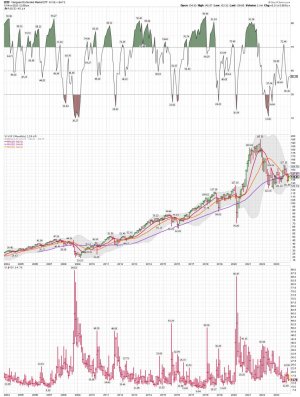

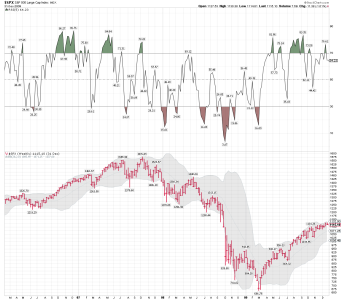

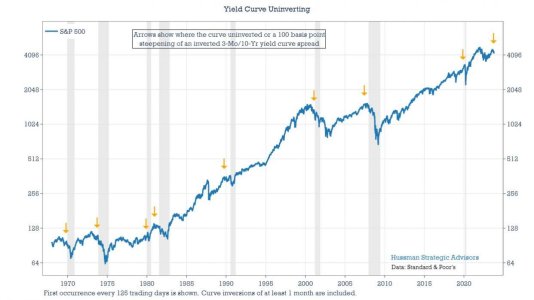

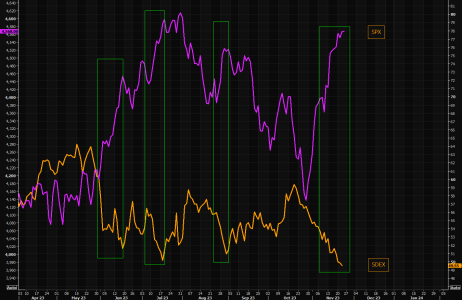

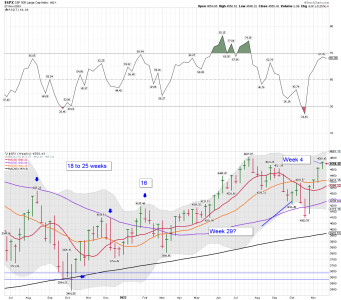

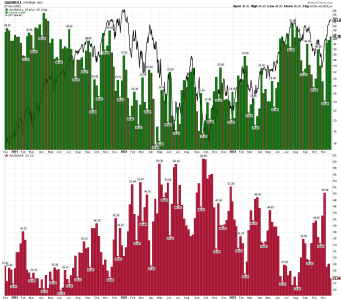

The SPX, Fed rates and the inverted yield curve. It had better be different this time.

2000 market: The inverted yield curve turned up and the SPX went down.

2007 market: The inverted yield curve turned up and the SPX went down.

2023 market: The inverted yield curve turned up and the SPX went??? we shall see how it plays out.

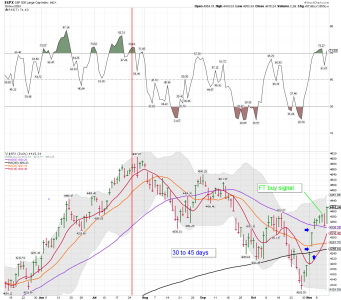

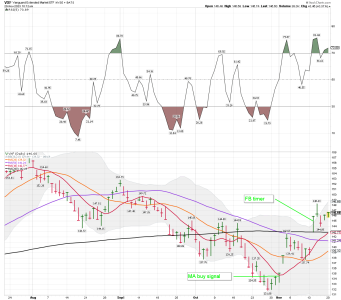

Bottom Line: The SPX remains on a buy signal as we head into the craziest time I have every seen coming from our government. I just trade the signals.

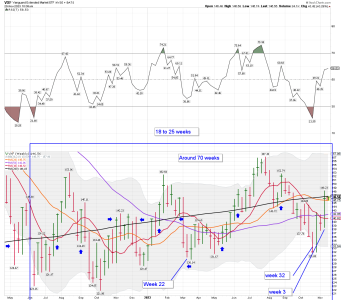

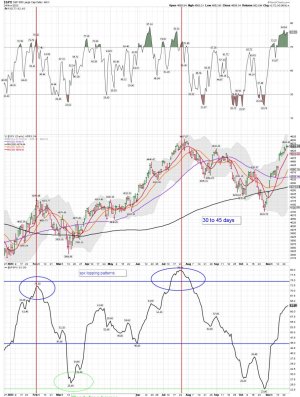

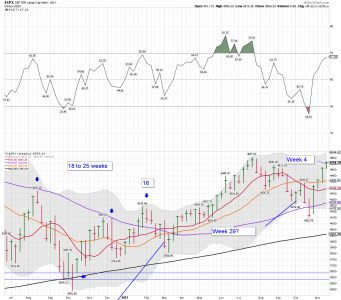

Weekly SPX 2008:

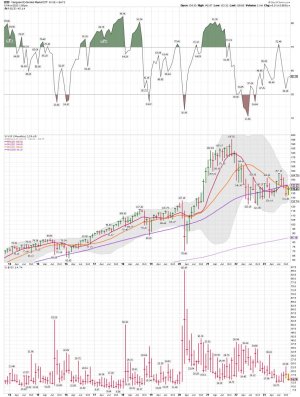

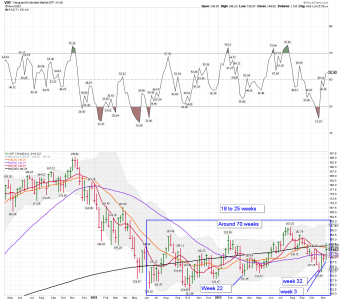

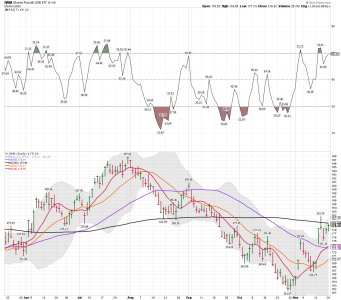

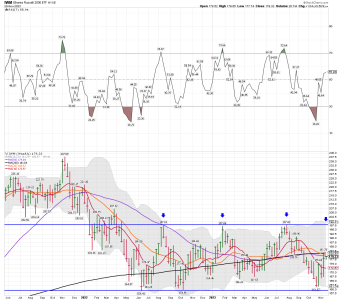

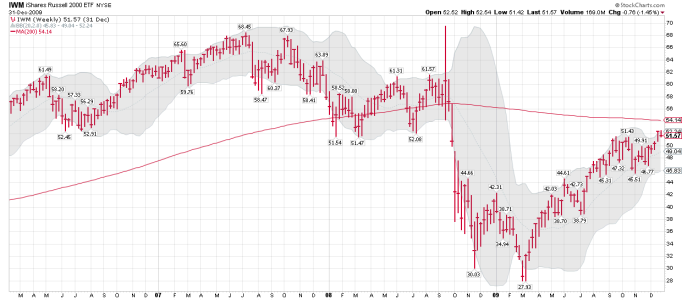

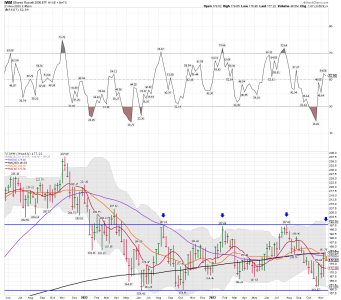

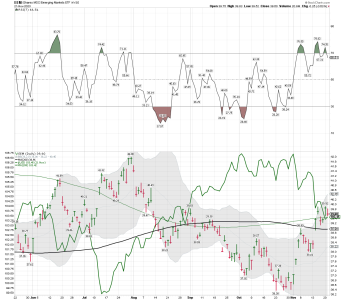

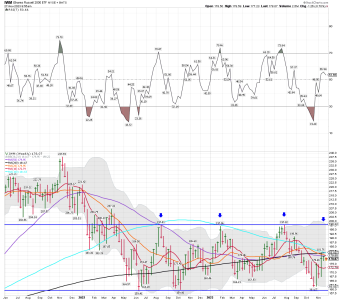

Weekly IWM 2008 and 2023: In 2008 IWM bounced around the 200 week MA...... until it didn't. I'm not calling out anything right here. I use historical data in my LT trading, and I'm just pointing out what the historical data is showing me. Once the inverted yield curve turns back up the market comes under lots of pressure.

Instincts vs. Market Timing Strategy

Humans are born with basic instincts for survival. They need to protect themselves at all costs.

Devoid Of Emotions

Experienced market timers, in contrast, react more decisively.

They carefully follow a trading strategy that is completely devoid of emotions. They follow through on buy and sell signals with absolute precision.

They know that any one or more buy or sell signals may be wrong, but they realize that to trade profitably they must learn to trust their timing strategy and act on it. Only over time are substantial profits realized, and only by those market timers who stay the course.

Think Outside The Box

If you want to be a winning market timer, you must learn to identify your need to follow the masses, and teach yourself to avoid doing what your need for security compels you to do.

You must reprogram yourself to think outside the box. Rather than follow the masses, you must follow your timing strategy, which may be contrary to what most people would do.

Over time, and with extensive experience, you will develop the skills that will allow you to trade decisively.

Once you have reprogrammed your behaviors, you will not be tempted to follow the masses, but will instead recognize these feelings for what they are. Instincts for survival, which may work in the physical world, are likely to cause poor decisions and loss of capital in the financial world.

Rather than Following The Masses, you must learn to follow a timing plan, which is not affected by the emotions of the masses.

The more decisively you can follow the timing strategy, the more profits you'll realize.

https://www.fibtimer.com/subscribers/fibtimer_commentary.asp