-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

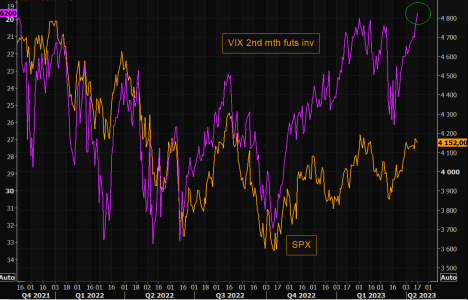

Say hello to inverse panic

SPX not even above the "magical" 4200, but VIX is in full crash mode. SPX vs the VIX 2nd month futures (inverted).

https://themarketear.com/newsfeed/coiY9wygyt

SPX not even above the "magical" 4200, but VIX is in full crash mode. SPX vs the VIX 2nd month futures (inverted).

https://themarketear.com/newsfeed/coiY9wygyt

Attachments

robo

TSP Legend

- Reaction score

- 471

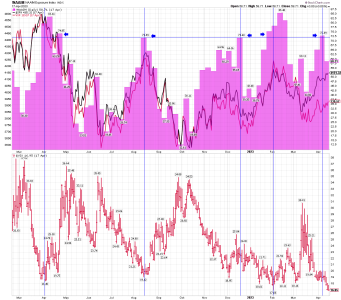

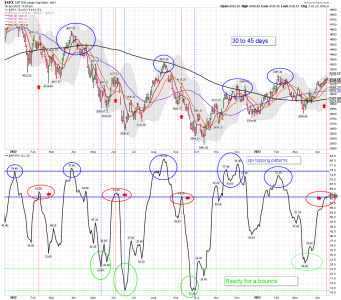

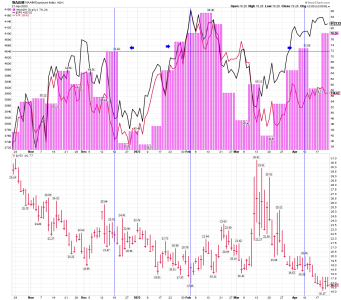

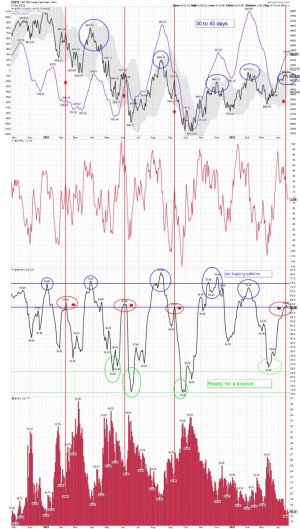

Some daily tracking charts: VIX, VXF, SPY and NAAIM: Not a time to continue to hold long positions based on my tracking indicators. However, these indicators are for risk management and not confirmed buy or sell signals. They are only warning signals....

Flat SPY and VXF:

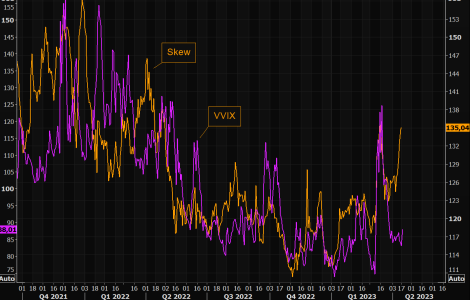

Say hello to inverse panic - VIX guy is back

The VIX guy is back

We haven't heard from "our" VIX guy in a long time. He remains as the number one contrarian indicator when it comes to volatility. His latest reasoning is that we are entering a regime shift and that volatility will stay lower for much longer as "the market does not care about much". Regular readers of TME know our general logic on protection and volatility: "do not buy protection when you must, buy it when you can". We are getting very close to such a set up. Using options for directional bets (up/down) as well as protection is looking attractive. Time for a thread on volatility:

Flat SPY and VXF:

