robo

TSP Legend

- Reaction score

- 471

This ProTimer report may be distributed as long as it is used in its entirety.

Current Strategy Positions

Fibtimer currently has 13 successful strategies

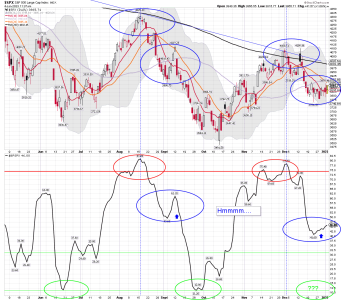

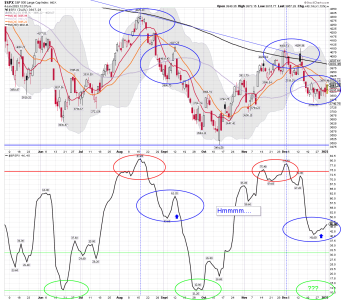

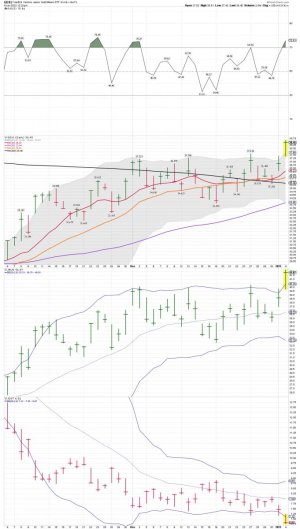

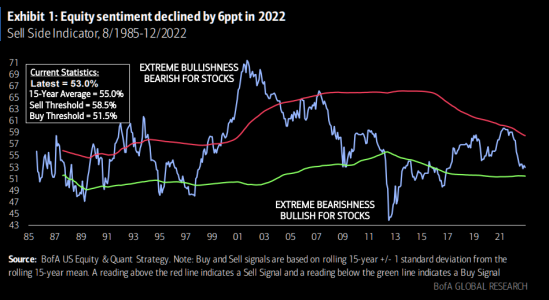

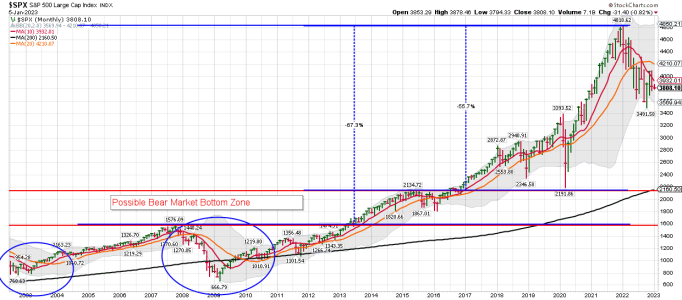

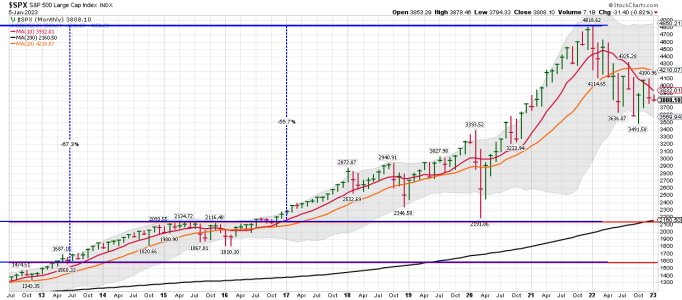

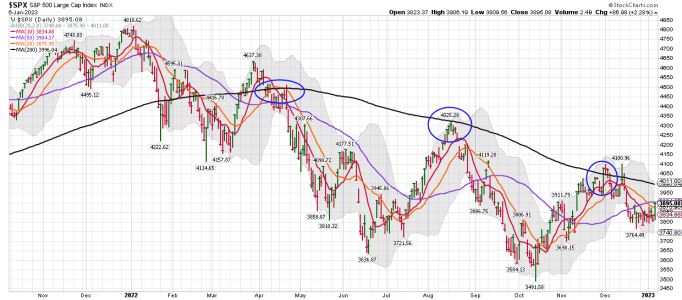

S&P 500 Position - BEARISH

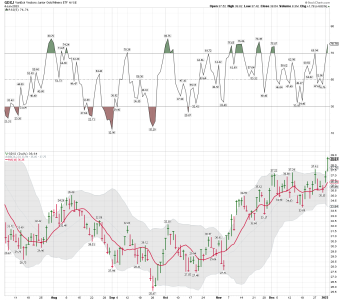

Nasdaq 100 Position - BEARISH

SmallCaps Position - BEARISH

U.S. Dollar Position - BEARISH

Bond Fund Position - BEARISH

Gold Fund Position - BEARISH

These positions were started over previous position weeks. You need to be a paid subscription for real time signals. International Timer, REIT Timer, the Diversified Portfolio, Sector Funds, ETF and Stock s are not included above.

Current S&P 500 and Nasdaq 100 Analysis for 1/1/23

Current Strategy Positions

Fibtimer currently has 13 successful strategies

S&P 500 Position - BEARISH

Nasdaq 100 Position - BEARISH

SmallCaps Position - BEARISH

U.S. Dollar Position - BEARISH

Bond Fund Position - BEARISH

Gold Fund Position - BEARISH

These positions were started over previous position weeks. You need to be a paid subscription for real time signals. International Timer, REIT Timer, the Diversified Portfolio, Sector Funds, ETF and Stock s are not included above.

Current S&P 500 and Nasdaq 100 Analysis for 1/1/23