Wow, so much doom and gloom out there right now. Hussman makes you want to bury your cash in the backyard. Can they all be right? The set up for a decline seems to be there, but will it be that easy for the bears who have been beaten to death for the last year?

The main reason I went to trend trading last year is so I could just ignore all the noise and just trade the price action.... I still ST trade the daily data, but for MT trading the weekly has worked well.

(I continue to trade what is happening not what I think will happen)

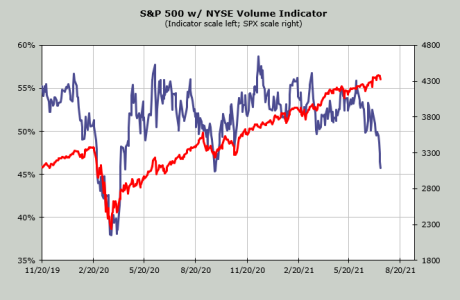

And that has not be easy at times. Many bears are just BTD these days, and the data shows it. I posted the (VTI) monthly data above and we are very stretched above the mean being this deep into the yearly cycle. With that said, the next YCL will probably just be another buying op, but for now that is just a guess. It seems the Fed will remain a player for now.

LOL..... This has been a historical run since the March 2020 low. The current setup is we have above average odds of tagging the 20 mma during the next YCL, and the data suggests that could be this year.

Bottom Line: Love it or hate it (VTI) remains in a uptrend.

I'm posting a VXF monthly chart below. Another index I like to trade at Vanguard.

VXF - Product summary

Seeks to track the performance of a benchmark index that measures the investment return of stocks from small and midsize companies.

Provides a convenient way to match the performance of virtually all regularly traded U.S. stocks except those in the S&P 500 Index.

Passively managed, using index sampling techniques.

https://investor.vanguard.com/etf/profile/VXF