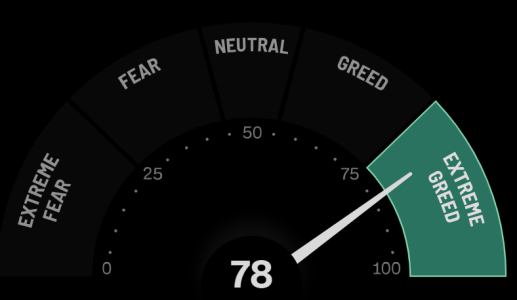

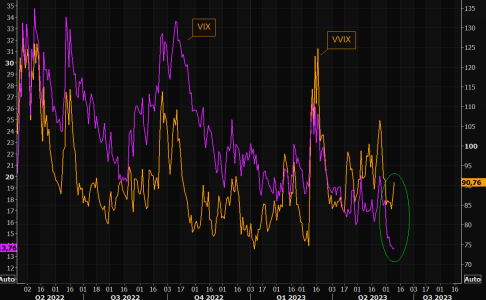

VIX slid to 13.50 for the first time since Valentine's Day 2020.

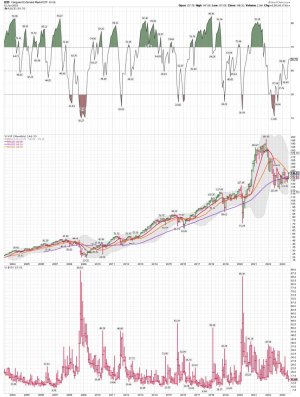

It is unusual for VIX to drop to 13.50 in any bear market, even for a short period of time. Investors are convinced by media stories such as the one which was most popular this morning on the internet, claiming that the S&P 500 was allegedly in a "new bull market." While the market's behavior in the short run is always unknowable, you can be confident that the S&P 500 has been in the same "boring" bear market since January 4, 2022, and will continue in its bear market probably for about another 1-1/2 to 2-1/2 years.

Kaplan

True Contrarian

@TrueContrarian

May 18

Fun fact: The value of AAPL surpassed the value of the entire Russell 2000 for the first time in May 2023 (all two thousand companies' combined market capitalizations)

https://twitter.com/truecontrarian?lang=en

Wednesday, May 3, 2023

"At some price, an asset is a buy, at another it's a hold, and at another it's a sell." --Seth A. Klarman

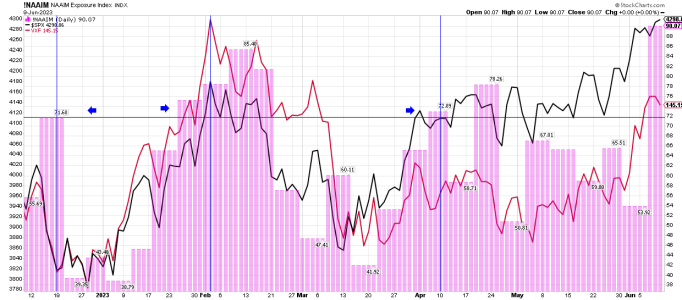

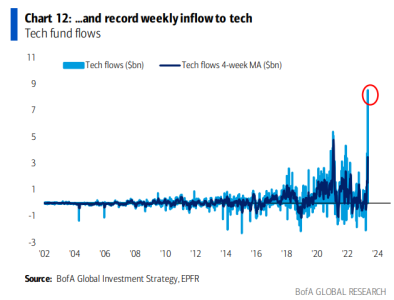

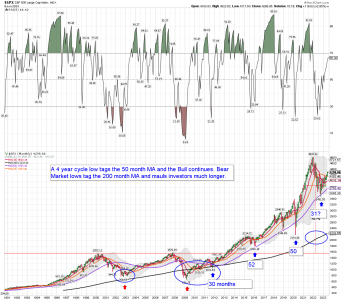

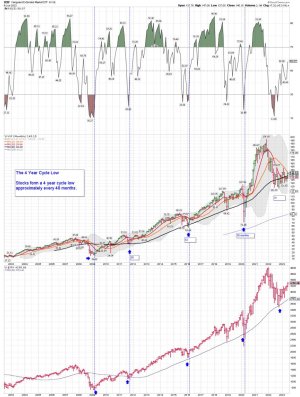

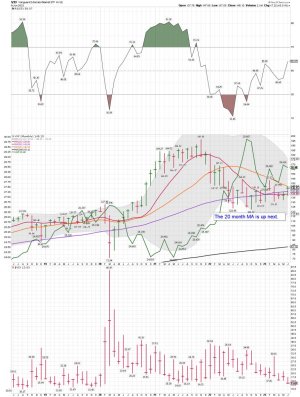

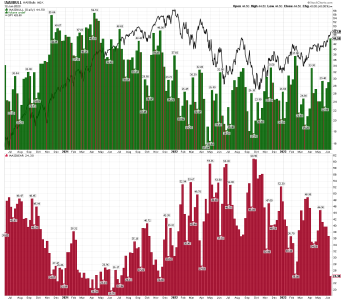

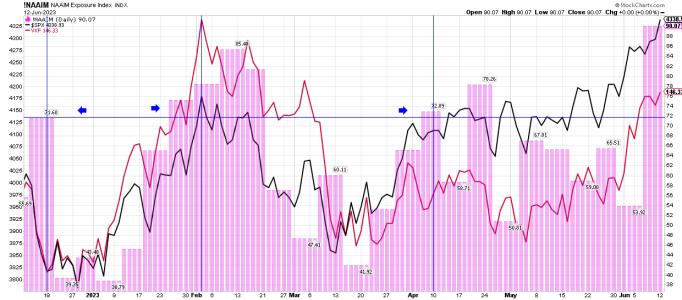

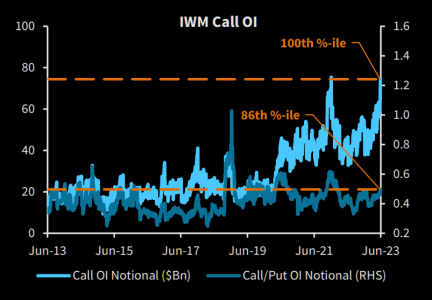

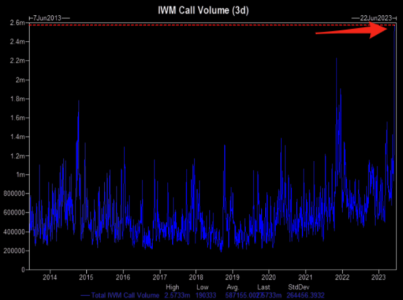

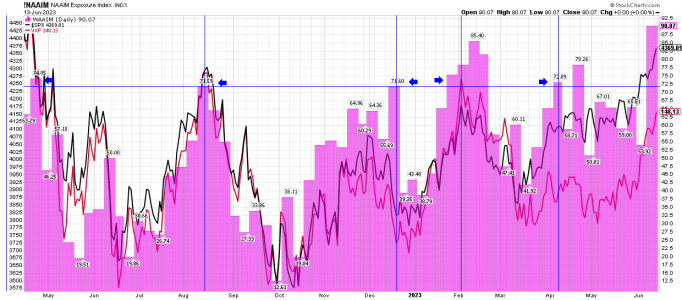

Practically every week we get a new all-time record or two: 1) the lowest VIX (15.53) during a bear market; 2) the longest rebound from an intermediate-term bottom during a bear market (nearly 7 months); 3) frequent record ratios of the biggest U.S. megacap shares relative to the rest of the S&P 500 or relative to other indices of small- and mid-cap U.S. shares. The last statistic is especially ominous, since the degree of overcrowding into the biggest U.S. companies has consistently been proportional to the subsequent total percentage losses for the best-known U.S. equity indices and funds. The following three charts highlight the astonishing enthusiasm for the biggest U.S. companies in recent weeks:

https://truecontrarian-sjk.blogspot.com/

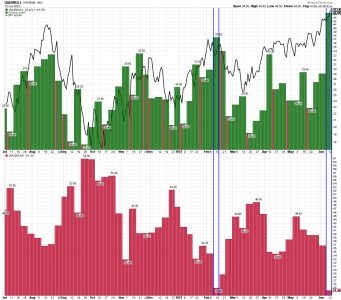

In 2021 the inflows into U.S. equity funds surpassed their total inflow from 2001 through 2020 combined. The all-time record average weekly net inflow into funds of large-cap technology shares, set in 2021, has been significantly surpassed in 2023: