robo

TSP Legend

- Reaction score

- 471

VTI daily: The Total Stock Market..... Just BTD!

Bottom Line: The trend remains up!

Yet Another Breadth Thrust to Frustrate Shorts

Jason Goepfert

Jason Goepfert

Published: 2021-08-26 at 07:30:00 CDT

Just leave it to this market. Unbelievable.

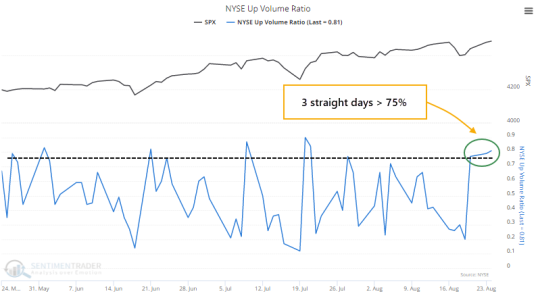

Seemingly whenever something negative triggers, buyers show up immediately. We saw on Monday that the S&P 500's approach to its former high was accompanied by a negative McClellan Summation Index and more 52-week lows than highs on the NYSE.

No matter, stocks continued to rise, and breadth turned around. The switch was dramatic enough that more than 75% of volume on the NYSE flowed into advancing securities. It happened on Monday, too. And Friday.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-0830d77b14-1271291994

Bottom Line: The trend remains up!

Yet Another Breadth Thrust to Frustrate Shorts

Jason Goepfert

Jason Goepfert

Published: 2021-08-26 at 07:30:00 CDT

Just leave it to this market. Unbelievable.

Seemingly whenever something negative triggers, buyers show up immediately. We saw on Monday that the S&P 500's approach to its former high was accompanied by a negative McClellan Summation Index and more 52-week lows than highs on the NYSE.

No matter, stocks continued to rise, and breadth turned around. The switch was dramatic enough that more than 75% of volume on the NYSE flowed into advancing securities. It happened on Monday, too. And Friday.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-0830d77b14-1271291994