Say hello to inverse panic - VIX guy is back

The VIX guy is back

We haven't heard from "our" VIX guy in a long time. He remains as the number one contrarian indicator when it comes to volatility. His latest reasoning is that we are entering a regime shift and that volatility will stay lower for much longer as "the market does not care about much". Regular readers of TME know our general logic on protection and volatility: "do not buy protection when you must, buy it when you can". We are getting very close to such a set up. Using options for directional bets (up/down) as well as protection is looking attractive. Time for a thread on volatility:

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

When the VIX Is Low, It’s Time to Go…

Jeff Clark | Apr 18, 2023 | Market Minute | 3 min read

There’s an old saying on Wall Street…

“When the VIX is high, it’s time to buy. When the VIX is low, it’s time to go.”

Last Friday, the Volatility Index (VIX) closed at its lowest level since January 2022. In other words, it’s time to go as we head toward the end of April.

The VIX is commonly referred to as Wall Street’s fear gauge. It measures the premium traders will pay for protective options.

Whenever the VIX dropped below 20, the S&P declined almost immediately after. Of course, the most recent action is an exception.

At the end of March, the VIX first dipped below 20. But the S&P 500 has managed to push slightly higher since then.

Only time will tell if this is a failed signal, or if the decline is merely delayed.

But based on the history of this indicator – and with the calendar heading into May – investors should be extra careful here.

The odds favor a move lower.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/when-the-vix-is-low-its-time-to-go/

Jeff Clark | Apr 18, 2023 | Market Minute | 3 min read

There’s an old saying on Wall Street…

“When the VIX is high, it’s time to buy. When the VIX is low, it’s time to go.”

Last Friday, the Volatility Index (VIX) closed at its lowest level since January 2022. In other words, it’s time to go as we head toward the end of April.

The VIX is commonly referred to as Wall Street’s fear gauge. It measures the premium traders will pay for protective options.

Whenever the VIX dropped below 20, the S&P declined almost immediately after. Of course, the most recent action is an exception.

At the end of March, the VIX first dipped below 20. But the S&P 500 has managed to push slightly higher since then.

Only time will tell if this is a failed signal, or if the decline is merely delayed.

But based on the history of this indicator – and with the calendar heading into May – investors should be extra careful here.

The odds favor a move lower.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/when-the-vix-is-low-its-time-to-go/

Attachments

robo

TSP Legend

- Reaction score

- 471

Nobody in control

SPX futures putting in the third doji like candle in a row. This is not the confident break out candle, so pay close attention here. So many dojis in a row post a big up move is usually a sign of the short term momentum losing some steam...

https://themarketear.com/newsfeed/cXavAytSsg

SPX futures putting in the third doji like candle in a row. This is not the confident break out candle, so pay close attention here. So many dojis in a row post a big up move is usually a sign of the short term momentum losing some steam...

https://themarketear.com/newsfeed/cXavAytSsg

Attachments

robo

TSP Legend

- Reaction score

- 471

My Blasphemous Prediction for Gold…

Jeff Clark | Apr 21, 2023 | Market Minute | 2 min read

Trading signals are generated when the index reaches extreme levels and then reverses.

The red arrow on the left-hand side of the chart points to the only sell signal triggered last year. The red arrow on the right-hand side of the chart points to where we are now.

BPGDM is approaching 80. It’s nearing the sort of overbought conditions that lead to a sell signal.

Yes, there is room for it to work higher. So, maybe the gold sector can continue its rally for a little while longer.

But the air is getting thin…

After a 50% rally in six months, the gold sector is closer to a top than it is to a bottom. There is more risk than there is reward.

After all, GDX fell 45% in five months following last year’s BPGDM sell signal.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/my-blasphemous-prediction-for-gold/

Jeff Clark | Apr 21, 2023 | Market Minute | 2 min read

Trading signals are generated when the index reaches extreme levels and then reverses.

The red arrow on the left-hand side of the chart points to the only sell signal triggered last year. The red arrow on the right-hand side of the chart points to where we are now.

BPGDM is approaching 80. It’s nearing the sort of overbought conditions that lead to a sell signal.

Yes, there is room for it to work higher. So, maybe the gold sector can continue its rally for a little while longer.

But the air is getting thin…

After a 50% rally in six months, the gold sector is closer to a top than it is to a bottom. There is more risk than there is reward.

After all, GDX fell 45% in five months following last year’s BPGDM sell signal.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/my-blasphemous-prediction-for-gold/

robo

TSP Legend

- Reaction score

- 471

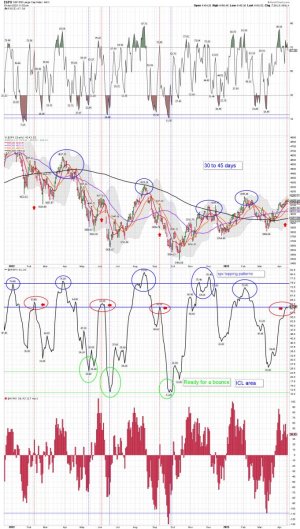

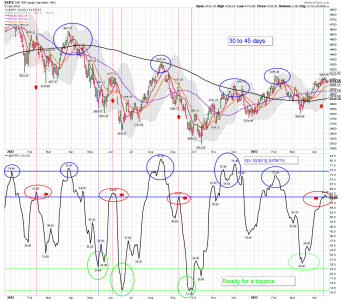

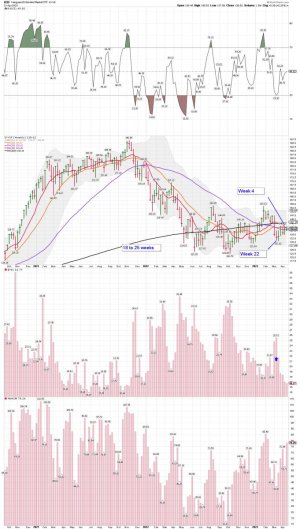

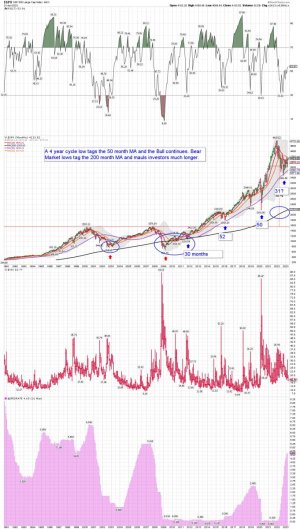

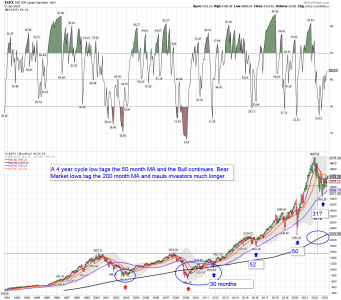

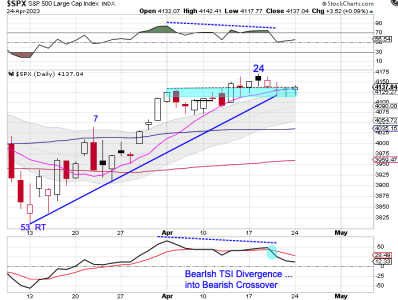

The data is the data and the SPX weekly data looks good. We shall see how the next daily cycle plays out as we get closer to the end of the current one.

Cycles: The 4/22/23 Weekend Report Preview

Stocks closed below the 4135 resistance level back in the consolidation zone on Thursday.

Friday was day 27, placing stocks in the early part of its timing band for a daily cycle low. Closing back in the consolidation zone shifts the odds that stocks are beginning their daily cycle decline.

We are still watching for is a close below the 10 day MA. Then a break below the daily cycle trend line will send stocks to seek out their DCL.

https://likesmoneycycletrading.wordpress.com/2023/04/22/the-4-22-23-weekend-report-preview/

The SPX weekly remains in a uptrend and on a buy signal. Week 5 since the ICL and the data looks good. (Bulllish)

Flat SPX as I continue to trade using Bear Market rules.....

Cycles: The 4/22/23 Weekend Report Preview

Stocks closed below the 4135 resistance level back in the consolidation zone on Thursday.

Friday was day 27, placing stocks in the early part of its timing band for a daily cycle low. Closing back in the consolidation zone shifts the odds that stocks are beginning their daily cycle decline.

We are still watching for is a close below the 10 day MA. Then a break below the daily cycle trend line will send stocks to seek out their DCL.

https://likesmoneycycletrading.wordpress.com/2023/04/22/the-4-22-23-weekend-report-preview/

The SPX weekly remains in a uptrend and on a buy signal. Week 5 since the ICL and the data looks good. (Bulllish)

Flat SPX as I continue to trade using Bear Market rules.....

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

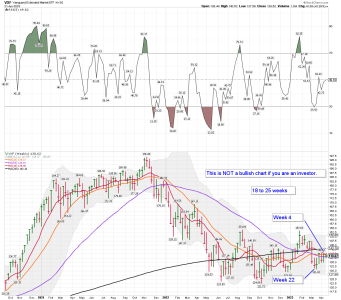

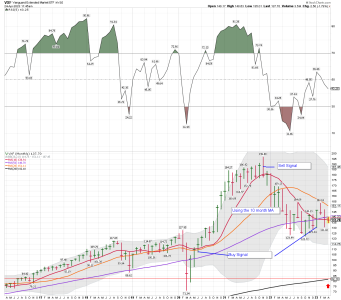

VXF weekly: VXF remains above the 50 week MA, but below the 200 week MA. Still no BEEF and NO leadership from over 4000 stocks..... Not what I like to see, so I continue to trade using Bear Market rules and track VXF and my other indicators. Looking for the next ST move into VXF in the coming months ahead.

NAAIM double

NAAIM Exposure 78. Almost a doubling in one month.

https://themarketear.com/newsfeed/cT4sQERfA-

NAAIM double

NAAIM Exposure 78. Almost a doubling in one month.

https://themarketear.com/newsfeed/cT4sQERfA-

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

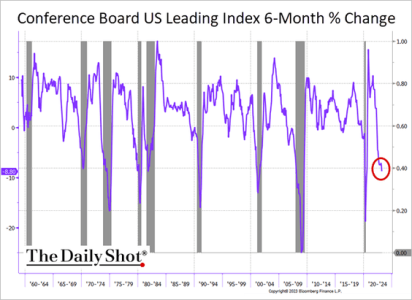

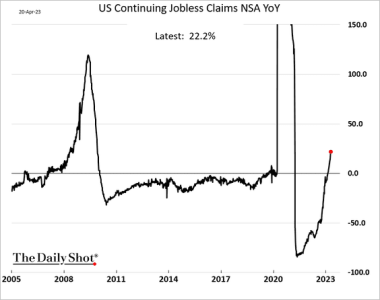

Several tweets from Jesse worth looking over.... @ the link below

https://twitter.com/jessefelder

Jesse Felder

@jessefelder

17h

'The Conference Board's index of leading economic indicators has never declined this much in six months without a recession.' https://thedailyshot.com/2023/04/21/continuing-jobless-claims-are-now-up-22-versus-last-year/ via

@SoberLook

https://twitter.com/jessefelder

Jesse Felder

@jessefelder

17h

'The Conference Board's index of leading economic indicators has never declined this much in six months without a recession.' https://thedailyshot.com/2023/04/21/continuing-jobless-claims-are-now-up-22-versus-last-year/ via

@SoberLook

Attachments

robo

TSP Legend

- Reaction score

- 471

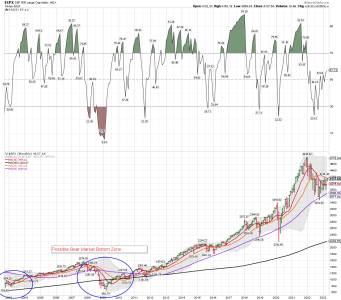

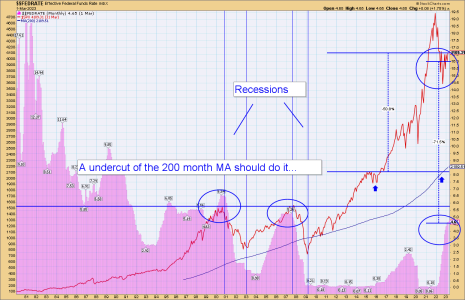

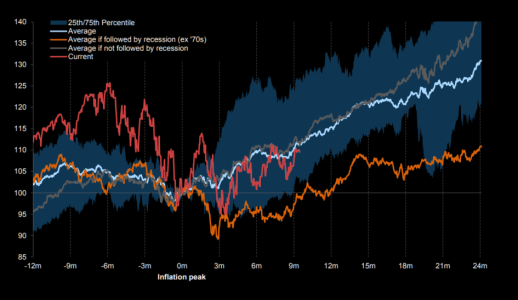

Cycles and the 4 year cycle lows. Sure, at 31 months it could be an early 4 year cycle low. The SPX tagged the 50 month MA and moved higher. However, Bear Market lows tag the 200 month MA before moving higher.

Bottom Line: The SPX remains on a buy signal and is trending higher. But make sure you understand that we are no longer in a Bull Market and the trading rules for me are much different. Just a handful of stocks driving this move. The VXF chart below, which is over 4000 stocks is telling me to be a tad more careful.

Flat SPY and VXF.

Bottom Line: The SPX remains on a buy signal and is trending higher. But make sure you understand that we are no longer in a Bull Market and the trading rules for me are much different. Just a handful of stocks driving this move. The VXF chart below, which is over 4000 stocks is telling me to be a tad more careful.

Flat SPY and VXF.

Attachments

robo

TSP Legend

- Reaction score

- 471

VXF monthly: The index hasn't been around long enough to look at the historical data for the last two Bear Market Bottoms - 2000 and 2008. I traded both of them and we are far from any type of Bear Market Bottom. Some tell me we will NEVER have another Bear Market, and that's fine too since I just trade the data. However, its pretty clear to me VXF is headed under 80.00ish at the next bear Market Bottom based on the data I'm using. I have NO IDEA when that might happen, but the odds continue to increase we are getting close to heading down much closer to the mean for the SPX. That's down around the 200 month MA. The SPX is way to stretched above the 200 month MA. The biggest blame should go to the fed as they kept rates way to low for to long after sending rates down close to zero.

For the record: ALL of my trades are based on a set of odds I use - Risk Management is just that in my opinion. How much and when to bet. However, don't think you can bluff the market. The house always win in the long-term. That is where Market timing comes in.

For the record: ALL of my trades are based on a set of odds I use - Risk Management is just that in my opinion. How much and when to bet. However, don't think you can bluff the market. The house always win in the long-term. That is where Market timing comes in.

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

The Monthly Historical Fed rate chart and the SPY:

Fabricated Fairy Tales and Section 2A

John P. Hussman, Ph.D.

President, Hussman Investment Trust

April 2023

Over the past decade, the Federal Reserve has wildly abused its ‘independence,’ violating both its 2A mandate and its responsibility for maintaining financial stability, insisting on unprecedented monetary expansion, bringing the ratio of Fed liabilities to both real and nominal GDP to levels never before seen in history, and triggering a decade of yield-seeking speculation that is likely to unwind in tears.

Market conditions

At present, our most reliable equity market valuation measures remain more extreme than at any point in history prior to July 2020, with the exception of a few months directly surrounding the 1929 peak, and two weeks in April 1930. Meanwhile, our primary gauge of market internals remains unfavorable, based on uniformity and divergence of market action across thousands of individual stocks, industries, sectors, and security-types, including debt securities of varying creditworthiness.

