robo

TSP Legend

- Reaction score

- 471

Brace for Impact

Imre Gams | Jun 14, 2023 | Market Minute | 3 min read

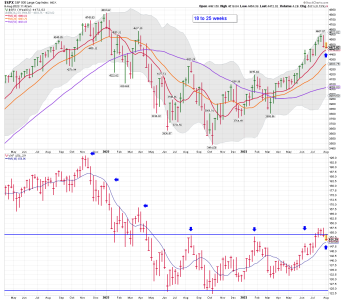

Stock market investors have had a lot to be happy about in recent weeks.

In fact, since the start of the year, the S&P 500 is currently up about 13%.

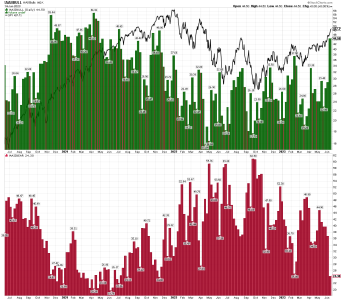

But if you only looked at the combined performance of 493 of the stocks that make up the S&P 500, the market would be about flat for the entire year.

That means just seven companies have been responsible for almost all of this year’s gains.

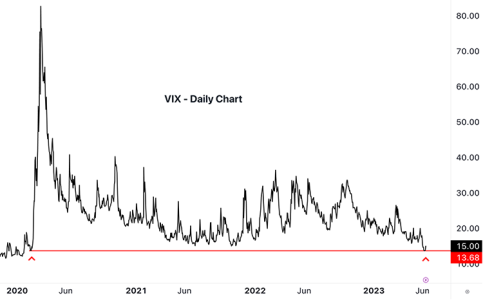

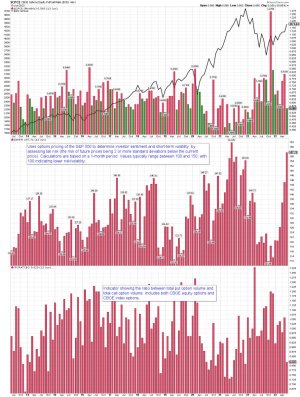

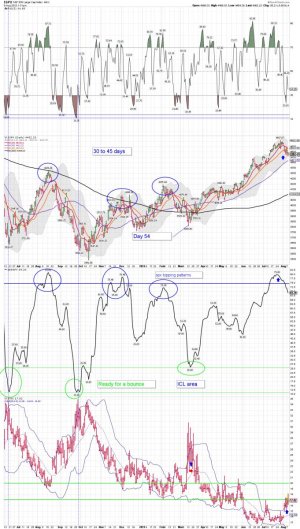

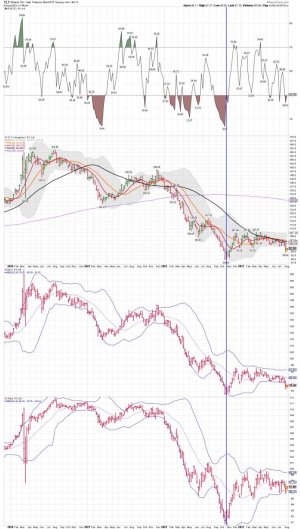

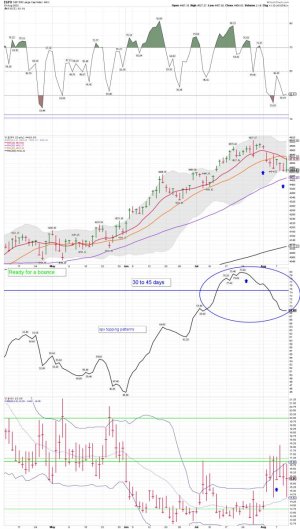

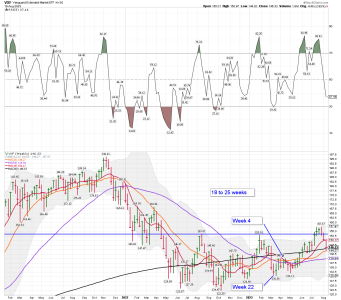

Unfortunately, my analysis of the VIX suggests that the second possibility might be relatively close at hand.

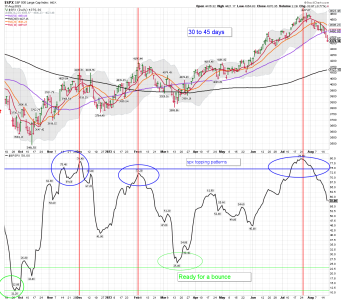

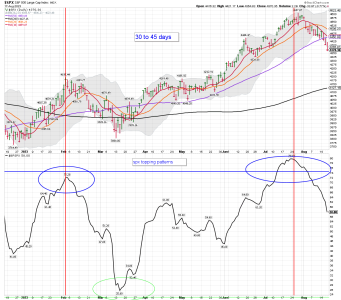

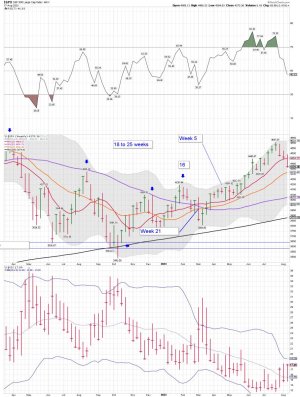

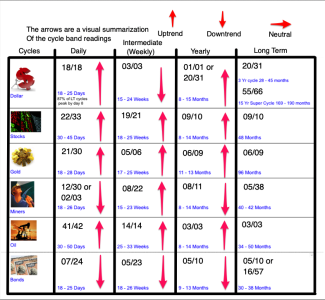

Let me walk you through a price chart of the VIX so you can see what I mean.

Unfortunately, my analysis of the VIX suggests that the second possibility might be relatively close at hand.

https://www.jeffclarktrader.com/market-minute/brace-for-impact/

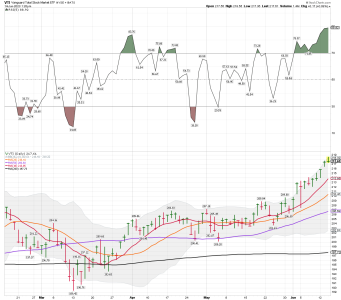

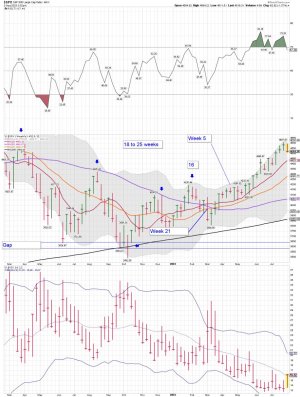

Buying PSQ below $10.90 and adding as we move lower.... ( Beer Money trade)

06/13/2023 Bought PSQ @ 10.8892

Imre Gams | Jun 14, 2023 | Market Minute | 3 min read

Stock market investors have had a lot to be happy about in recent weeks.

In fact, since the start of the year, the S&P 500 is currently up about 13%.

But if you only looked at the combined performance of 493 of the stocks that make up the S&P 500, the market would be about flat for the entire year.

That means just seven companies have been responsible for almost all of this year’s gains.

Unfortunately, my analysis of the VIX suggests that the second possibility might be relatively close at hand.

Let me walk you through a price chart of the VIX so you can see what I mean.

Unfortunately, my analysis of the VIX suggests that the second possibility might be relatively close at hand.

https://www.jeffclarktrader.com/market-minute/brace-for-impact/

Buying PSQ below $10.90 and adding as we move lower.... ( Beer Money trade)

06/13/2023 Bought PSQ @ 10.8892

Attachments

Last edited: