robo

TSP Legend

- Reaction score

- 471

Shorts

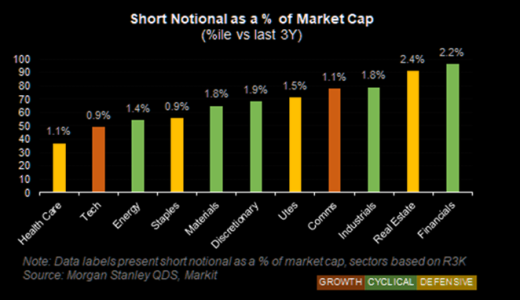

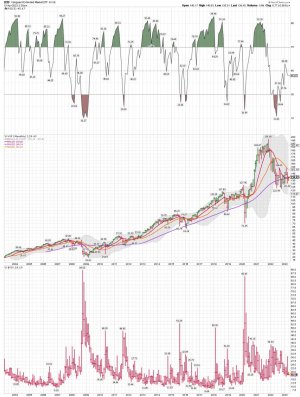

MS Securities Lending estimates investors added shorts street wide on the order of $27-30bn at the single-name level and $6-9bn at the index level. Single-name shorts as a % of market cap now sits above average at 1.4% (75th %ile vs the last 3Y) vs ETF shorts that remain around median levels at 1.5% (59th %ile vs the last 3Y), per Markit. Across Russell 3000 single-names, Cyclical sectors made up the majority of the short additions. Financials shorts, in particular, stood out in March totaling over $10bn – Financials short interest as a % of market cap is now the highest amongst the sectors at 2.2% (96th %ile vs the last 3Y, per Markit). Shorts across Growth and Defensive single-names mostly netted out to flat on the month.

MS Securities Lending estimates investors added shorts street wide on the order of $27-30bn at the single-name level and $6-9bn at the index level. Single-name shorts as a % of market cap now sits above average at 1.4% (75th %ile vs the last 3Y) vs ETF shorts that remain around median levels at 1.5% (59th %ile vs the last 3Y), per Markit. Across Russell 3000 single-names, Cyclical sectors made up the majority of the short additions. Financials shorts, in particular, stood out in March totaling over $10bn – Financials short interest as a % of market cap is now the highest amongst the sectors at 2.2% (96th %ile vs the last 3Y, per Markit). Shorts across Growth and Defensive single-names mostly netted out to flat on the month.