robo

TSP Legend

- Reaction score

- 471

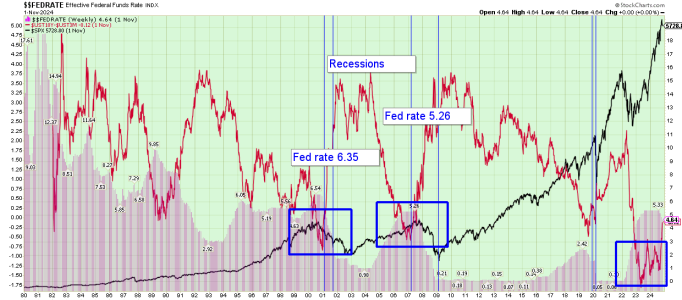

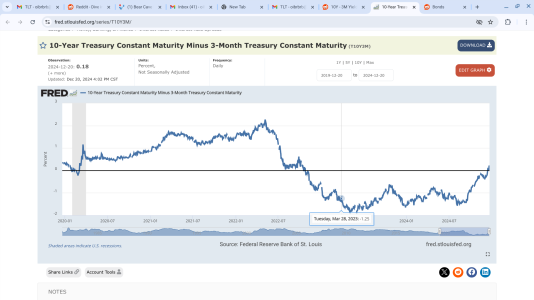

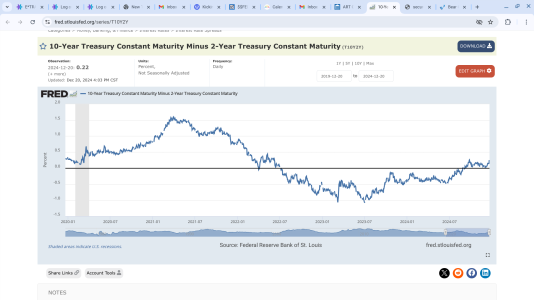

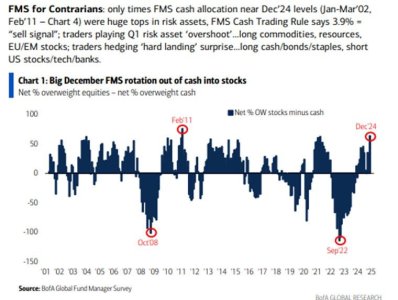

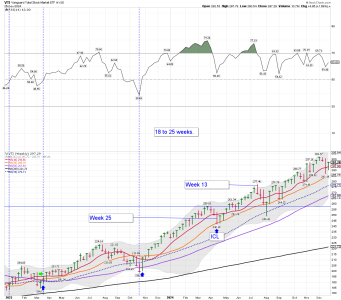

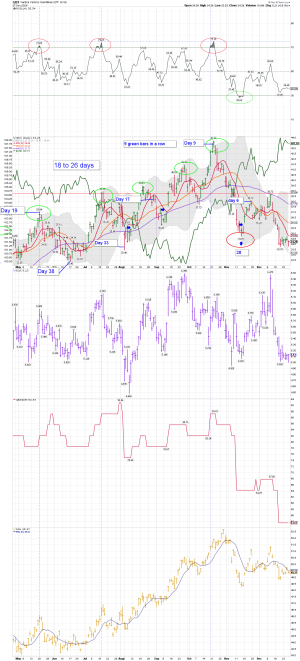

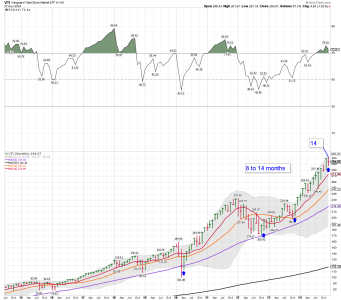

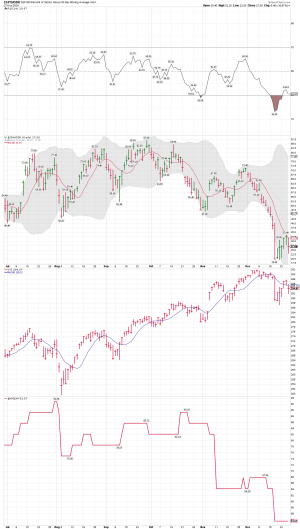

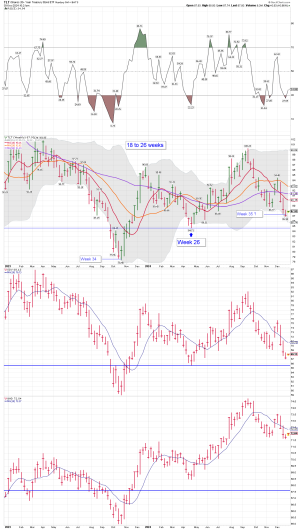

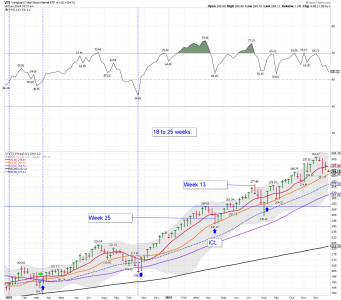

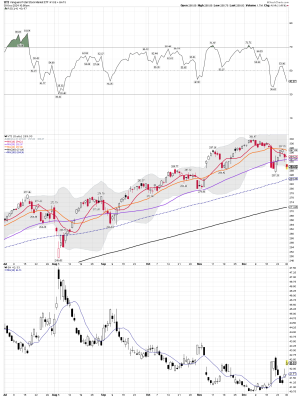

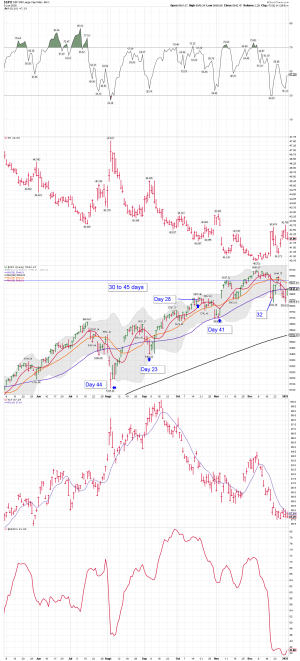

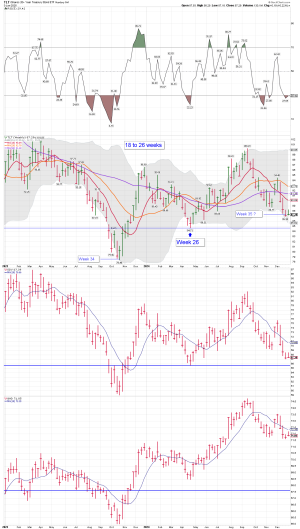

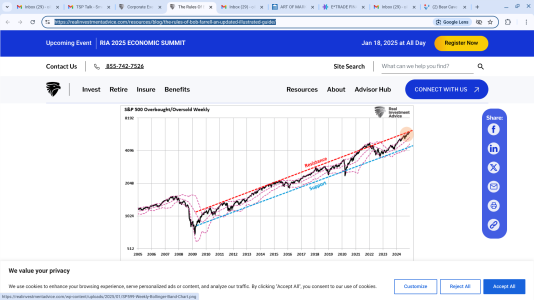

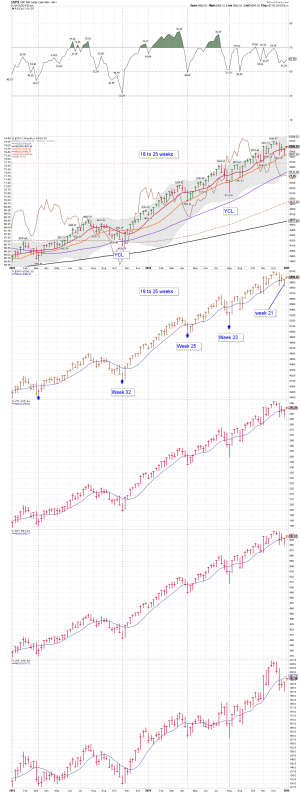

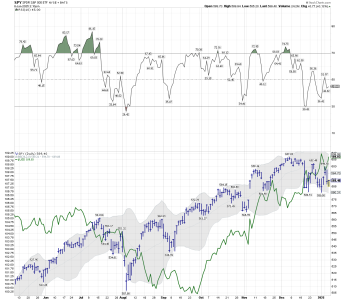

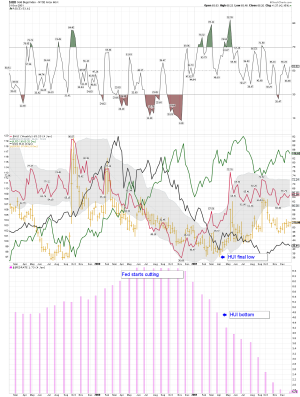

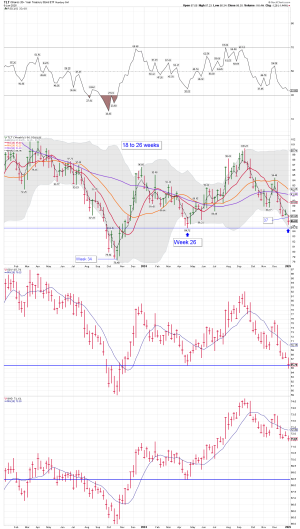

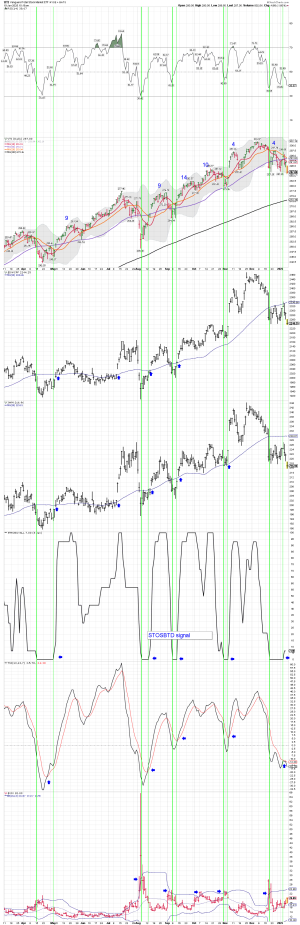

What happens when the yield curve inversion has completed. A historical chart, and it had better be different this time. Some are saying soft landing, and that is possible. We shall see how it plays out.

Attachments

Last edited: