robo

TSP Legend

- Reaction score

- 471

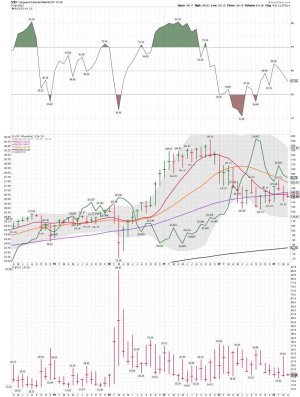

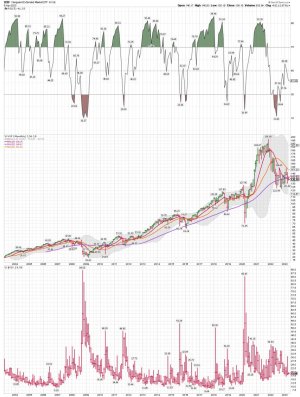

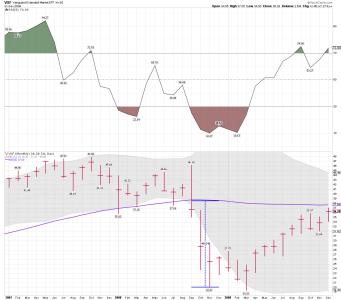

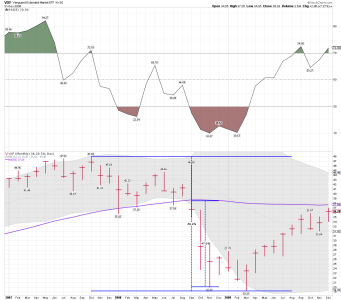

The SPX and Fed rate hikes/cuts: Based on the historical chart below, it's easy to see what might happen as the SPX moves lower and rates move higher. Lots of finger pointing going on in DC, but you can see the Fed has their hands all over this bubble..... Can you say LOW RATES TO LONG!

David Rosenberg

All I have to say is thank the Good Lord that Jim Bullard isn’t an FOMC voter.

David Rosenberg

3h

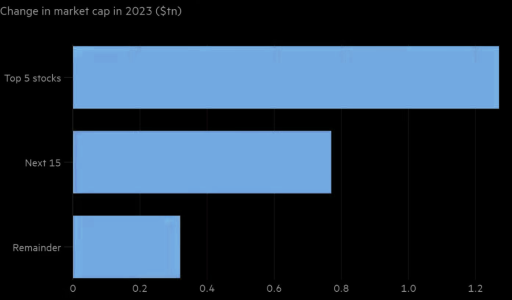

The crisis is with regulators who are idle while Comerica bonds blow out. The contagion is here. Everyone’s been focusing on an equity market driven by six stocks. This is a liquidity crisis of epic proportions. It’s incredible that policymakers are still sitting on their hands.

David Rosenberg

Instead of focusing on the bank crisis at the presser, Powell came out and emphasized: “We have to bring inflation down to 2%. The costs of failing are much higher.” Why exactly is 2% such a vital data-point for these central bank zealots?

David Rosenberg

@EconguyRosie

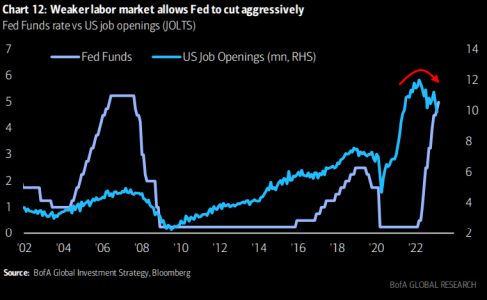

Fed is at 5.1% on the funds rate by year-end and the futures strip is 3.7%. The 2-year T-note yield has plunged to 3.64%! The same bond market telling the Fed a year ago it was behind the inflation curve is now telling Powell he is way behind the recession curve.

https://twitter.com/EconguyRosie?lang=en

David Rosenberg

All I have to say is thank the Good Lord that Jim Bullard isn’t an FOMC voter.

David Rosenberg

3h

The crisis is with regulators who are idle while Comerica bonds blow out. The contagion is here. Everyone’s been focusing on an equity market driven by six stocks. This is a liquidity crisis of epic proportions. It’s incredible that policymakers are still sitting on their hands.

David Rosenberg

Instead of focusing on the bank crisis at the presser, Powell came out and emphasized: “We have to bring inflation down to 2%. The costs of failing are much higher.” Why exactly is 2% such a vital data-point for these central bank zealots?

David Rosenberg

@EconguyRosie

Fed is at 5.1% on the funds rate by year-end and the futures strip is 3.7%. The 2-year T-note yield has plunged to 3.64%! The same bond market telling the Fed a year ago it was behind the inflation curve is now telling Powell he is way behind the recession curve.

https://twitter.com/EconguyRosie?lang=en