"Those conditions may change, but for now we continue to estimate the likelihood of negative 10-12 year S&P 500 total returns, with the prospect of interim losses on the order of -60%."

I recognize that these projections seem preposterous, but that is the situation that more than a decade of Fed-induced, yield-seeking speculation has now created for investors. For an extensive, data-rich discussion, see my February comment, Headed for the Tail.

https://www.hussmanfunds.com/comment/mc230424/

Fabricated Fairy Tales and Section 2A

John P. Hussman, Ph.D.

President, Hussman Investment Trust

April 2023

Over the past decade, the Federal Reserve has wildly abused its ‘independence,’ violating both its 2A mandate and its responsibility for maintaining financial stability, insisting on unprecedented monetary expansion, bringing the ratio of Fed liabilities to both real and nominal GDP to levels never before seen in history, and triggering a decade of yield-seeking speculation that is likely to unwind in tears.

Market conditions

At present, our most reliable equity market valuation measures remain more extreme than at any point in history prior to July 2020, with the exception of a few months directly surrounding the 1929 peak, and two weeks in April 1930. Meanwhile, our primary gauge of market internals remains unfavorable, based on uniformity and divergence of market action across thousands of individual stocks, industries, sectors, and security-types, including debt securities of varying creditworthiness.

"Those conditions may change, but for now we continue to estimate the likelihood of negative 10-12 year S&P 500 total returns, with the prospect of interim losses on the order of -60%."

I recognize that these projections seem preposterous, but that is the situation that more than a decade of Fed-induced, yield-seeking speculation has now created for investors. For an extensive, data-rich discussion, see my February comment, Headed for the Tail.

https://www.hussmanfunds.com/comment/mc230424/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

Me be watching too....but my focus remains on VXF: VXF daily.....

Consolidation – Update

Stocks closed back in the consolidation zone on Thursday. While stocks did close higher on Monday, they remain in the consolidation zone

Stocks still could break higher. But at this stage of the daily cycle, any gains now will likely be given back once the daily cycle decline begins.

We are still watching for is a close below the 10 day MA. Once that happens, a break below the daily cycle trend line will send stocks to seek out their DCL.

https://likesmoneycycletrading.wordpress.com/2023/04/24/consolidation-update-2/

Consolidation – Update

Stocks closed back in the consolidation zone on Thursday. While stocks did close higher on Monday, they remain in the consolidation zone

Stocks still could break higher. But at this stage of the daily cycle, any gains now will likely be given back once the daily cycle decline begins.

We are still watching for is a close below the 10 day MA. Once that happens, a break below the daily cycle trend line will send stocks to seek out their DCL.

https://likesmoneycycletrading.wordpress.com/2023/04/24/consolidation-update-2/

Attachments

robo

TSP Legend

- Reaction score

- 471

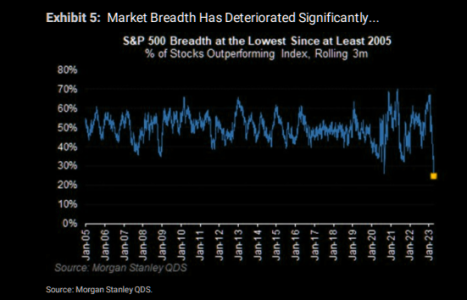

A new Bull Market...... WE shall see how that plays out....

What about market breadth?

The percentage of stocks outperforming the index has collapsed. Bearish Wilson adds: "We are challenged to find a period in history during which these indices have underperformed to such a degree while a new bull market was beginning."

https://themarketear.com/newsfeed/coq5CVx0Wk

What about market breadth?

The percentage of stocks outperforming the index has collapsed. Bearish Wilson adds: "We are challenged to find a period in history during which these indices have underperformed to such a degree while a new bull market was beginning."

https://themarketear.com/newsfeed/coq5CVx0Wk