robo

TSP Legend

- Reaction score

- 471

Jeff Weniger

@JeffWeniger

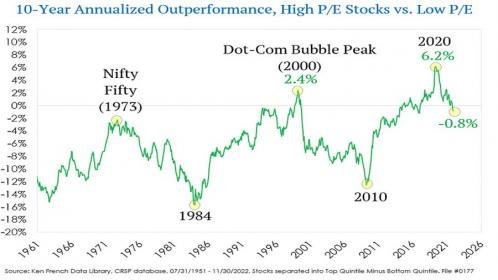

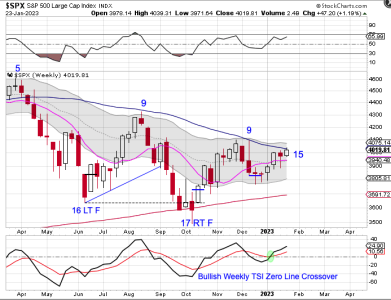

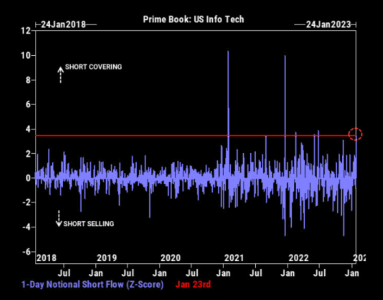

The 20% of stocks with the Highest P/E beat the 20% with the Lowest P/E by more in the 10 years through Covid than they did in the 10 years to the peak of Dot-Com mania in 2000.

The next 10 years may look very different.

https://twitter.com/JeffWeniger/status/1616183214724235291?mc_cid=407f2b2876&mc_eid=5b348a9ca0

https://mailchi.mp/felder/earnings-are-unsustainable?mc_cid=407f2b2876&mc_eid=5b348a9ca0

@JeffWeniger

The 20% of stocks with the Highest P/E beat the 20% with the Lowest P/E by more in the 10 years through Covid than they did in the 10 years to the peak of Dot-Com mania in 2000.

The next 10 years may look very different.

https://twitter.com/JeffWeniger/status/1616183214724235291?mc_cid=407f2b2876&mc_eid=5b348a9ca0

https://mailchi.mp/felder/earnings-are-unsustainable?mc_cid=407f2b2876&mc_eid=5b348a9ca0