robo

TSP Legend

- Reaction score

- 471

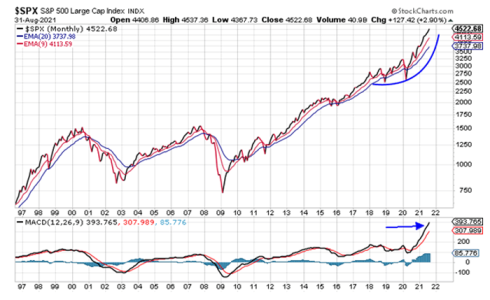

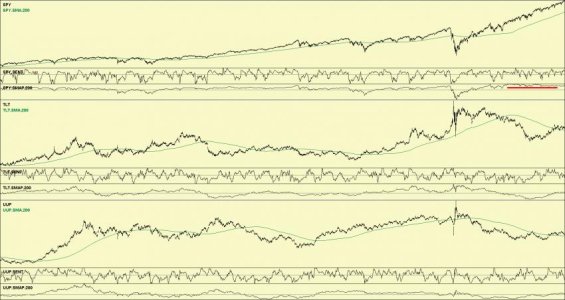

SPY daily: Getting closer to the completion of this daily cycle. Not normal to have 5 daily cycles before we get an ICL, but nothing is normal about this stock market. Will we get a tag of the 50 dma and then a continuation of the melt-up during the next daily cycle low (DCL). That would make it 6 if that happens.

SPY weekly: Waiting on the next ICL..... LOL..... if we every get one.....

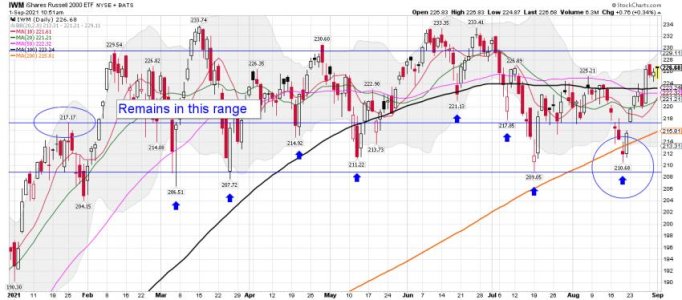

IWM weekly: Still keeping my eye on this sector. Having some trouble after tagging the upper BB. So that pattern remains in play.... It could be different this time because we did get a tag of the 200 dma and buyers came in.

SPY weekly: Waiting on the next ICL..... LOL..... if we every get one.....

IWM weekly: Still keeping my eye on this sector. Having some trouble after tagging the upper BB. So that pattern remains in play.... It could be different this time because we did get a tag of the 200 dma and buyers came in.