robo

TSP Legend

- Reaction score

- 471

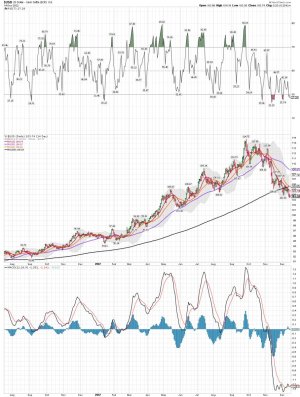

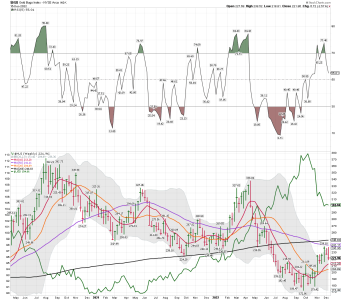

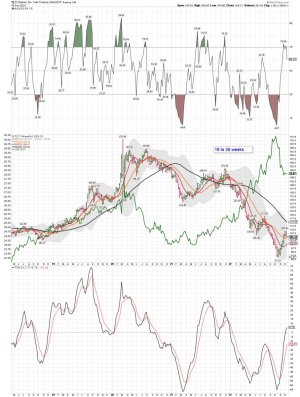

USD dollar daily: The move lower continues and the USD remains below the 200 day MA.

Bottom Line: Remains is a downtrend..... We shall see if a flight to safety changes that in the months ahead. A tad oversold, so one would think at least a ST bounce be coming and soon. I don't use the dollar chart for trading, but track it very closely because I trade the gold miners.

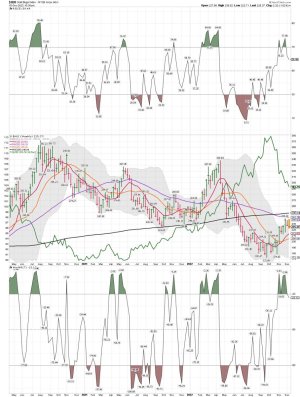

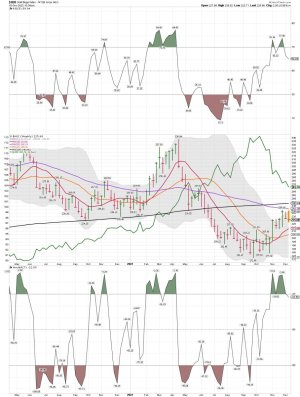

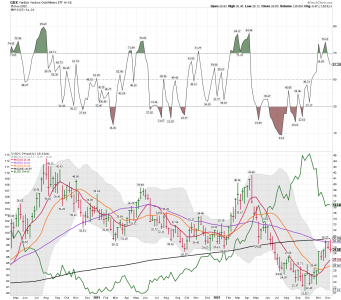

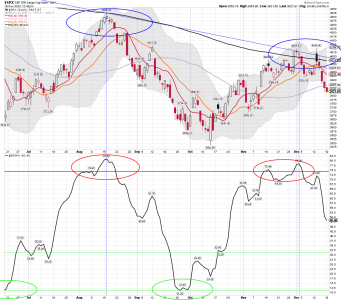

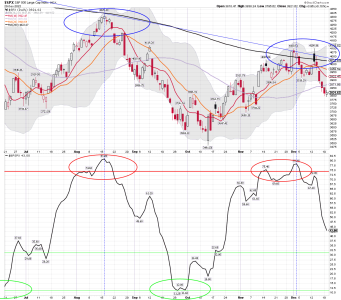

HUI weekly: HUI remains below the 50 and 200 week MA. That needs to change before we can say the BULL MARKET IS BACK! Well, that's based on my trading guidelines.

The USD and HUI can move up together if the investing conditions are supportive. You can see on the chart, that at times they both move up together.

Bottom Line: Remains is a downtrend..... We shall see if a flight to safety changes that in the months ahead. A tad oversold, so one would think at least a ST bounce be coming and soon. I don't use the dollar chart for trading, but track it very closely because I trade the gold miners.

HUI weekly: HUI remains below the 50 and 200 week MA. That needs to change before we can say the BULL MARKET IS BACK! Well, that's based on my trading guidelines.

The USD and HUI can move up together if the investing conditions are supportive. You can see on the chart, that at times they both move up together.