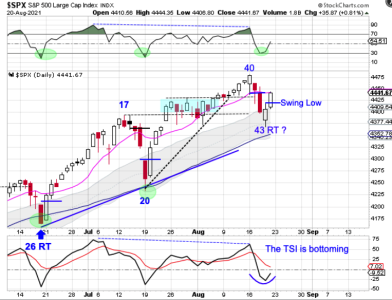

My cycle chart.

SPX 200 DMA is up and stocks are close to breaking down from a rising wedge. DCL/ICL due now. Buy the dip.

USD 200 DMA is turning up and the dollar broke above the previous high. Another week or two to the peak.

Gold 200 DMA is turning down. DCL/ICL due over the next two weeks. Buy the dip.

GLD sentiment and SMA Percent is neutral so I don't see an extreme that can lead to a big move.

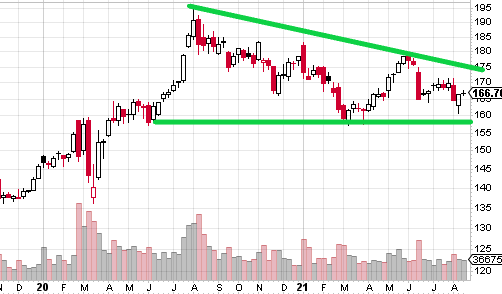

Daily/Weekly chart.

UUP is embedded (trend).

GLD is stuck on the 20 DMA.

GDX has a daily indecision candle but needs a lower low next week to setup an easier weekly turn.

I looked at which mining ETF I want to buy. GDXJ is lagging GDX but should outperform once we get an ICL. Volume is not high enough for a serious low (yet).

So what is my plan?

I am looking for a cup and handle and need to watch for a cycle low over the next two weeks using short-term indicators. Accumulating GDX, preferably on a high volume flush that breaks below 30.6. I really want to see the gap at 27 filled which could happen if stocks get a real ICL. But will that happen with the Fed walking back tapering before even talking about it in an FOMC announcement. If I end up buying too early then I have the option of switching to GDXJ for more leverage.

This post took way more time than I expected (3 hours). I hit the image limit. Couldn't delete the extra images. When creating a copy of my post I kept getting stretched links in my pasted text. Also, the images are compressed and blurry which makes my eyes tired. It would be nice if I could submit a Wordpad document with text and images that is turned into a post.

Also I really should be adding features to my charting program so I can analyze stocks faster instead of struggling with forum software. Smash that like button if you want to encourage me to put my programming hat back on.