The Fed effect, and I'll be watching. We shall see how it all plays out. Some crazy stuff going on in DC too.

USD daily:

The U.S. Dollar

Like the U.S. dollar.

The dollar is fascinating. Some analysts consider the dollar a safe haven. Others say the dollar seems to do well when the U.S. economy is doing well.

The truth is, both camps are correct...

In many ways, the dollar is the ultimate safe haven. As the global reserve currency, it’s backed by the full might of America. That’s why during times of uncertainty, you can see the dollar strengthen quickly.

When looking for a safe haven, the U.S. has many attractive options. Whether it’s Treasuries, stocks, or just plain old cash, the U.S. has something for everyone.

Why GM’s embarrassing EV hiccup could skyrocket 1 battery firm

80,000 Americans are anxiously awaiting the delivery of their new Hummer EVs.

They’ve signed the paperwork… handed over the deposit…

But so far this year — GM has delivered just 2 electric Hummers. Two!

“This is just the tip of a $10 Trillion iceberg,” says the best-selling financial author Nomi Prins, “No automaker is safe.”

She discovered a new battery stock that could save America’s floundering EV market.

One firm using AI has unlocked a novel solution…

She calls it “Forever Lithium.”

The CEO of Jeep said: “You have to secure your supply. If not, you’re out of business.”

And one company that supplies it could mint more EV millionaires than the rise of Tesla.

On the other hand, let’s say the U.S. economy is outperforming the rest of the world by a wide margin. In such a scenario, the dollar can also strengthen.

During such a time, investors are afraid of putting their money to work in emerging markets. While emerging markets can deliver better returns, they’re also riskier. And if the global economy is lagging the U.S., then investing in the U.S. is the best move.

What about when the dollar is declining in value? That scenario happens for a couple different reasons as well.

The first is when other countries are successfully outcompeting the U.S. for investment flows. If growth prospects are considered more attractive outside the U.S., there will be less demand for the dollar.

The second scenario is when investors see weakness in the U.S. economy. This means they expect the Fed to cut interest rates to help the economy out.

Free Trading Resources

Have you checked out Jeff's free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.

More Weakness Coming

Right now, we’re trending more closely to the second scenario, which results in dollar weakness.

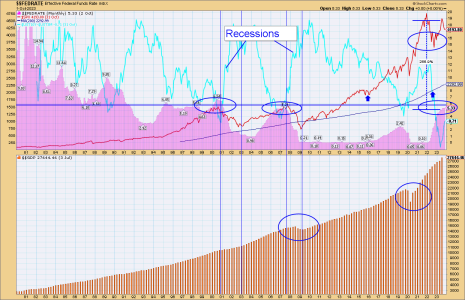

The reasoning is simple. Higher rates should cool off the economy. And it’s unlikely the Fed will get the balancing act of raising rates high enough to tamp down inflation – while not sinking the economy into a recession – exactly right.

If the Fed overshoots raising rates, the economy will eventually start cooling down. At this point, the Fed will go back to its old playbook of cutting rates and printing money to help stimulate the economy.

Although more and more central banks are expected to hold rates – or even cut them – next year, the Fed is likely to be among the first to act.

This was true in the opposite direction, too. The Fed was the first major central bank to raise rates in 2022.

It was the Fed that kicked of the dollar’s period of strength in 2022. And it will be the Fed that kicks off this next period of dollar weakness.

In fact, the decline in the dollar has already started. At the beginning of October, DXY was up nearly 4% year-to-date. As of writing, DXY is now up just 0.37%.

Based on my analysis, I expect at least another 10% decline or so before the dollar stabilizes.

Happy trading,

The Dollar Decline Has Started | Jeff Clark Trader