robo

TSP Legend

- Reaction score

- 471

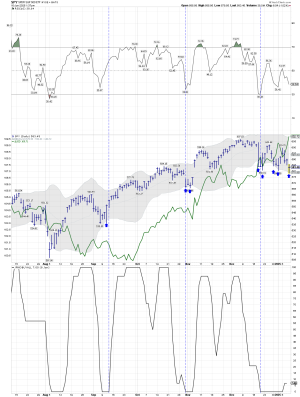

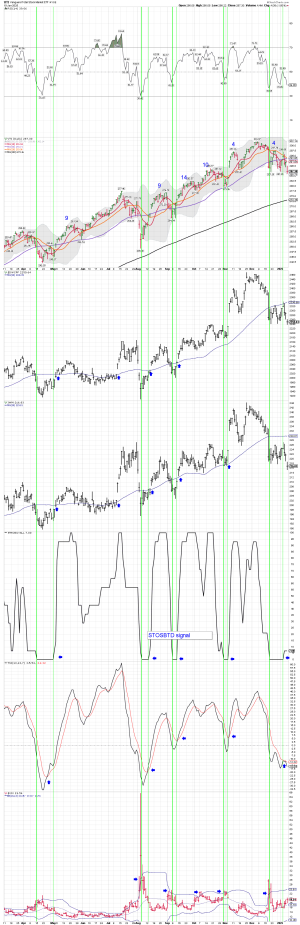

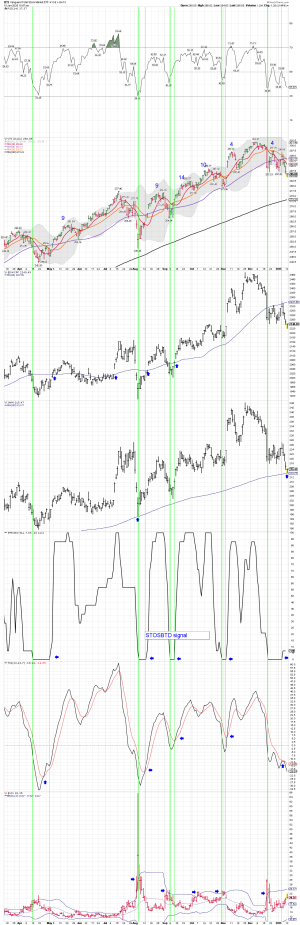

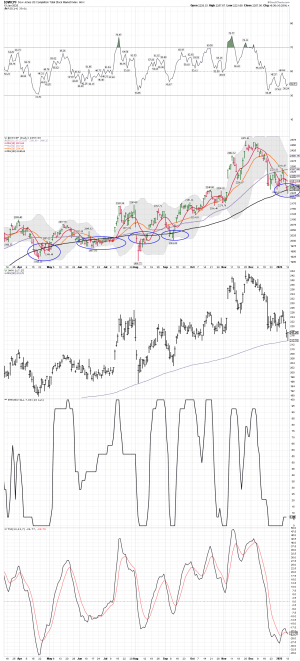

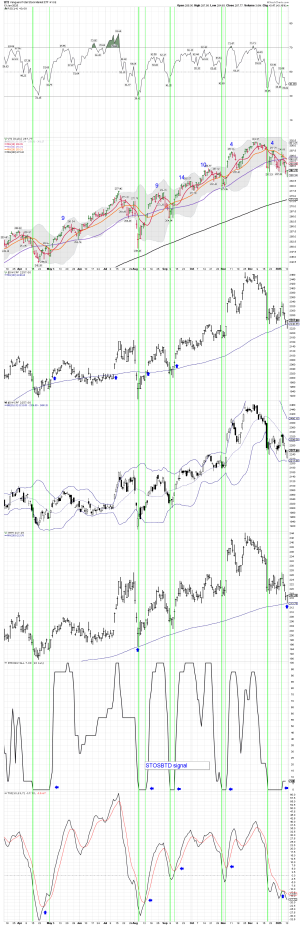

SPY/USD daily: The USD continues its move higher, and the SPY tagged the lower BB on the daily chart. The good news is buyers came in, but the bad news is we are getting deeper into a possible YCL coming our way. We shall see how it all plays out.

So what does that mean? For me, based on my data, I'm MT Bearish and ST Bullish. Waiting on the the change over in DC before holding any MT positions.

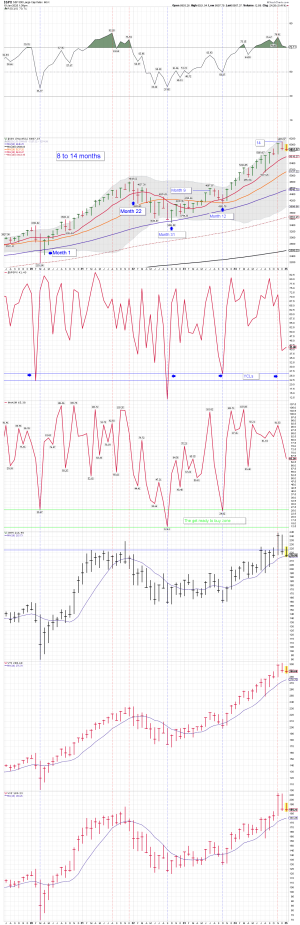

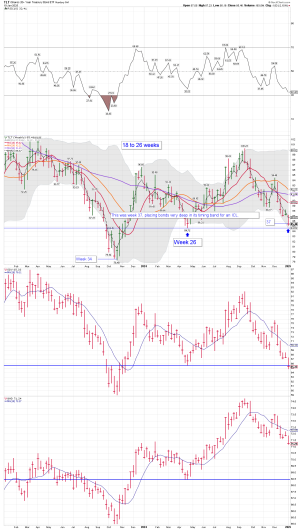

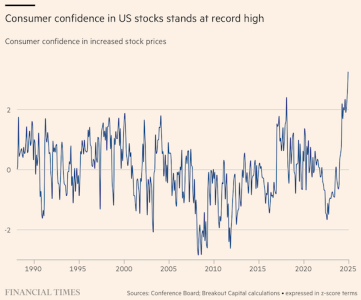

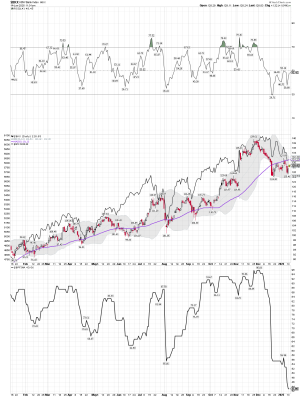

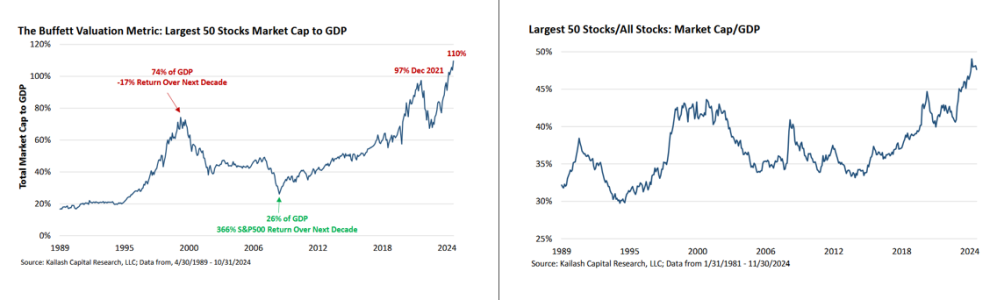

Note the monthly chart (SPY/VXF/IWM/VTI): If you use the 10 month MA for LT positions like I do, we still have NO sell signals.... That doesn't mean that it's all clear sailing. We are deep into this cycle and many other indicators are flashing - "Danger" Get ready to Reduce your positions Will Rogers....

So what does that mean? For me, based on my data, I'm MT Bearish and ST Bullish. Waiting on the the change over in DC before holding any MT positions.

Note the monthly chart (SPY/VXF/IWM/VTI): If you use the 10 month MA for LT positions like I do, we still have NO sell signals.... That doesn't mean that it's all clear sailing. We are deep into this cycle and many other indicators are flashing - "Danger" Get ready to Reduce your positions Will Rogers....

Attachments

Last edited: