robo

TSP Legend

- Reaction score

- 471

Things you don't want to see with a market at new highs. The column of stocks at new highs is shorter than the one at new lows.

Helene Meisler

@hmeisler

https://twitter.com/hmeisler/status/1418889012450889739?mc_cid=a9c377896b&mc_eid=5b348a9ca0

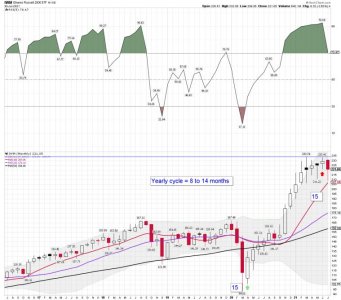

IWM daily: Remains under its 100 dma while the SPY makes new ATH's.

Helene Meisler

@hmeisler

https://twitter.com/hmeisler/status/1418889012450889739?mc_cid=a9c377896b&mc_eid=5b348a9ca0

IWM daily: Remains under its 100 dma while the SPY makes new ATH's.