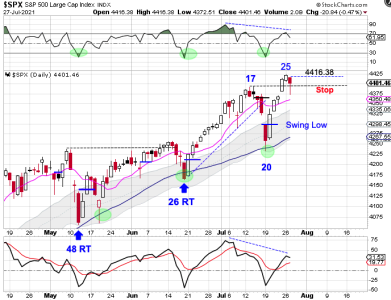

If I'm understanding your question correctly - Those indicators are the number of days in the current daily cycle. The (RT) means Right Translated which is a good thing. I use cycles as part of my trading system, but for Risk Management only. Cycles are a very good tool to have in you tool box. I track two cycle guys.

BOB LOUKAS and Likesmoney

Likesmoney just tracks the cycles as part of his service, but Bob gives recommended trades. That is why the price of the two services is very different. I'm currently not a sub with either service. Go to the link below and do some reading and you will have a much better understanding how cycles can be used for trading. It's easy reading even for a novice.

I'm not a sub or suggesting you should join a service that uses cycles for trading, but understanding cycles sure improved my overall trading. At one time I was a sub with both so I could learn more about cycles, and how to use them for trading. The comments below by Bob are close to how my current trading system works. I hope I answered your question and if not, reading over the data at the link below should help you understand how to use cycles. I mainly trade the daily cycles, but track the others for MT positions.

https://thefinancialtap.com/about-me/

Bottom Line: I'm a trend trader and use cycles as one of my Risk Management tools.

WHAT ARE MARKET CYCLES

Cycles are everywhere and our lives are intertwined within them. There are cycles in the seasons, in the weather, in interplanetary movements, in human aging, and even human moods. Cycles also extend into the affairs of humans, where economic and business cycles describe periodic movements in world economies and financial markets. The prices of financial assets move in repeating rhythms as our emotions related to these assets ebb and flow.

At its simplest, a Cycle is a sequence of events that repeats. Each event in the sequence is similar to a past event. When strung together in the sequence, these sequences are similar to prior sequences….creating a repetitious pattern (cycle) that characterizes the flows of an asset over time. The longer the history of events that form the Cycles, the more definable the Cycle becomes.

https://thefinancialtap.com/what-are-market-cycles/

WHY SUBSCRIBE?

Perspective

Everyone wants winning trades, and the best chance of getting them is when the forces in favor of the trade converge. Identifying these convergences is where the study and discipline of Cycles can give investors a serious edge. Combining Macro and Cycles Analysis, The Financial Tap will only put on trades if the right odds and probabilities greatly favor the trade being successful.

It’s all about putting the trade in perspective, executing when it makes the most sense, having the conviction to stand aside when the odds are not in our favor.

Mentoring

It’s not enough for any market advisory service to be right or to simply stream out successful trades.

They need to be clear, concise and educational. Investors want to trust and understand the investments they are making. More so, investors want to improvise on the investments as it fits and relates to their personal situation. In order for investors to extract the most value out of a service, they must feel comfortable, believe in it, and most importantly trust it.

Through your membership, The Financial Tap will help guide you through all aspects of wealth management. Don’t think of the membership in terms of a trading service, think of it as a membership to endless investment and wealth management training.

Risk Management

Losing trades are a certainty, and in fact they occur rather frequently. It is how well they are managed that determines how successful a strategy will be. Risk management must be at the core of any strategy, as mitigating losses ensures that the worse you could do, is not make any money. Anybody can make a lot of money when enough risk is applied. Earning gains with minimal risk, while protecting capital, is at the heart of risk management.

Before any investment is made, the appropriate risk management questions must be answered. Defining risk is so often overlooked, yet by managing risk, you allow your portfolio to grow with the winning trades. Learn proper risk management via its practice at The Financial Tap. We will show you how great risk management strategies can be applied within your own strategies.

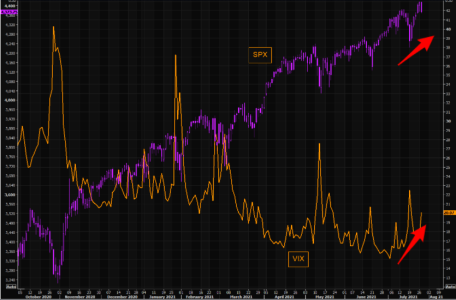

Trend

Where is the market heading? What are the longer secular Cycles telling us? Understanding the Cycles help you find the trends, makes you a better investor. Cycles help you beyond just the equities markets; understanding and investing with the greater cycles greatly benefits all facets of your personal wealth management.

For example, knowing when the Cycles are favorable for purchasing an investment property, starting a business or when to change the long term holdings of your 401k retirement funds have far reaching wealth implications. By following The Financial Tap, you get to study and learn the cycles; you too could incorporate the proven power of cycles in your every day wealth management planning.

Performance

There are day traders, swing traders and trend traders, just to name a few, all requiring skilled disciplines within themselves. The Financial Tap is rather unique in that it trades within a well defined model based off of Cycle movements in the markets.

The Financial Tap does not make attempt to make many trades within the Investor Portfolio, it’s designed to wait for the most advantageous trades that meet the Cycles requirements. Trading within a defined Cycles framework allows the investor the comfort of trading infrequently, while capitalizing on the bigger trending moves of the Investor Cycles. Our proven track record in showing stellar returns based off our Cycles outlook is another reason to subscribe.

Strategy

I am a realist and I’m the first to tell you that there is no holy grail of trading. Anybody trying to guarantee you type of result is not to be trusted.

However, one thing I do know for certain is that I have found several unique and concrete strategies that make the world of sense to me, and I’ve been able to use these strategies to make serious money. I also understand that the less I trade, the better my strategies will perform over the long run and the more time I can devote to my family and other passions. Getting short term trades is important, as is learning strategies that help you plan for long term wealth success.

Patience

Patience is a key ingredient to the success of The Financial Tap strategies. Being assertively patient is a trait shared by all very successful investors and its one reason why The Financial Tap is so too. Waiting for the most opportune moment to execute trades or knowing how to handle the waves of each cycle is what sets the elite apart from the rest. Our strategies require patience, coupled with a disciplined approach; you too will learn these skills.