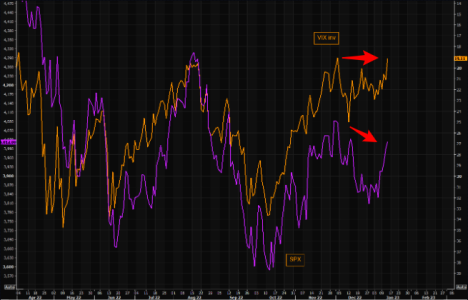

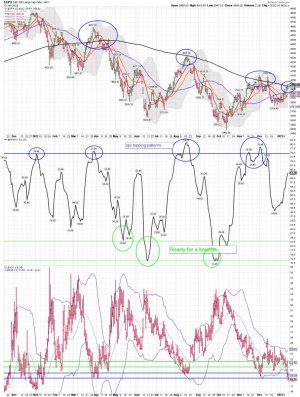

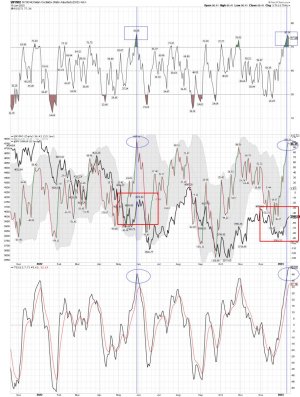

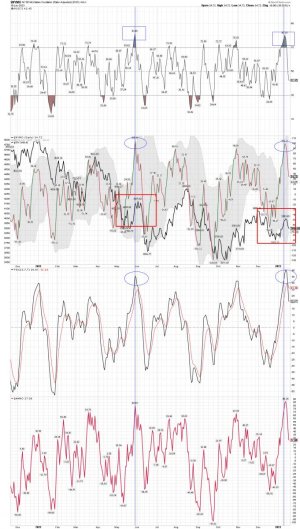

VIX daily: IF the pattern plays out the next move is down. However, my magic 8 ball is broken.

Jeff's VIX “crystal ball” data is a excellent trading indicator to track. Another indicator to help you determine yours odds of holding a position. Long or Short..... Now is a time to be more nimble.

Our Crystal Ball Is Showing Contrarian Sentiment

By Jeff Clark, editor, Market Minute

The crystal ball is warning us not to trust the current stock market rally.

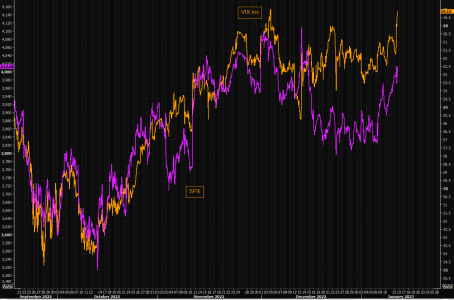

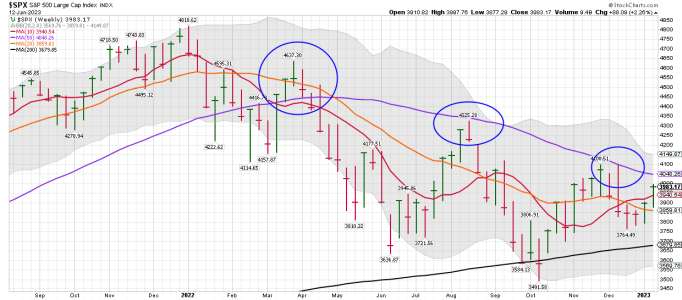

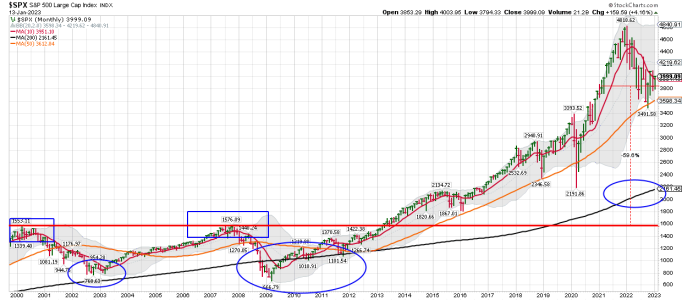

Friday’s big bounce following the non-farm payrolls report pushed the S&P 500 to its highest level since mid-December. It broke above several resistance levels – like the 9-day and 20-day exponential moving averages (EMAs).

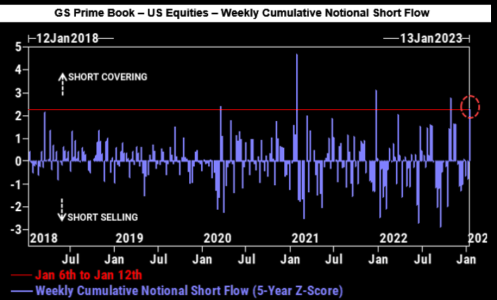

And it changed the sentiment of many of the financial television talking heads – who were wildly bearish on Thursday but flipped to bullish following Friday’s move.

Most of the talking heads are now looking for higher stock prices over the next several weeks.

But the crystal ball suggests otherwise…

When VIX calls are far more expensive than the equivalent put options, it shows VIX option traders expect the index to move sharply higher over the next few weeks.

And a rising VIX (rising volatility) usually accompanies a falling stock market.

So, if you’re making short-term bullish bets, be careful. The VIX “crystal ball” has a very good track record… I’m betting it’ll prove correct this time, as well.

Best regards and good trading,

https://www.jeffclarktrader.com/market-minute/our-crystal-ball-is-showing-contrarian-sentiment/