robo

TSP Legend

- Reaction score

- 471

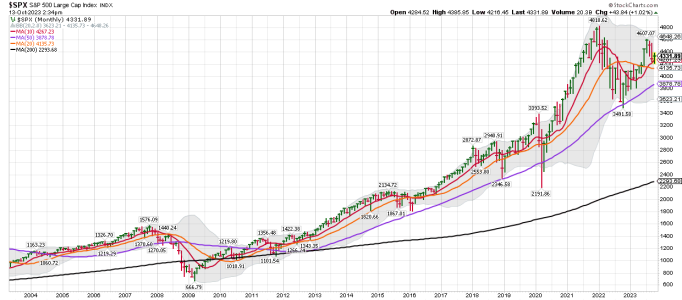

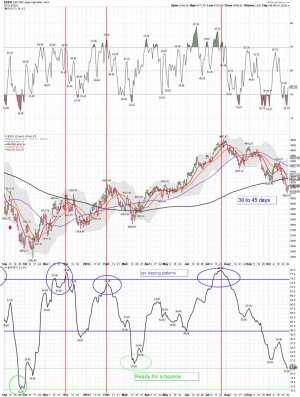

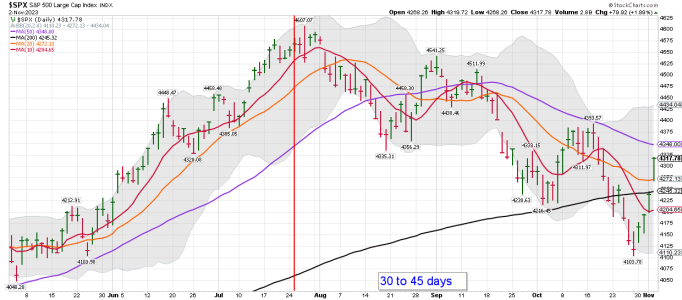

The inverted yield curve at around 18 months now has never been wrong. It has to be different this time or we are getting closer. The world and our government can't get much done either. Blame who you want, but the inverted yield data is sending out a warning signal. Don't buy to much if you are BTDs!